TWLO 10 Day Winning Sparking SaaS, Still Too Conservative?

$Twilio(TWLO)$ , a leader in SaaS, jumped 9% at one point right after its stock performance earnings report, and then rose for 10 consecutive trading days.

The company's excellent Q1 results, along with strong FY25 guidance, led to a surge in investor confidence.Even some investment banks believe the updated 2025 guidance is still too conservative.

Performance and Market Feedback

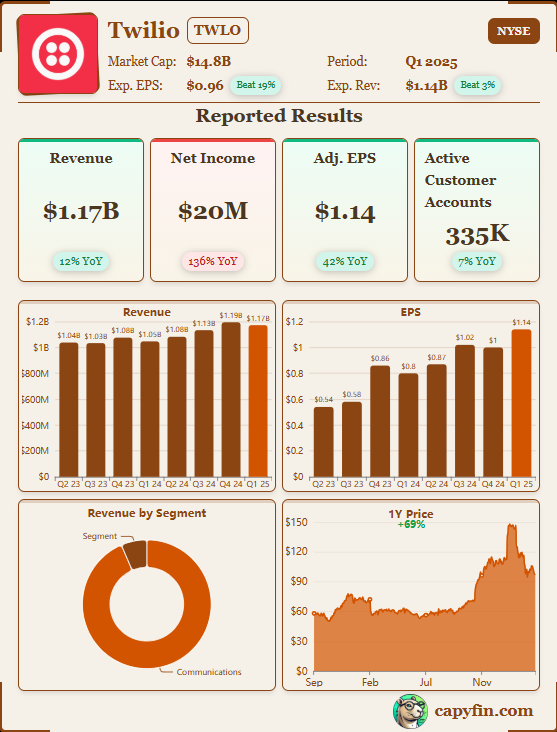

Overall Q1 revenue of $1.17B, +12% yoy, topped estimates of $1.14B, achieving double-digit revenue growth for the third consecutive quarter.Communications revenue was $1.097B, +13% yoy.

On the earnings front, Non-GAAP operating income was $213M. net income was $20.02M, a sharp improvement from the net loss in Q1 2024. eps was $1.14, well ahead of expectations of $0.94

Investment Highlights

Strong recovery on the revenue side with increased attractiveness of principle AI-enabled products.While Q1 was a double-digit increase from a relatively low base in the same period last year, the increase in Net Dollar Retention (NDR) to 107% from 102% in Q1'24 is also a good indicator of the popularity of many of Twilio's offerings (e.g., ConversationRelay) with customers and the expanding partnerships with voice-enabled AI startups.Artificial Intelligence startups are expanding.AI-powered voice interactions are sparking new interest and customer adoption rates, and cross-channel adoption is improving ROI.

Key growth drivers were ISVs, self-service, cross-selling and international expansion.Growth was realized across all of the company's top five verticals, including financial services, technology, professional services, retail and e-commerce.Twilio also announced a partnership with ElevenLabs to augment AI capabilities with more than 1,000 voices in more than 40 languages.

Strongly upgraded full-year earnings guidance.Expect full year organic revenue growth of 7.5-8.5%, up from prior guidance of 7-8%; Non-GAAP operating profit of $850-875M, up from prior guidance of $825-850M; free cash flow of $850-875M, up from prior guidance of $825-850M

Cash flow strengthened, with cash, cash equivalents and short-term marketable securities at $2.45B at the end of Q1, up from $2.38B at the end of the previous quarter. $126.3M worth of stock was repurchased in Q1.Meanwhile, $1.87B remains from the current $2B stock buyback.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·2025-05-08A little upgrade momentum and it's $115 next week.LikeReport

- Merle Ted·2025-05-08Back to 120’s in couple weeks.LikeReport

- BaronLyly·2025-05-07Exciting times for TWLOLikeReport