May Outlook: A Divided Market, Divided Strategies

$SPDR S&P 500 ETF Trust(SPY)$

The market digested Trump’s dovish talk on Wednesday and split into two camps—one bullish, one still bearish.

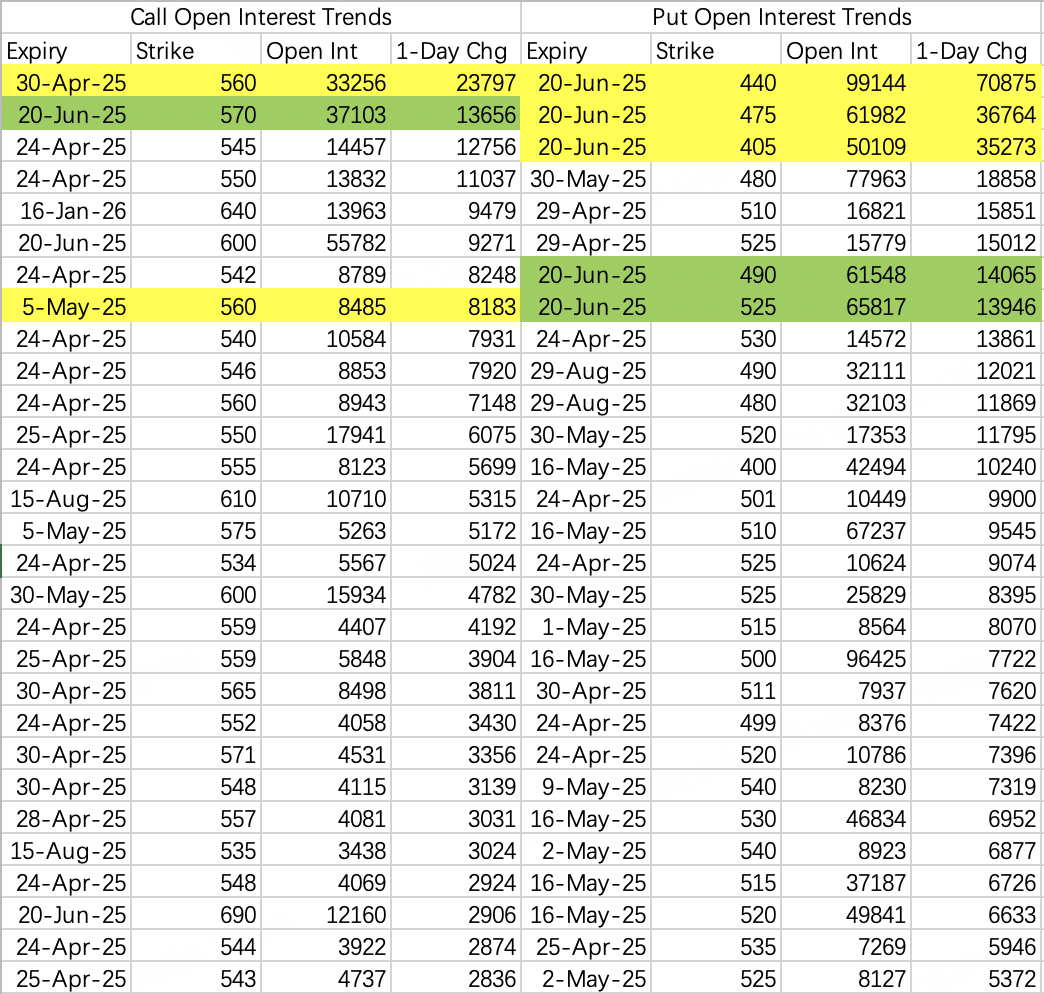

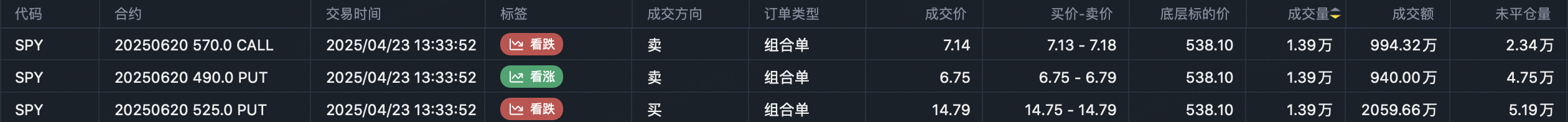

You see this reflected in SPY options positioning. The extreme bears are still pressing their bets, with institutions putting on June expiry butterfly spreads targeting below $475. The more moderately bearish are sticking to defined-risk strategies, like selling the $570 call, buying the $525$ put, and selling the $490 put.

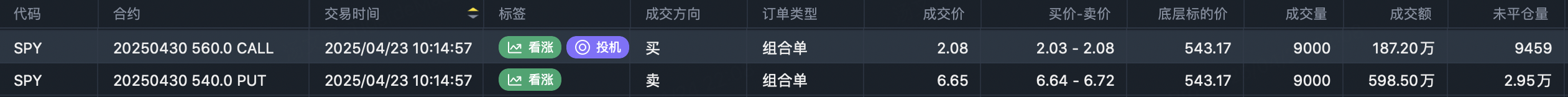

Bulls are more aggressive, choosing strategies like selling the $540 put and buying the $560 call.

Here’s some of the notable action:

Buying $SPY 20250430 560.0 CALL$ , volume: 14,000 contracts

Selling $SPY 20250430 540.0 PUT$ , volume: 14,000 contracts

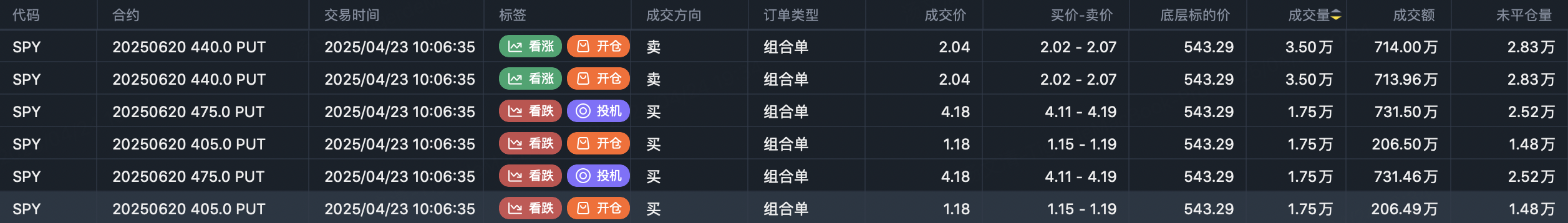

Buying $SPY 20250620 475.0 PUT$ , volume: 35,000 contracts

Selling $SPY 20250620 440.0 PUT$ (x2), total volume: 70,000 contracts

Buying $SPY 20250620 405.0 PUT$ , volume: 35,000 contracts

Selling $SPY 20250620 570.0 CALL$ , volume: 13,900 contracts

Buying $SPY 20250620 525.0 PUT$ , volume: 13,900 contracts

Selling $SPY 20250620 490.0 PUT$ , volume: 13,900 contracts

$NVIDIA(NVDA)$

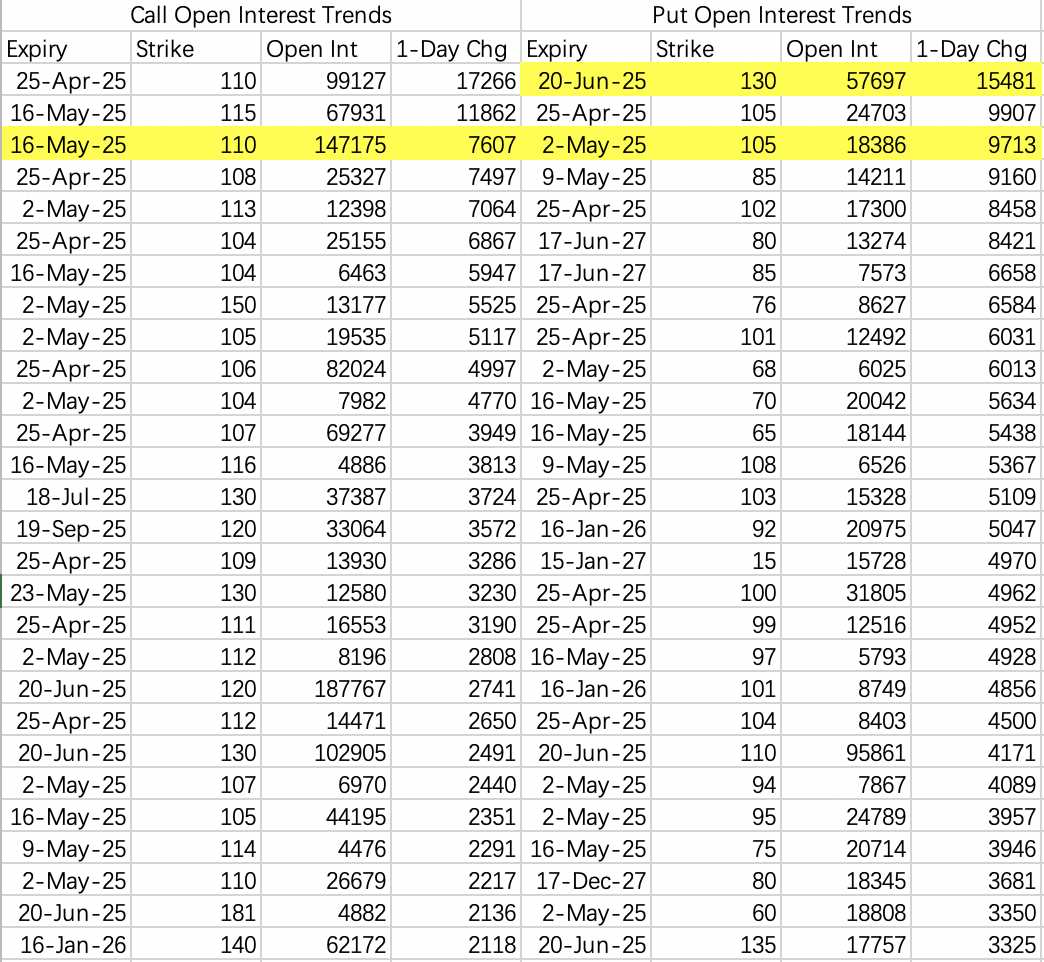

How does this market split show up in NVIDIA’s options activity?

Most bearish positions are still pretty ugly, hedging for extreme downside, while bullish call activity still gets stuck around the $110 strike.

While there’s a big roll into $NVDA 20250516 115.0 CALL$ , this is actually rolling down from $NVDA 20250516 125.0 CALL$ , lowering the strike and thus lowering May’s expectations.

Worth noting: the $130 put ($NVDA 20250620 130.0 PUT$ ) saw another 15,000 contracts opened. This time, institutions got smarter and didn’t reveal the trade direction.

It’s clear the institutions hired some pro traders for $NVDA 20250620 130.0 PUT$ —they deliberately hid the side of the trade, but judging by how quickly they hit the market at the open, it looks more like selling than buying.

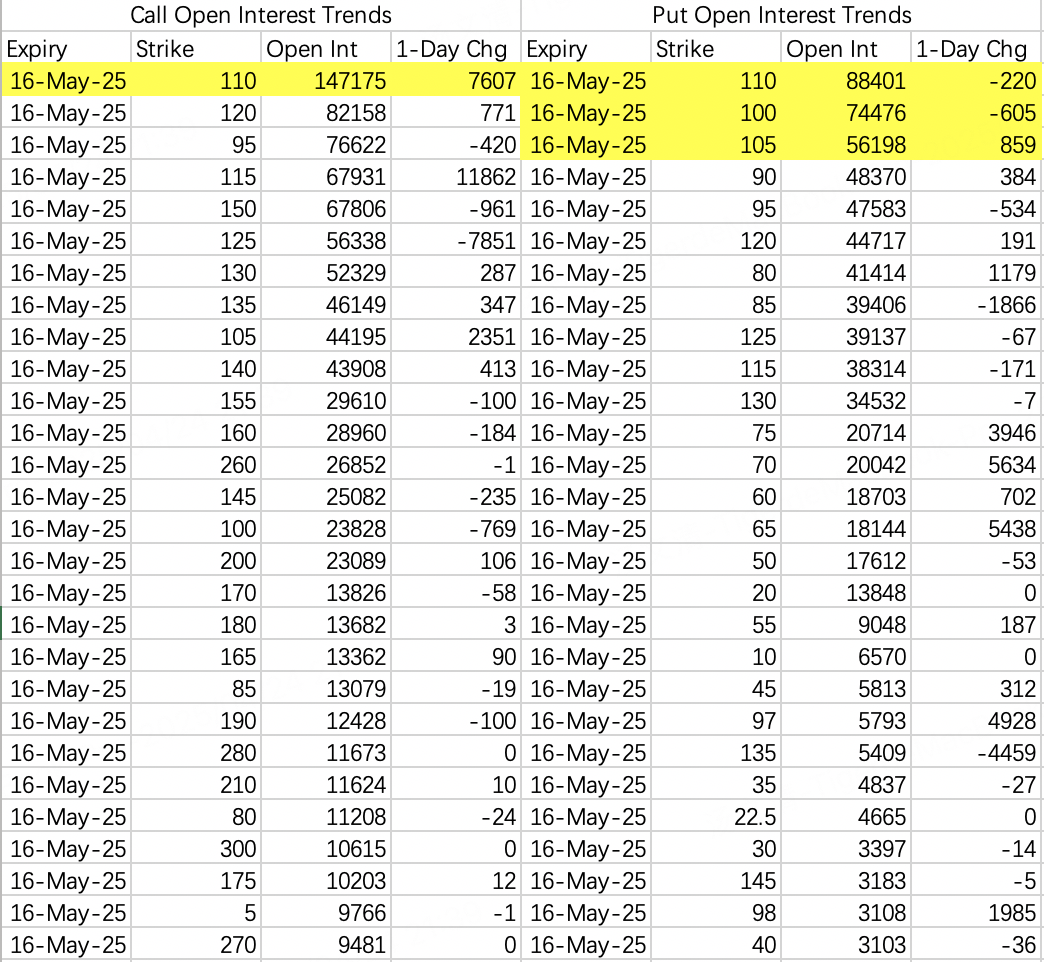

Leaving aside these whales, let’s look at May’s monthly OI: By May 16 expiry, the option action is likely to cluster around the strikes with the largest open interest.

That leads to this takeaway: there’s a high probability NVDA closes between $100$ and $110$ on May 16, with a smaller chance of a drop below $90$.

So, the best strategy up to May 16 is to sell the $110$ call, sell the $100$ put, and buy the $80$ put—in other words, a short strangle plus a protective long put.

You can adjust this more flexibly, moving strikes up or down. For example, for next week’s expiry:

$Tesla Motors(TSLA)$

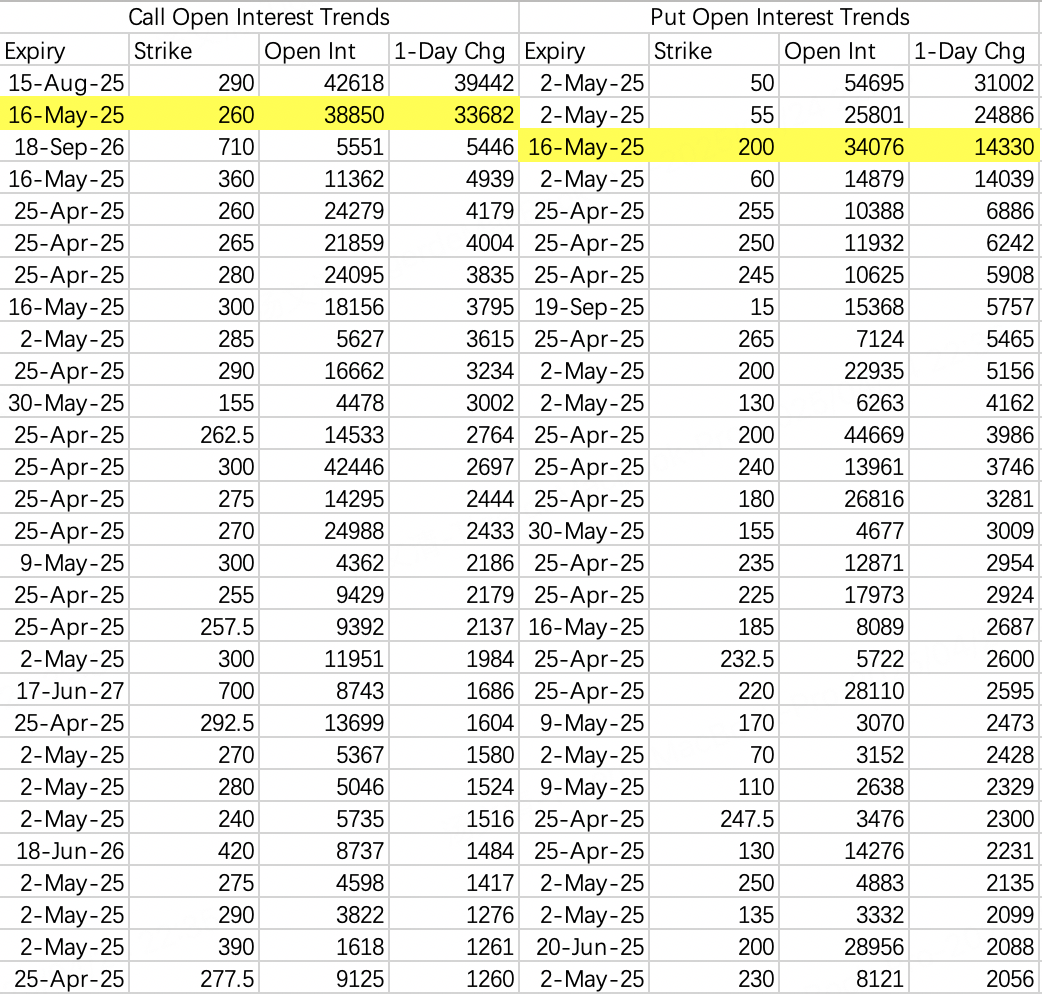

Tesla’s situation is just as divided—even analysts can’t agree on a target price. For this earnings report, Morgan Stanley is bullish as always, setting a $410$ target, while JPMorgan slashed their target to $115$.

Options positioning is also extreme. The “50 put guy” dropped $55,000 to buy 55,000 contracts of next week’s $50$ and $55$ puts.

On the bullish side, someone bought 33,000 contracts of the May $260$ call: $TSLA 20250516 260.0 CALL$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.