Chime IPO: From Losses to Profits — What’s Next?

Chime Financial $Chime Financial, Inc.(CHYM)$ is going public this week on the NYSE. If you're into fintech or just looking for a new investment idea, this one might be worth a look — especially if you're interested in companies helping everyday Americans manage their money better.

What does Chime do?

Chime is the biggest digital banking app in the U.S. — though it's not a bank itself. Instead, it works with two partner banks (The Bancorp Bank and Stride Bank) to offer its services.

Its target users? People earning under $100,000 a year. Chime focuses on making simple, low-cost banking tools for folks who often get ignored by traditional banks.

Its main features include:

Free checking accounts

Getting paid up to 2 days early

No overdraft fees

Easy-to-use debit card and payment tools

It’s not about crypto, high-end investing, or flashy tech — just solid financial services that work better and cost less.

Chime now has 8.6 million active users. On average, each user brings in $251 a year in revenue. That might not sound huge, but Chime’s business is very efficient — its gross margin on transactions is 67%, which is unusually high for payment companies.

Is Chime making money?

Yes — and that’s a big deal. Many fintechs are still losing money, but Chime has turned a profit.

In Q1 2025, Chime reported:

$9.1 million in operating income

$12.9 million in net income

88% gross margin (higher than many software companies!)

Revenue is growing fast too:

Up 32% year-over-year in Q1 2025

Up nearly 31% for all of 2024

Chime used to lose money — including a $200 million loss in 2023 — but now it's trending in the right direction: more users → more revenue → lower marketing costs → stronger profits.

Who are Chime’s competitors?

Chime makes about 80% of its money from swipe fees (when users make purchases with their debit cards). That means it depends heavily on users spending money — and on its two partner banks, which hold all its customer deposits. If either bank cuts ties, that would be a big risk for Chime.

Chime competes not only with big banks like Bank of America and Wells Fargo, but also with other fintech players like:

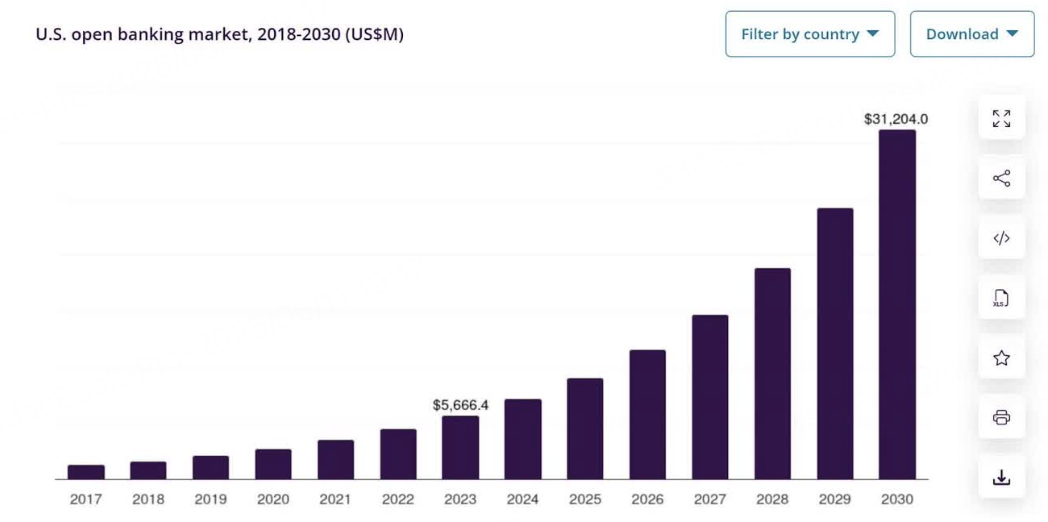

Fintech is a tough space, but the market is growing fast. Analysts expect the U.S. “open banking” market to grow from $7.1 billion in 2024 to over $31 billion by 2030 — that’s nearly 28% annual growth.

What about the IPO price?

Chime is pricing its shares between $24 and $26. In the past, private investors valued the company as high as $25 billion. More recently, it was valued around $3.3 billion.

If Chime trades at around 15 times 2024 revenue, its market cap could land above $10 billion — a solid bounce back.

One thing to note: Chime has a dual-share structure. Regular investors will get one vote per share, but the founders hold shares with 20 votes each. That gives them a lot of control.

Also, there are no announced anchor investors in this IPO — that could mean more price swings after it starts trading.

Bottom line

Chime looks like one of the stronger fintech IPOs we've seen in a while. It’s profitable, growing fast, and has a loyal user base. It solves real problems for everyday people, and does it with a solid business model.

But there are still risks — especially if something goes wrong with its partner banks, or if the IPO price is too high. And like all fintech stocks, it depends on how the market feels about tech and interest rates right now.

Still, if you believe in the long-term growth of digital banking for middle-income America, Chime might be worth adding to your watchlist.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·2025-06-12Chime IPO is a blessing in disguise for Sofi. We welcome competition. We will see what happens tomorrow with Chime, if it pops many will see Sofi as undervalued.LikeReport

- Tiger_CashBoostAccount·2025-06-12你最近在股市上的成功做得很好!你对研究和分析的承诺在你的结果中显而易见。使用Tiger Cash Boost账户进行交易,并使用对价交易来增强您的策略。”欢迎今天开设CBA,享受高达20,000新加坡元的交易限额,即将推出的新加坡、香港和美国股票0佣金、无限制交易。以及ETF。

- 如何开一个CBA?

- 如何链接您的CDP帐户?

- 关于CBA的其他常见问题。

- 现金提升账户网站。

LikeReport - 如何开一个CBA?

- Mortimer Arthur·2025-06-12希望CHYM上市後,SOFI的估值將被完全低估,我們會看到一些行動。LikeReport

- stomachooo·2025-06-11Great insights! Excited for Chime's journey! [Wow]LikeReport

- WendyDelia·2025-06-11Exciting opportunityLikeReport