AI Stocks Receive Unexpected Tailwinds This Week

TSMC’s CEO spoke at the annual shareholders’ meeting, highlighting strong demand for AI hardware and announcing that humanoid robot chip contributions will arrive in 2025, a year earlier than expected.

Meta signed a 20-year nuclear energy procurement agreement with Constellation Energy to meet the growing power demands of its data centers.

Broadcom (AVGO) announced the official launch of its latest data center switch chip, Tomahawk 6, ahead of its earnings report.

NVIDIA (NVDA) is set to attend next week’s Paris AI Day event.

The most significant pending catalyst is Broadcom’s earnings report, scheduled for release after the close on Thursday, June 5th. Broadcom’s stock price has already begun to rise in anticipation of the report. Broadcom is expected to achieve AI revenue of $19–20 billion in FY2025, representing over 60% YoY growth, with a 60–65% annual compound growth rate for AI over the next three years.

Options and Trading Strategy for $AVGO$

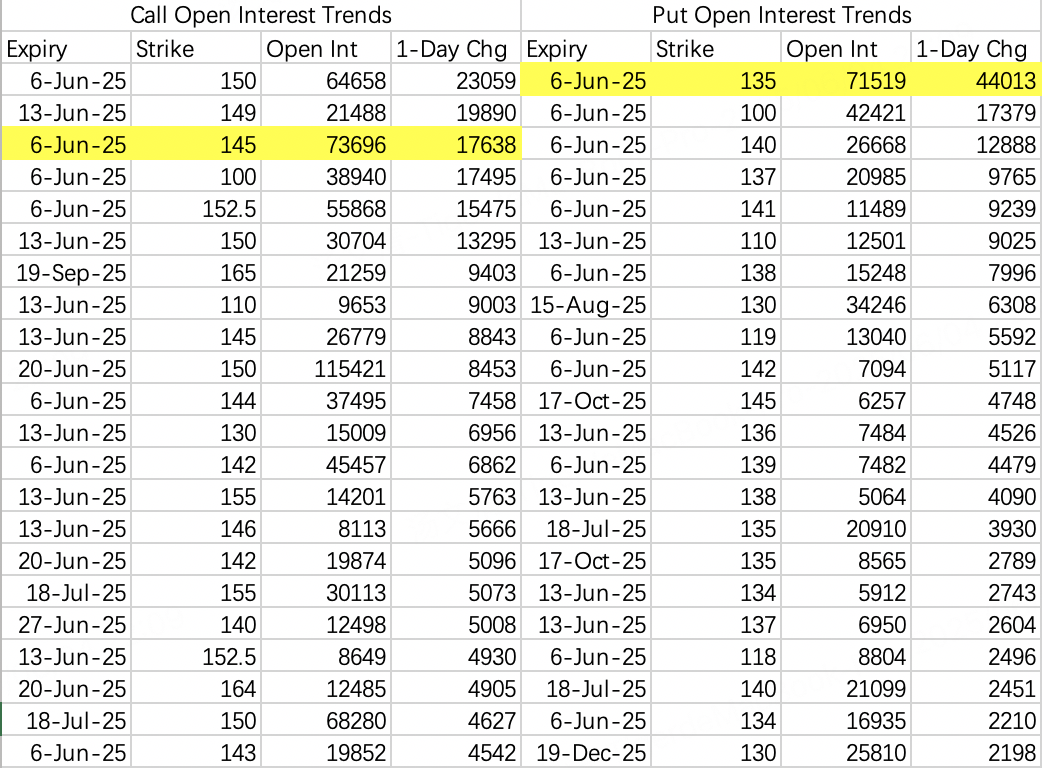

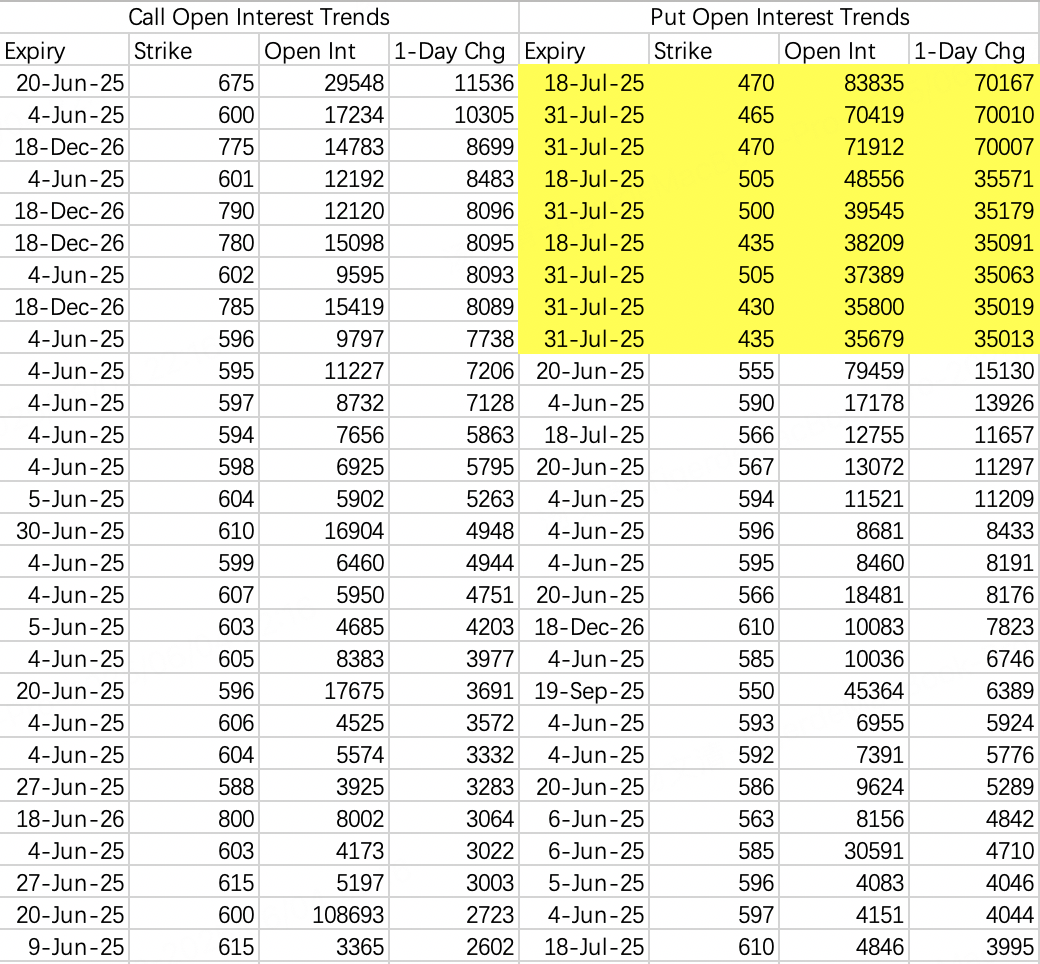

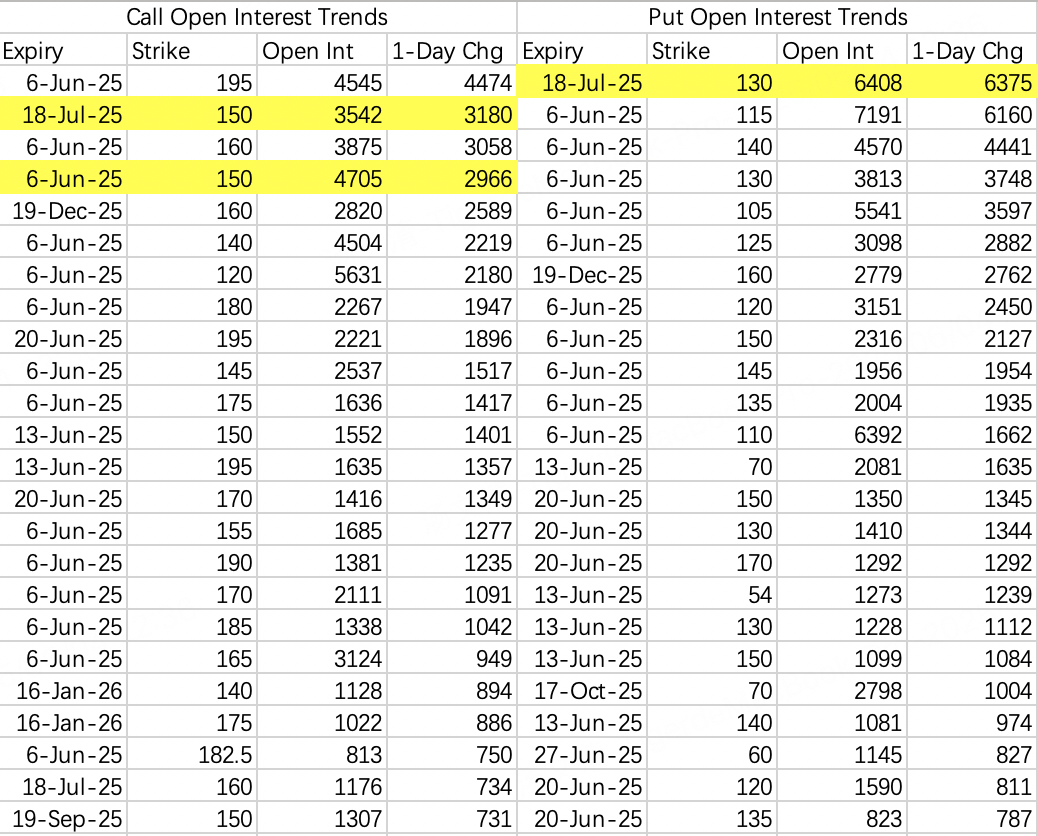

Based on open interest data, Broadcom’s earnings-related price expectations are as follows:

Upside target: $270.

Downside target: $210.

Given the three consecutive days of gains this week, post-earnings price movement is likely to resemble NVIDIA’s, with a bias toward the upside.

Suggested trading strategies:

For conservative traders: Sell $AVGO 20250606 230.0 PUT$ .

Alternatively: Sell $AVGO 20250606 245.0 PUT$ .

$NVIDIA (NVDA)$

The week’s closing range is expected to be $135–145.

Due to the unexpected tailwinds, AI stocks have rallied collectively. Institutional sell call orders were squeezed, forcing institutions to roll their $139 sell calls to $145 on Tuesday.

$S&P 500 ETF (SPY)$

Large bearish orders continue to focus on butterfly spread strategies. This week, three sets of spreads were opened simultaneously:

July 18th expiration:

July 31st expiration (set 1):

July 31st expiration (set 2):

Traders anticipate that the upcoming July tariff negotiations will cause market turbulence. Generally, the timeline for bearish positions to materialize is uncertain. My view is that trades should focus on higher-certainty opportunities while maintaining disciplined position sizing.

$CoreWeave, Inc. (CRWV)$

I don’t have much insight into this NVIDIA-affiliated stock. However, it’s worth watching to see how long the current AI rally lasts. There’s no clear bullish target, but demand for at-the-money call options has been significant.

The pullback is expected to reach $130. After Broadcom’s earnings release on Friday, selling puts should be a relatively safe strategy.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.