Tesla Earnings – Presidential Support

Tesla really lives up to its status as a “presidential stock”—even the earnings release got a presidential boost. After Tuesday’s close, Tesla reported earnings, and then Trump just happened to announce after hours that he won’t fire Powell and will lower tariffs on China.

Remember, Trump previously made a big show of announcing “buy DJT” at the open and then, intraday, announced a 90-day tariff freeze. This time, making the announcement after hours looks an awful lot like he was giving his old friend a hand.

Of course, being Trump, he couldn’t hold back—he had Bessent come out at noon Tuesday to talk up the China ADRs, sending them higher during the session.

Normally, an intraday leak is enough for the market to price things in, but institutions stayed rational—options volume didn’t spike, in fact, it shrank. $NVDA$ options volume was only 60% of normal, $TSLA$ 80%, while $SPDR Gold Shares(GLD)$ options volume was 4.5x the usual level.

Makes sense: even though Trump’s softer tone is a positive sign and stopped the market from making new lows, the actual tariff policy is still nowhere near concrete. So, the trend is still rangebound.

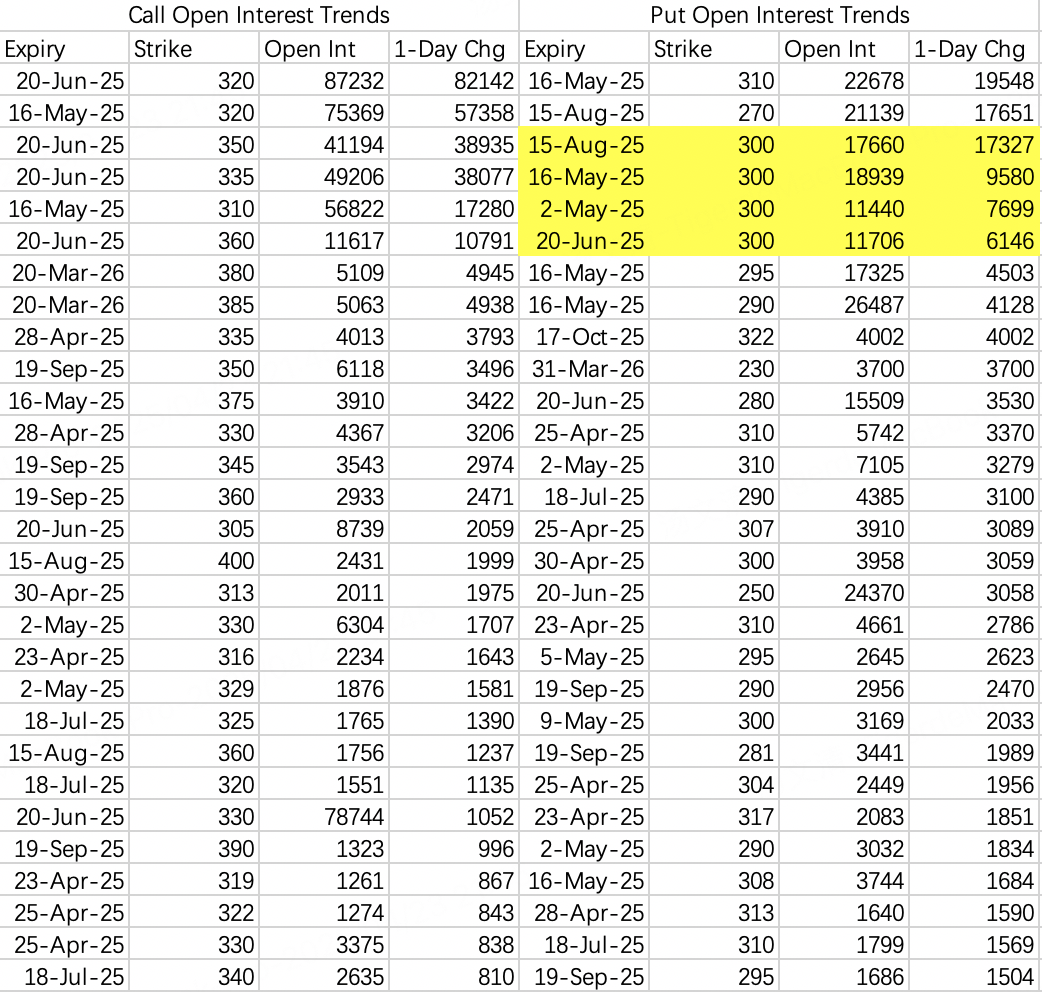

Looking at GLD options activity, the market seems to expect this pullback to bottom out at $300.

$Tesla Motors(TSLA)$

Earnings were predictably bad—auto division revenue down 20% year-over-year. Musk may be back, and Trump may want to lower tariffs, but neither can fix Tesla’s brand damage right now.

Still, the stock popped on earnings. Notably, institutions didn’t lower their sell call strike for this week, which shows just how cautious they’re being.

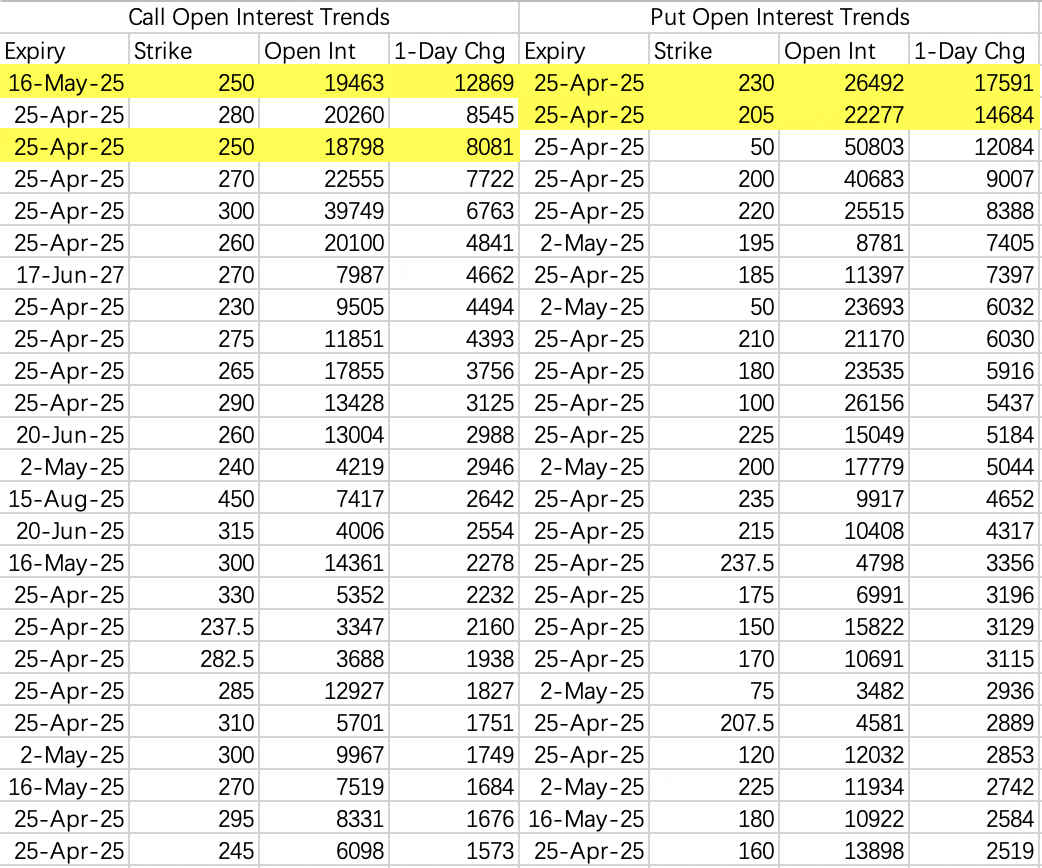

On Tuesday, April 22, someone sold the May $250 call: $TSLA 20250516 250.0 CALL$ . Makes sense—expecting Tesla to stay in the $200–$250 range.

$NVIDIA(NVDA)$

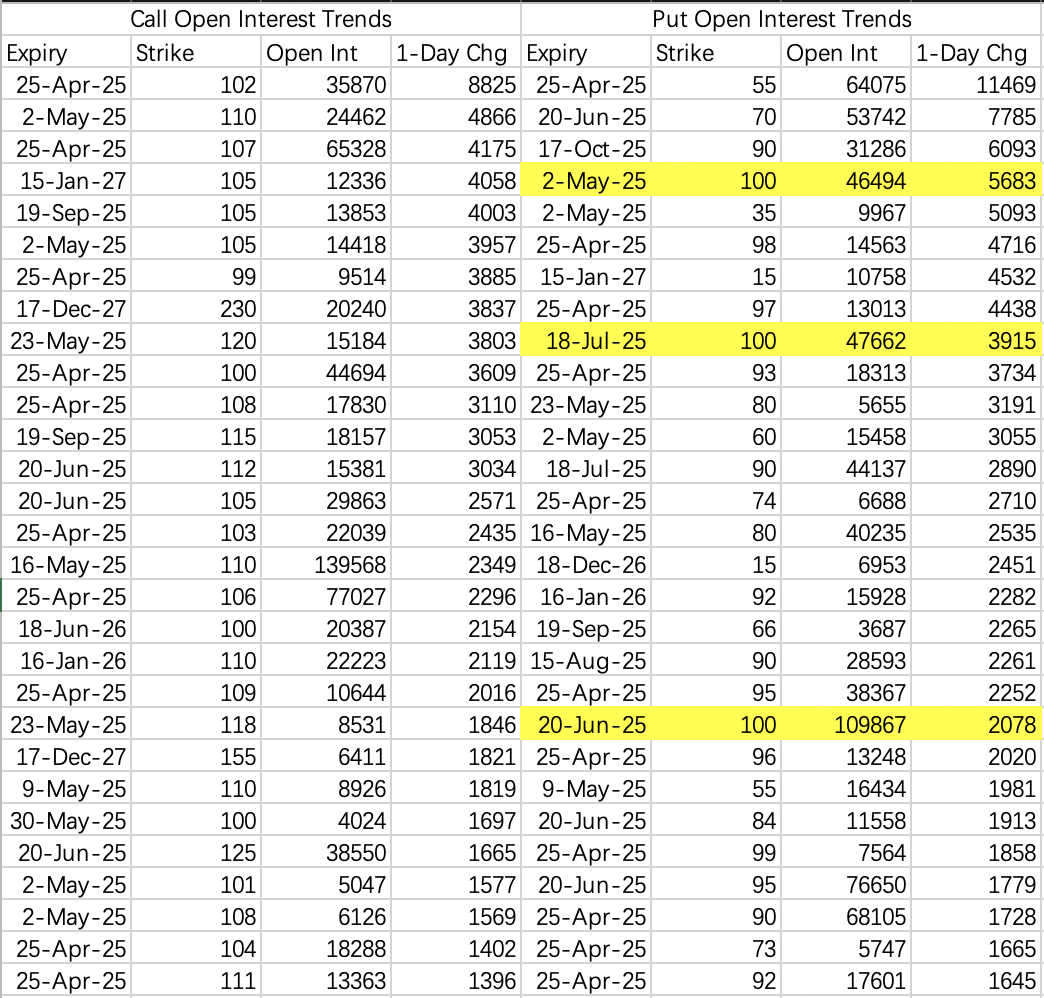

Bearish expectations for NVIDIA have basically all dropped into double-digit territory. Nothing too noteworthy in Tuesday’s options flow—watch for Wednesday, likely more range trading.

The good news: looks safe to close the week above $90, and the odds of staying above $100 next week are rising. But $110 is still resistance.

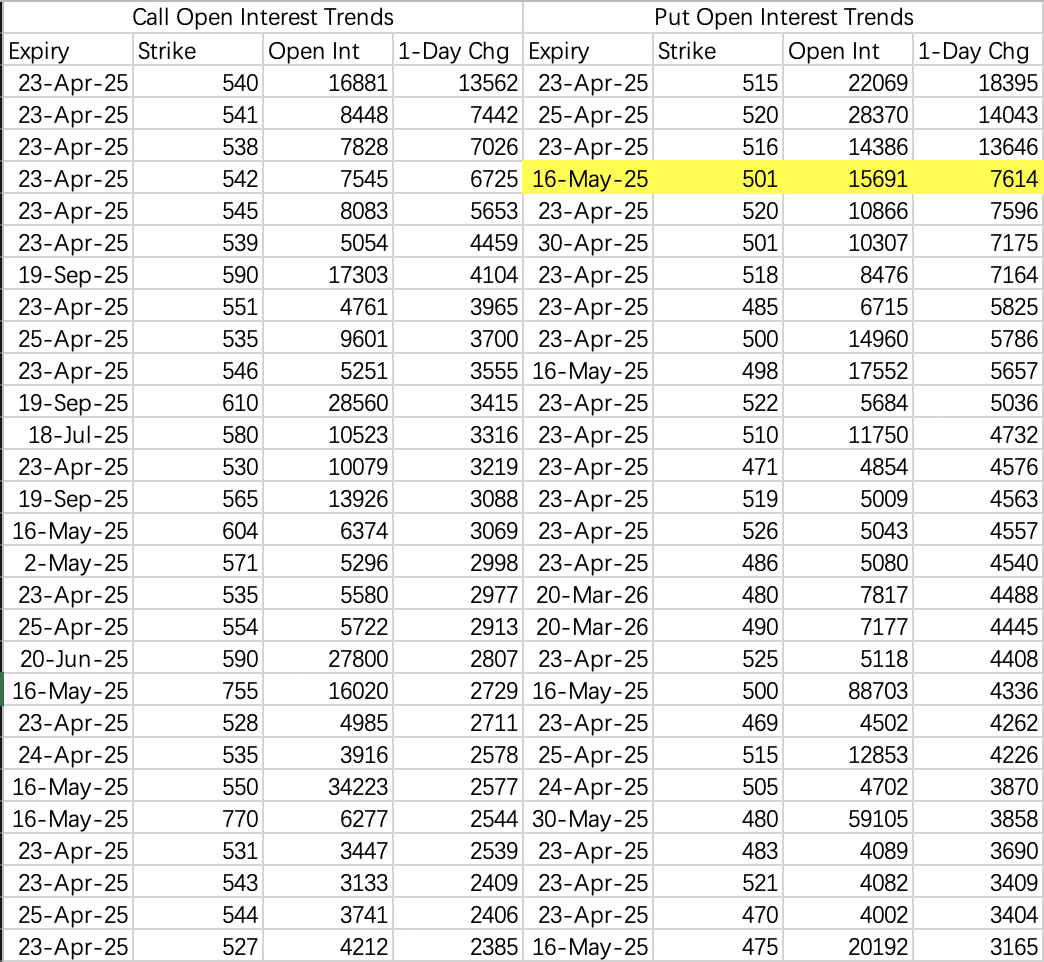

$SPDR S&P 500 ETF Trust(SPY)$

Both bulls and bears have paused on long-term bets.

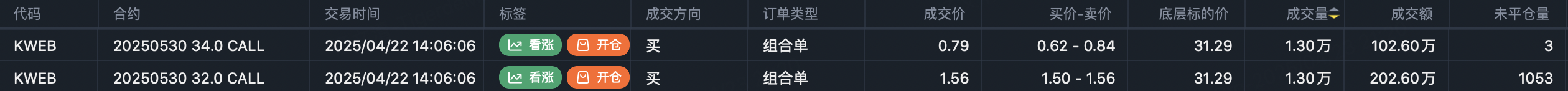

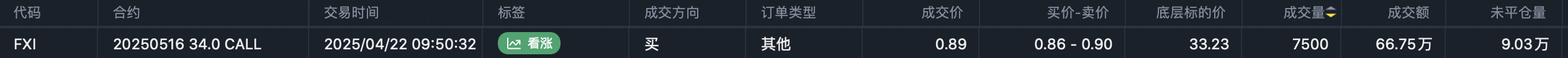

Chinese ADRs got a little bump, but there’s no big bullish conviction—large trades in KWEB and FXI are still targeting $34$.

Buying $KWEB 20250530 32.0 CALL$ , selling $KWEB 20250530 34.0 CALL$

Buying $FXI 20250516 34.0 CALL$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.