NVIDIA Earnings Report: Above 145 or Below 145?

Conclusion First:

145 is a relatively important threshold. Options large orders betting on the earnings report primarily revolve around strategies targeting whether the stock will exceed 145 or stay below 145.

For the week of June 6th (next week’s expiration week), implied volatility might surpass this week’s levels, and there could be significant price swings.

The earnings expectations are relatively transparent. If the disclosed earnings match the known information, the stock price is likely to rise post-earnings but will most likely pull back afterward. A sell put strategy remains the most stable.

Earnings Overview

The earnings data this time is fairly ordinary, with bullish and bearish factors being relatively transparent. Revenue is expected to meet forecasts, but there may not be a notable upside surprise.

Biggest Bearish Factor:

The H20 ban is expected to reduce NVIDIA’s April quarter revenues (F1Q26E, impacted for 23 days) by approximately $1 billion and July quarter revenues (F2Q26E) by about $5 billion.Biggest Bullish Factor:

The explosive growth of Tokens, which proves that AI investments are not entirely speculative. Reports indicate that all major hyperscale cloud service providers have reported stronger-than-expected Token growth. Industry insiders widely expressed surprise at the unexpected growth in inference demand, leading to a rush to increase GPU deployments.

Options Data

Based on calculations, the predicted earnings-related volatility is 7.4%. Assuming a stock price of 135, an upward move would push the price to 145, while a downward move would drop it to 125.

From the perspective of options large orders, strategies favoring a bullish move above 135 are more prevalent. However, due to recent macroeconomic events, the overall upward momentum in the broader market is insufficient. As such, more traders are choosing to short this week’s volatility.

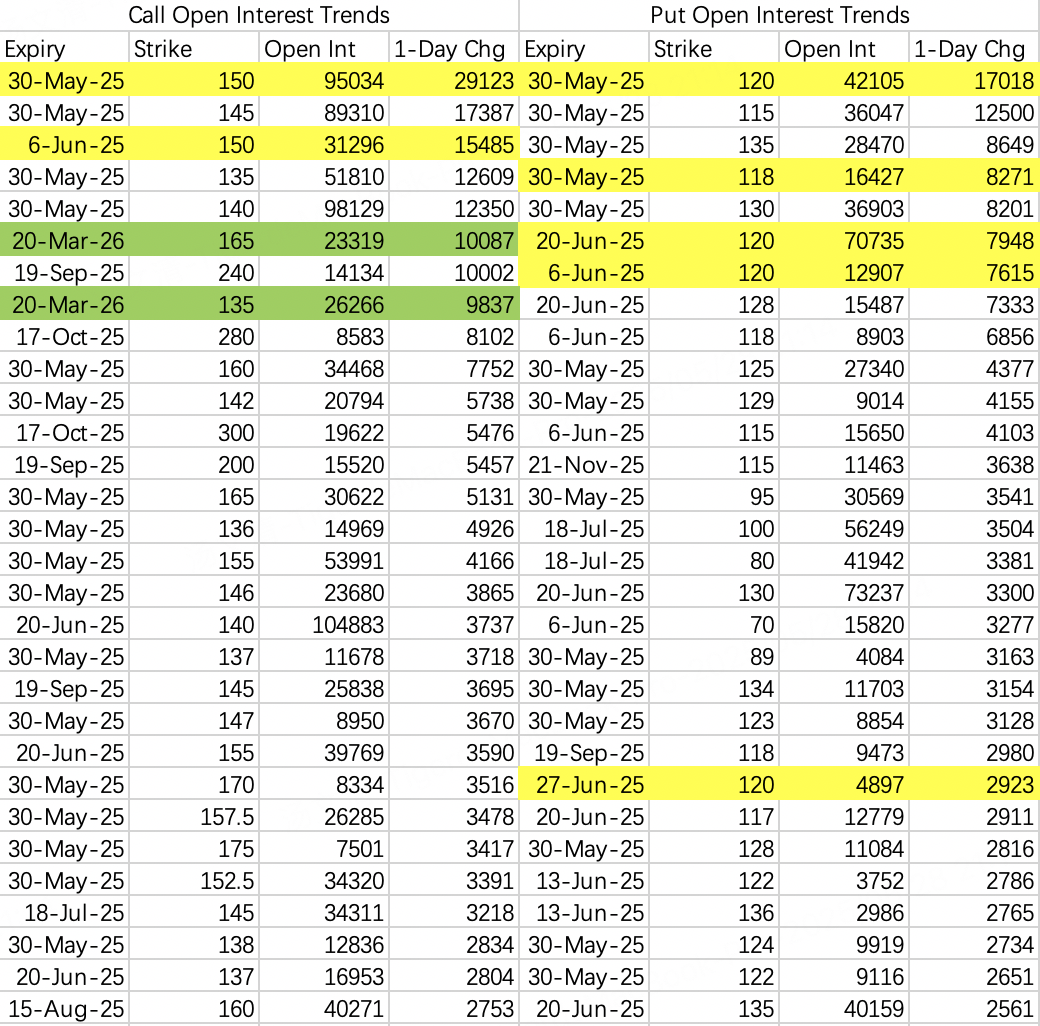

The chart shows Tuesday’s options open interest data, with a significant increase in open interest for the 150 call and 120 put. For options expiring this week, selling dominates, while for options expiring June 6th, buying dominates. This indicates a strategy of shorting this week’s volatility and going long on next week’s volatility.

Strategy Details

Sell this week’s 150 call and 120 put, then buy next week’s 150 call and 120 put:

A similar strategy involves the 150-118 pair, but it won’t be elaborated further.

Bullish Large Orders

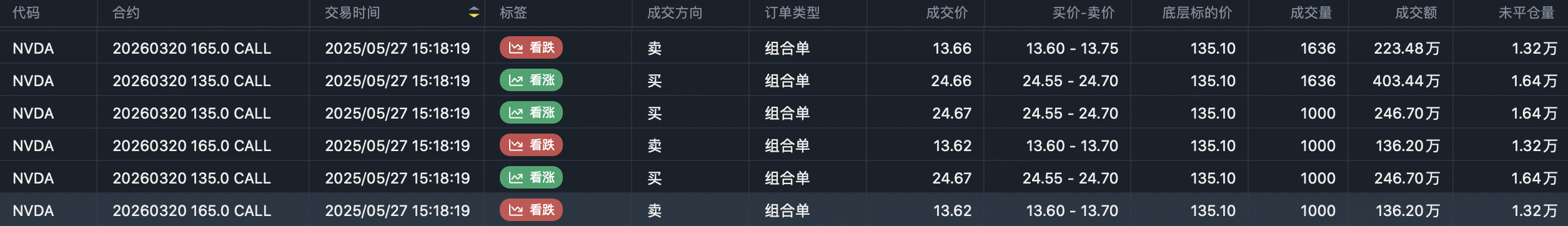

A spread strategy involving buying the 135 call and selling the 165 call:

Bearish Large Orders

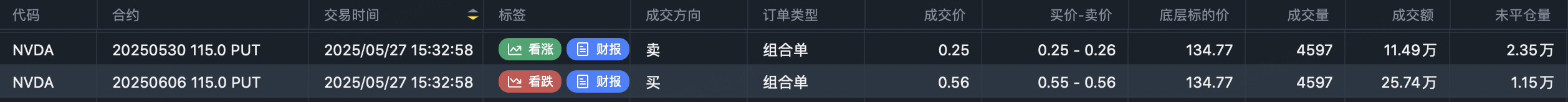

A bearish calendar spread strategy involves selling this week’s 115 put and buying next week’s 115 put:

Summary

The earnings expectations for NVIDIA can be summarized in two words: no drop. There is a high probability of the stock price rebounding to 140, making it suitable for a sell put strategy. However, if the stock gaps up after the earnings report, further actions should depend on the specific price level, as chasing the rally might not be advisable.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.