Large or Small Volatility?

In addition to NVDA, TSLA, and SPY, there are also notable large orders for GOOGL, AAPL, PLTR, INTC, ASHR, and CORZ.

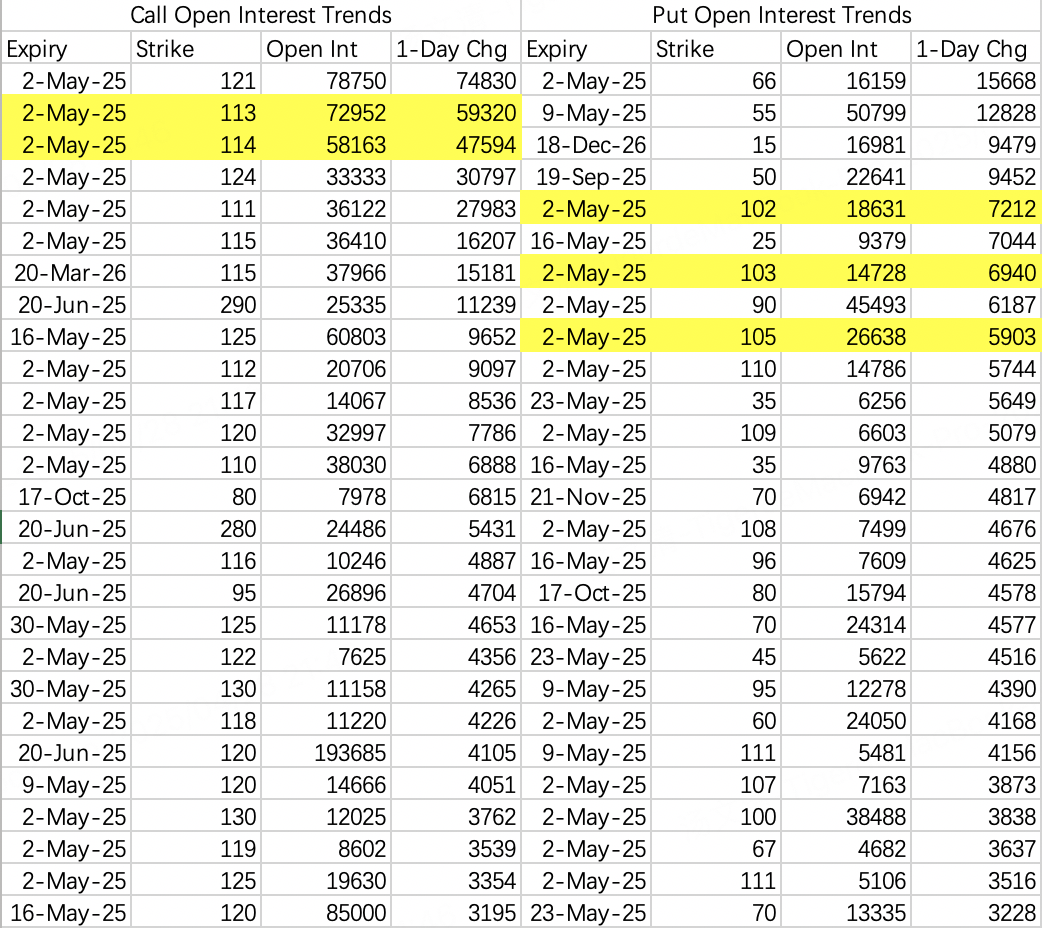

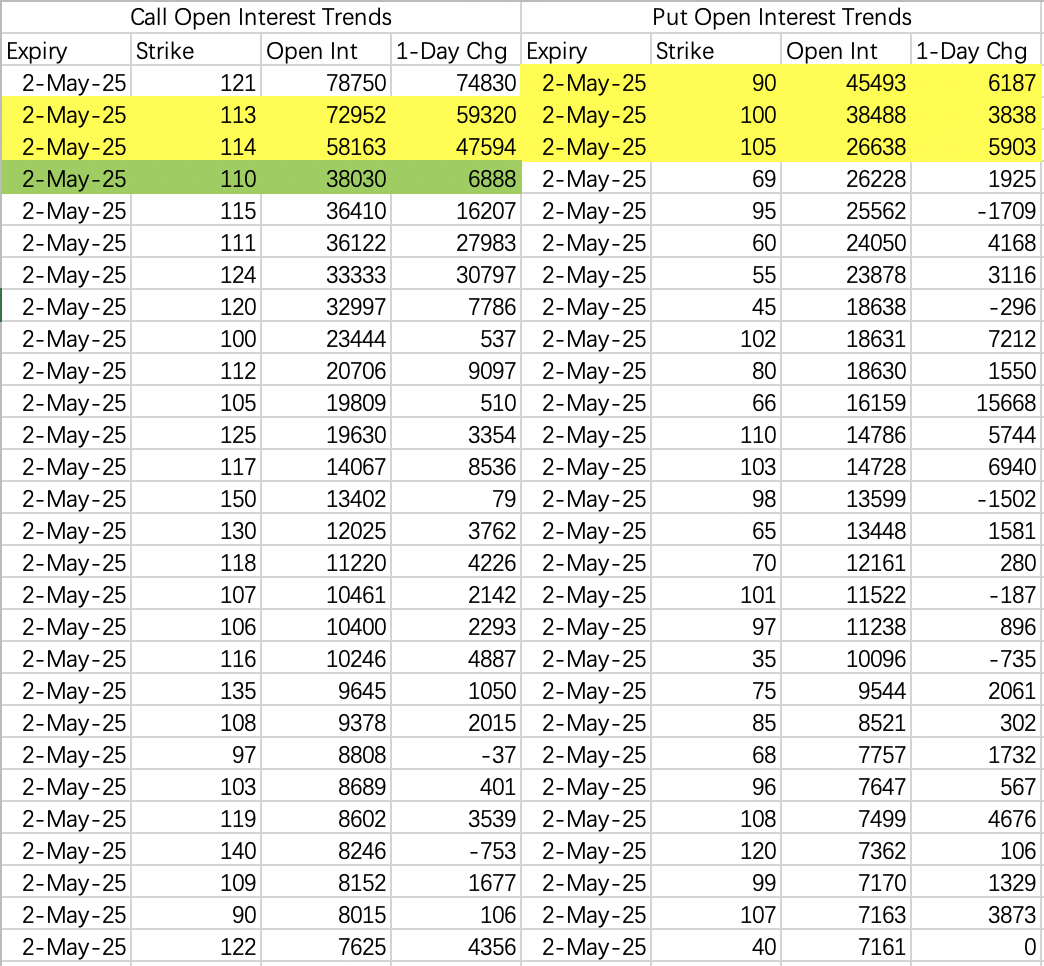

$NVIDIA(NVDA)$

This week's fluctuation range is broadly 100–115 and narrowly 105–113, depending on the tech earnings reports this week. However, considering the stock price may align with 110 or even reach 120 before May 16, selecting a small position to sell put options with a strike price of 105 is reasonable.

Special emphasis on small positions and risk control here. After all, we are in the middle of tariff negotiations. While Trump aims for a quiet earnings season for U.S. stocks, others may not think the same. Ideally, the stock price will trend upward during earnings season, but in a less ideal scenario, a sudden backstab could derail everything.

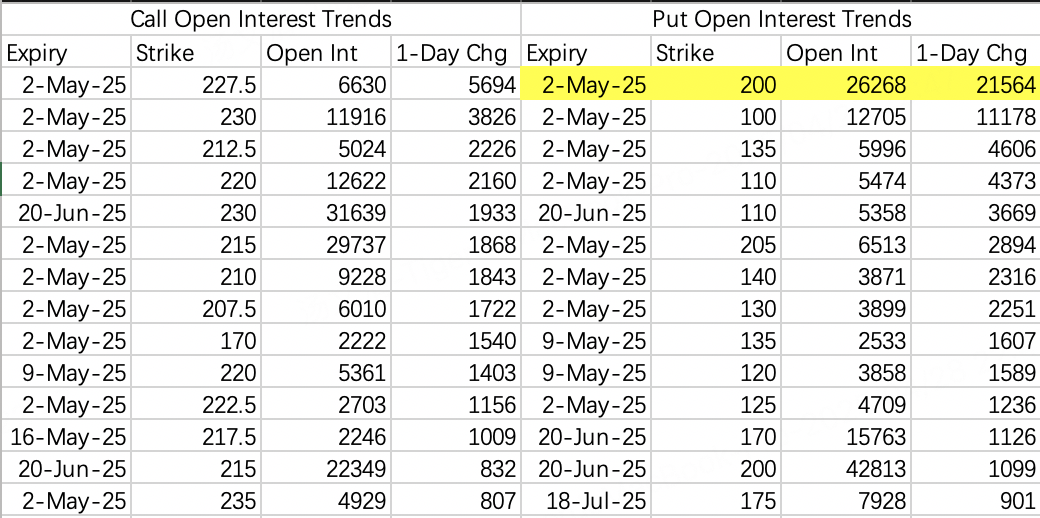

This explains why deep out-of-the-money put options have seen a surge in open interest again, as the VIX has dropped to the bottom. It's a good time to buy volatility on the dip. If you don't want to hedge by buying puts, directly reducing your position is the simplest approach.

This week, the upper limit of the increase is still based on the institution's sell call strike price of 113–114. The lower limit has three levels: 90 seems unlikely, but whether it's 105 or 100 depends on whether the S&P fills last week's May 30 gap.

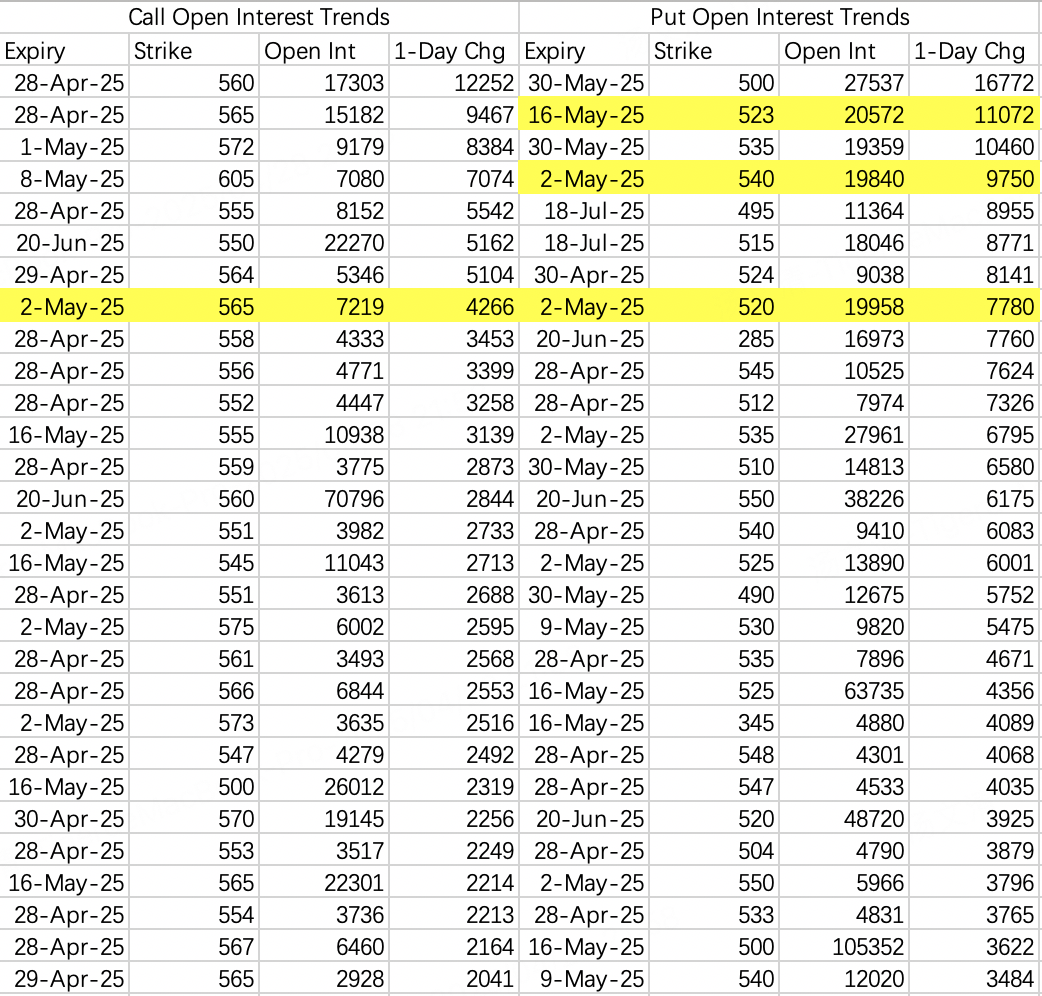

$SPDR S&P 500 ETF Trust(SPY)$

The upper limit for SPY this week is 565, while the lower limit is either 540 or 520, depending on whether the gap needs to be filled.

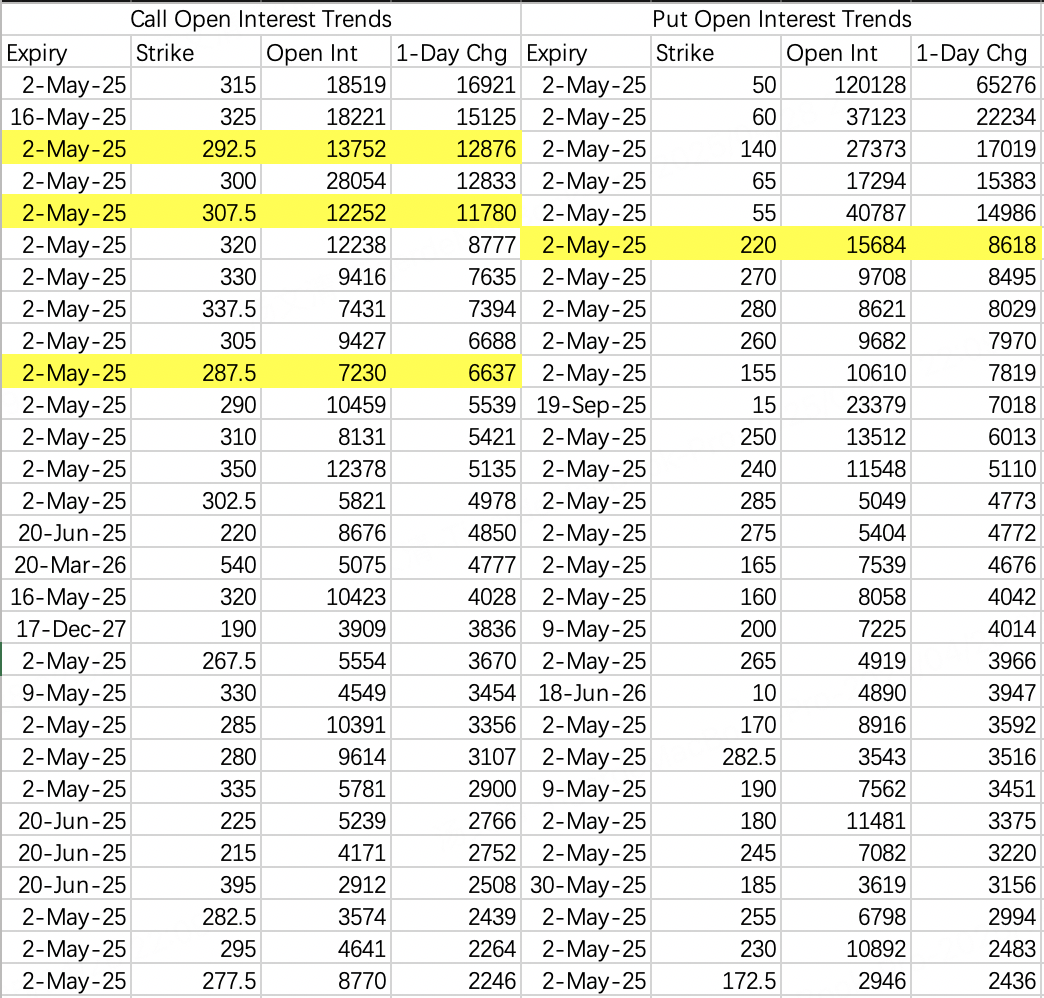

$Tesla Motors(TSLA)$

This week's fluctuation range is 220–307.5.

The upper limit for Tesla this week is between 287.5 and 307.5. To avoid liquidation, institutions have selected multiple ranges for bullish spreads. The two largest sell call strike prices are $292.5 TSLA 20250502 292.5 CALL$ and $307.5 TSLA 20250502 307.5 CALL$.

The lower limit remains at 220. Notably, like NVIDIA, deep out-of-the-money puts have seen a significant surge in open interest again, with "Big Brother 50" making another move.

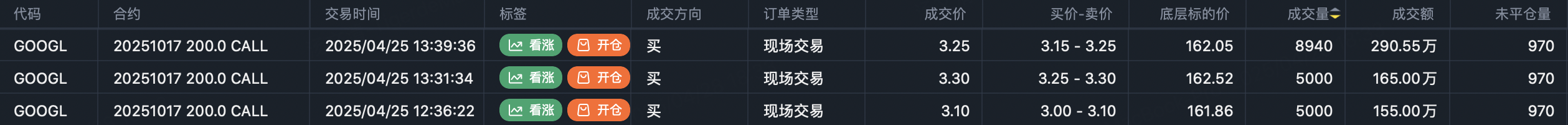

$Alphabet(GOOGL)$

An inspiring large order: someone opened 31,000 contracts of deep out-of-the-money call options for Alphabet at a strike price of 200, expiring in October, with a total transaction value of about $10 million. The option is $GOOGL 20251017 200.0 CALL$ and was traded on the exchange.

However, apart from this aggressive bullish order, there are no other bullish large orders for tech stocks, so the probability of Alphabet soaring on its own is quite low. Let’s wait and see.

$Apple(AAPL)$

The S&P's gap-filling momentum may come from Apple’s earnings report. Last Friday, 21,000 contracts of $AAPL 20250502 200.0 PUT$ expiring this week were opened. The transaction price is hard to judge, but I believe it was mainly bought.

However, it’s odd to see puts being purchased, as Apple’s earnings data looks good. Due to concerns about tariffs, demand was pulled forward, resulting in shipments exceeding expectations. Preliminary IDC data shows that Apple’s iPhone shipments in Q1 2025 increased by 10% year-over-year.

In any case, with a few days left until Friday’s earnings report, we’ll continue to monitor the situation.

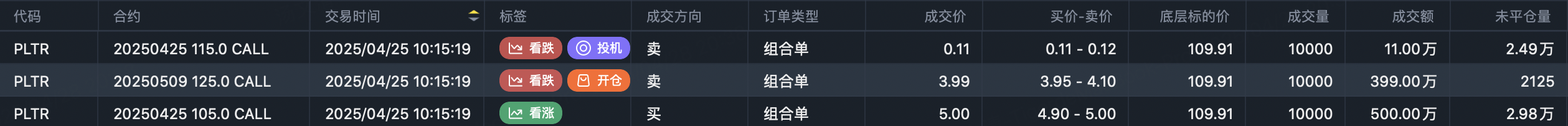

$Palantir Technologies Inc.(PLTR)$

A large order to sell $PLTR 20250509 125.0 CALL$ was opened with 12,000 contracts. The expectation is that the stock price won’t exceed 125 by May 9.

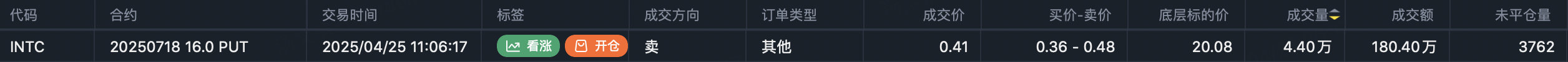

$Intel(INTC)$

A large order to sell $INTC 20250718 16.0 PUT$ was opened with 45,000 contracts.

$X-trackers Harvest CSI 300 China A-Shares Fund(ASHR)$

It’s worth noting that KWEB and FXI didn’t see large orders, but ASHR had 73,000 contracts opened for the $ASHR 20250516 27.0 CALL$ expiring on May 16.

Among these 73,000 contracts, strategies and directions are inconsistent, indicating a market divergence on whether the price at this level is bullish or bearish.

Bullish strategy: Single-leg buy of $ASHR 20250516 27.0 CALL$ .

Bearish strategy: Buy $ASHR 20250516 25.0 PUT$ and sell $ASHR 20250516 27.0 CALL$ .

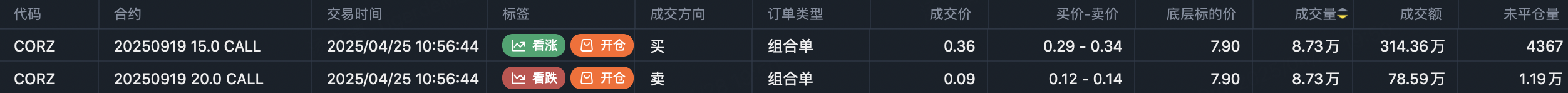

$Core Scientific, Inc.(CORZ)$

There was an unusual large order exceeding 100,000 contracts in this small-cap blockchain stock, with someone betting on CORZ rising to 15–20. While large movements in options for small companies are often unreliable, such volumes are rare. The potential blockchain-related catalysts are easy to understand, so let’s mark this for observation.

Sell $CORZ 20250919 20.0 CALL$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.