Earnings Are Strong, But Missing a Catalyst

$NVIDIA(NVDA)$

Conclusion:

NVIDIA's Q1 performance could have supported a stock price of $150, but it stalled at $143, primarily due to a lack of broader macroeconomic confidence. NVIDIA's fundamentals remain solid, making it one of the best stocks to hold. However, considering the upcoming triple witching day in June, it’s not advisable to take aggressive bullish positions in the short term.

Earnings Data:

NVIDIA’s Q1 revenue reached $44 billion. If we include the $2.5 billion lost due to recent restrictions, total revenue would have been close to $46.5 billion. Adjusting for the restriction, Q2 guidance ($8 billion) would translate to a total of $53 billion, reflecting a 14% quarter-over-quarter growth.

Currently, four major factors are driving demand for NVIDIA’s products:

Exponential growth in inference-based AI demand.

A shift in U.S. government policy regarding the spread of AI technologies.

Accelerated deployment of enterprise AI agents.

The global construction of numerous new AI factories.

A conservative estimate suggests that FY2027 earnings per share (EPS) could reach $6.25. At a price-to-earnings ratio (P/E) of 25–30x, this corresponds to a stock price range of $155–$185.

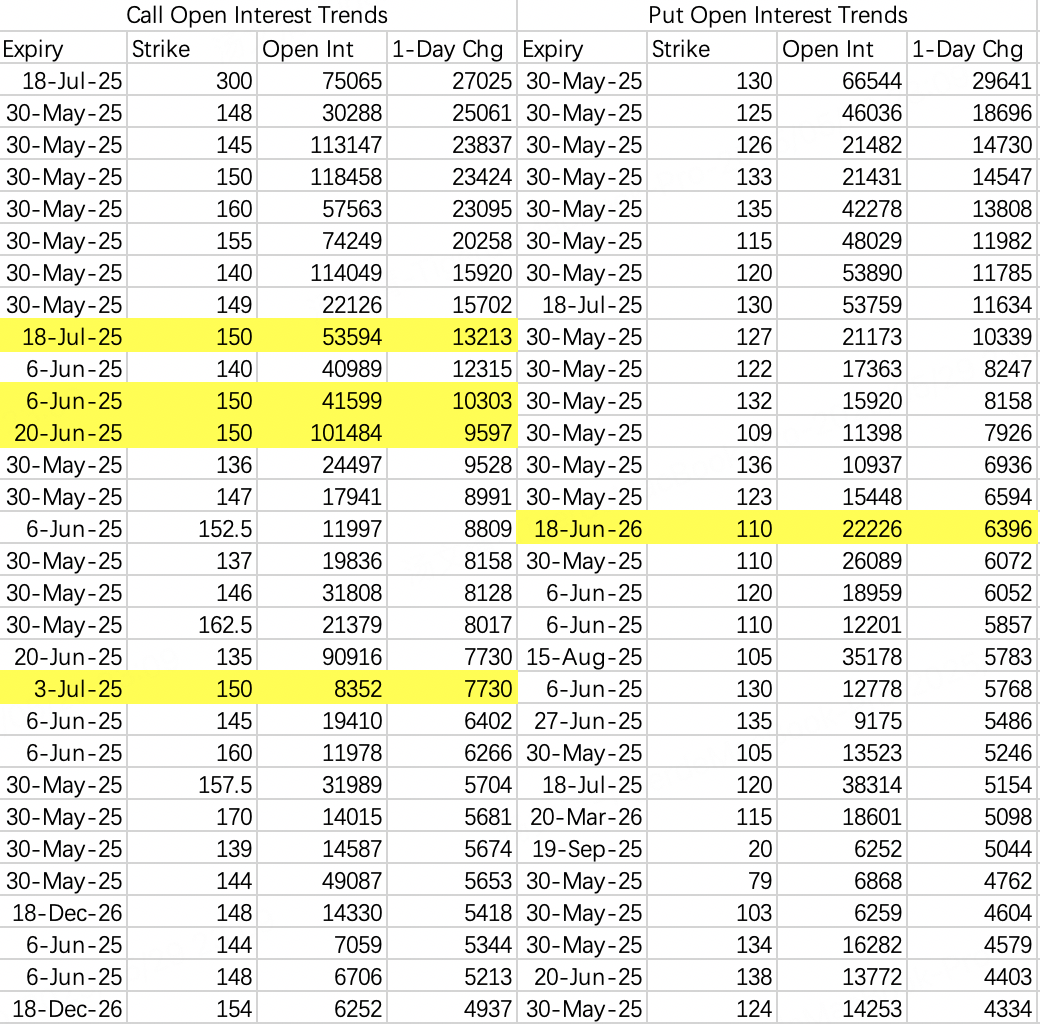

Options Data:

For today, Wednesday’s options open interest data may not be highly relevant as most positions were bets placed on the earnings report. However, the aggressive strategies align with the $150 price target.

For example, the most popular bullish spread strategies involved:

Buying the $NVDA 20250526 148.0 CALL$ and selling the $NVDA 20250526 152.5 CALL$ .

Buying the $NVDA 20250526 149.0 CALL$ and selling the $NVDA 20250526 155.0 CALL$ .

Both strategies were built around an upward move to $150, with expiration dates set for this week. Most of these positions were opened shortly after the market opened around 10:00 AM.

Were these strategies foolish? Not at all. Even before yesterday, many strategies were bullish toward $150. This suggests that the earnings data indeed supported a price above $150. However, due to cautious buyers and a lack of enthusiasm, the stock only managed to achieve a “passing grade.”

That said, the $150 target is not a relic of the past. It represents NVIDIA’s current upside potential and indicates that the stock’s upward trajectory is still intact.

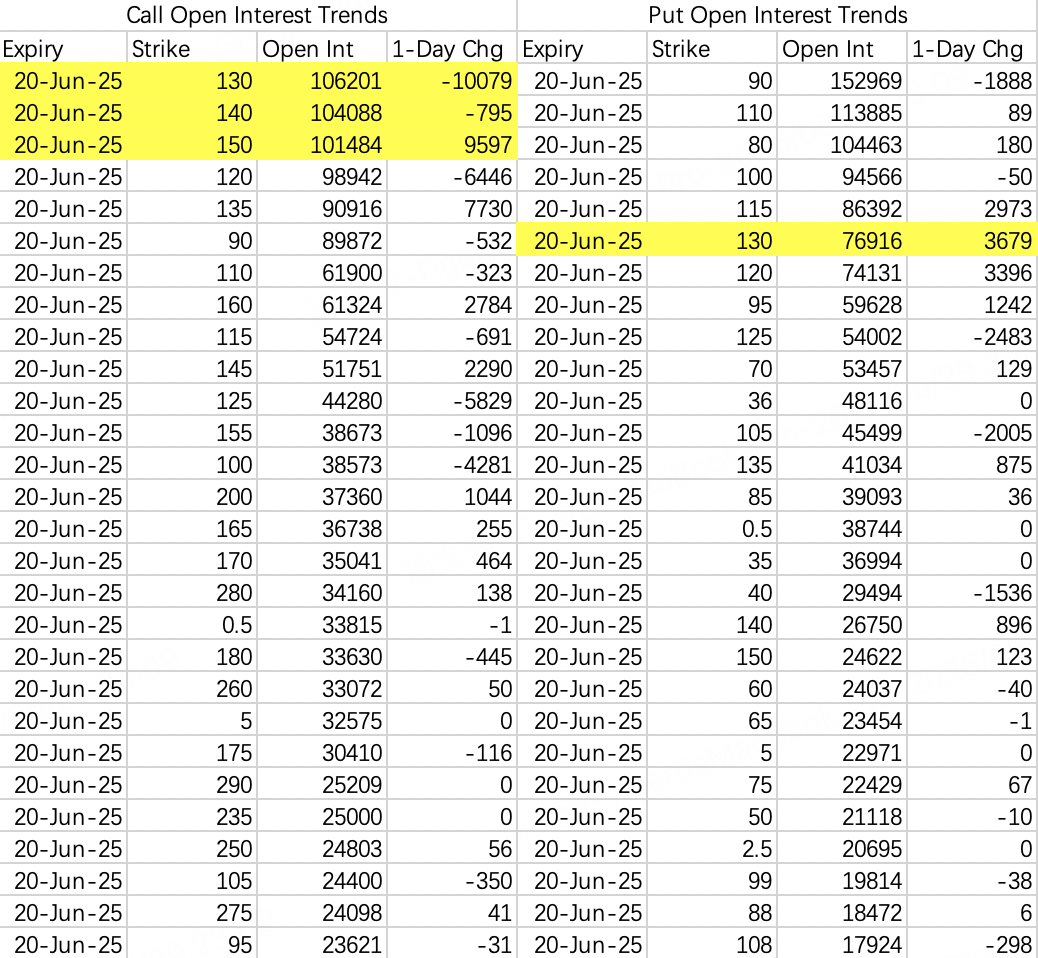

Looking ahead, NVIDIA faces the June 20th triple witching day. This event has accumulated a large number of options positions, including those opened as bearish bets due to tariff issues and others placed in anticipation of the earnings report. While there’s a potential for volatility, a “two-sided squeeze” may limit larger price swings, with a potential pullback to the $120–$130 range.

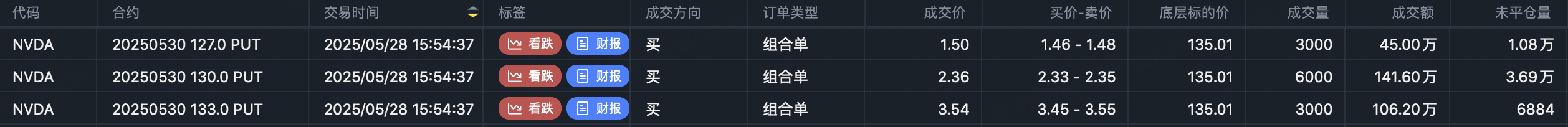

Interesting Observation:

Before the Wednesday close, just before the earnings report was released, the stock dipped sharply—a counterintuitive move that triggered large bearish orders. One example was a butterfly spread at $127-$130-$133. Based on the transaction value, this order had an extremely low cost. The sale of the $NVDA 20250530 130.0 PUT$ almost fully covered the purchase of the other two legs.

This reflects the conflicted mindset of the traders—reluctant to pay insurance premiums (buying puts) but still concerned about potential downside risks. Similarly, the zero-cost bullish and bearish strategies reflect similar sentiments.

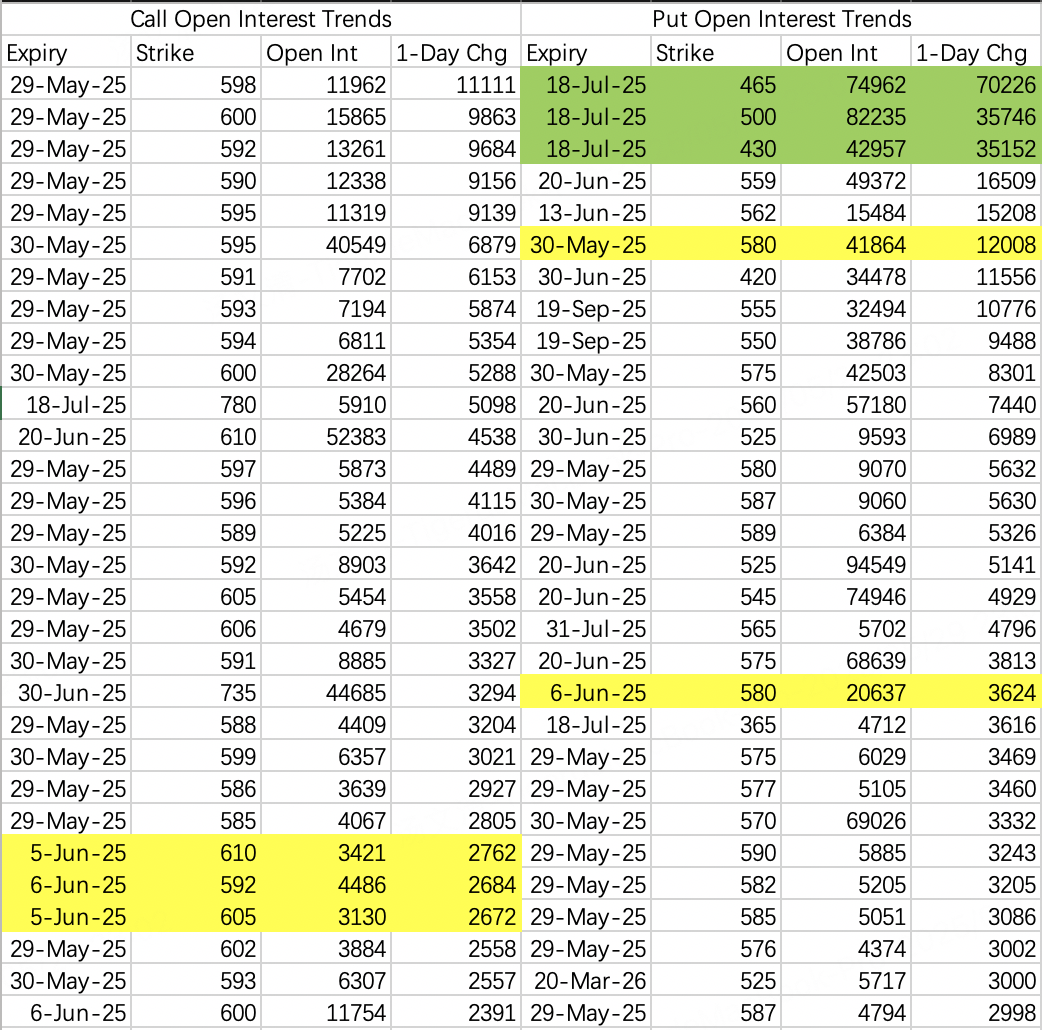

$SPDR S&P 500 ETF Trust(SPY)$

The U.S. International Trade Court ruled Trump’s global tariffs illegal and ordered them to stop. Analysts believe Trump will appeal. Frankly, this isn’t particularly good news—internal disputes mean negotiations will likely be delayed.

Bearish butterfly spread strategies have resurfaced. Unlike the June 30th expiration, the new expiration date is July 18th, giving the impression of delayed market disruptions.

$Trump Media & Technology(DJT)$

Trump-related stocks saw large bearish orders, with traders buying $DJT 20250718 20.0 PUT$ . The volume reached 27,100 contracts, with a transaction value of $6.37 million.

$Unity Software Inc.(U)$

Unity saw large bullish orders. The $U 20260116 30.0 CALL$ had an open interest of 41,000 contracts, with a transaction value of approximately $15.15 million. Rumor has it that “Roaring Kitty” endorsed the stock again. Could Unity be planning a stock offering?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.