Bears Take Action: $7 Million Bet on SPY Dropping to 600

$SPDR S&P 500 ETF Trust(SPY)$

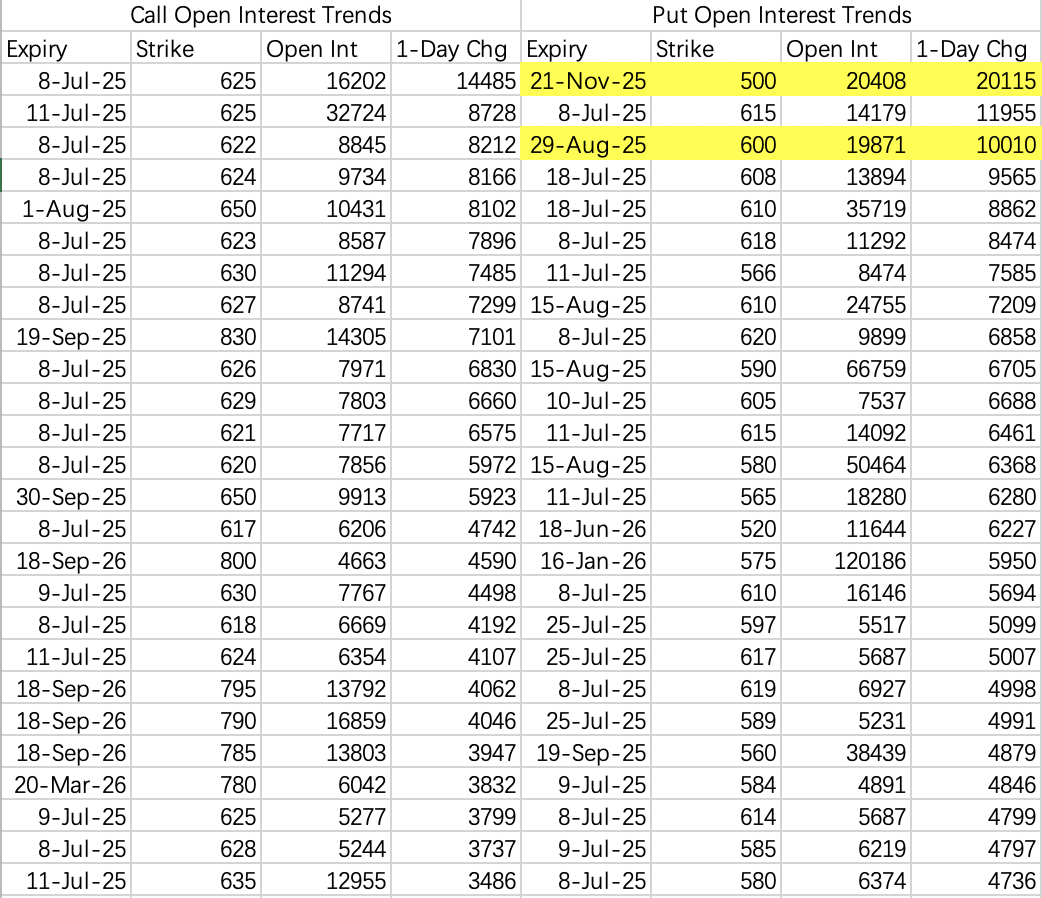

There has been notable activity in long-dated bearish single-leg put options:

$SPY 20251121 500.0 PUT$ : 20,000 contracts opened, with a transaction value of approximately $7.6 million.

$SPY 20250829 600.0 PUT$ : 10,000 contracts opened, with a transaction value of around $7.6 million.

It’s highly likely that the same trader placed these two orders in separate trades — one betting on a long-term volatility surge, and the other on a near-term drop to 600.

$NVIDIA(NVDA)$

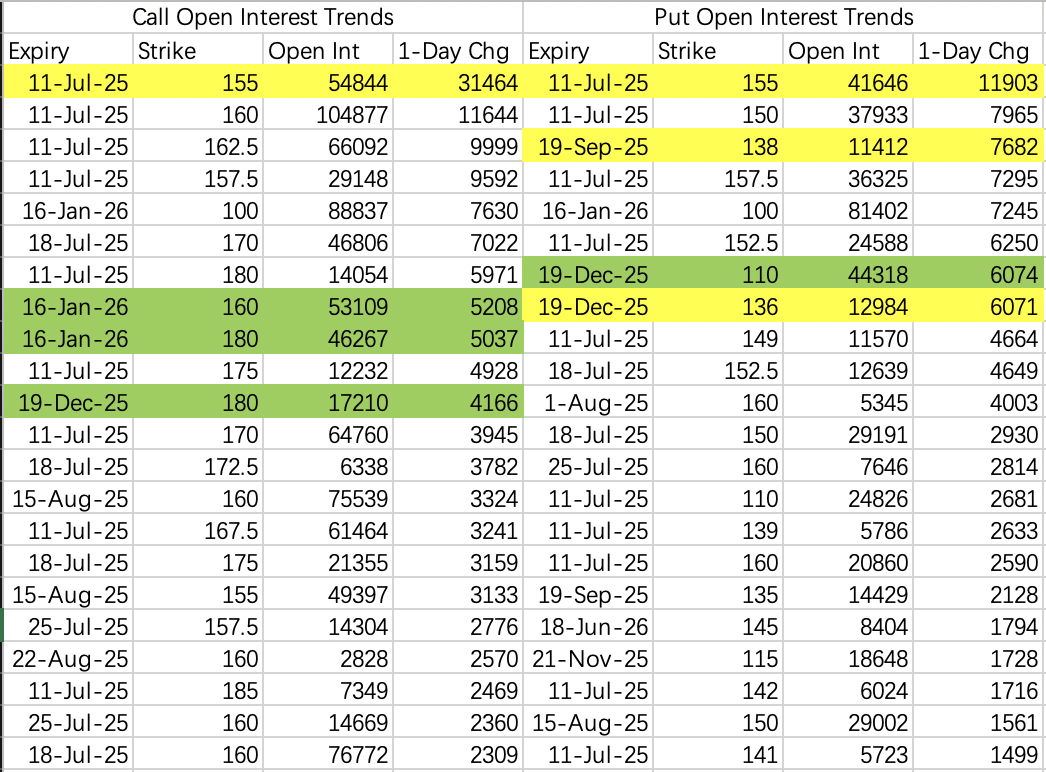

If all goes as expected, NVIDIA will likely continue fluctuating between 150 and 160 this week, with a high probability of closing near 155 on Friday. Based on this, I plan to execute a straddle:

Sell $NVDA 20250711 155.0 CALL$ + Sell $NVDA 20250711 155.0 PUT$ .

On the bearish side, there are single-leg put buyers:

$NVDA 20250919 138.0 PUT$ (expiring in September).

$NVDA 20251219 136.0 PUT$ (expiring in December).

This aligns with the overall pullback expectations.

At this level, a sell call + buy put strategy also looks appealing.

$Tesla Motors(TSLA)$

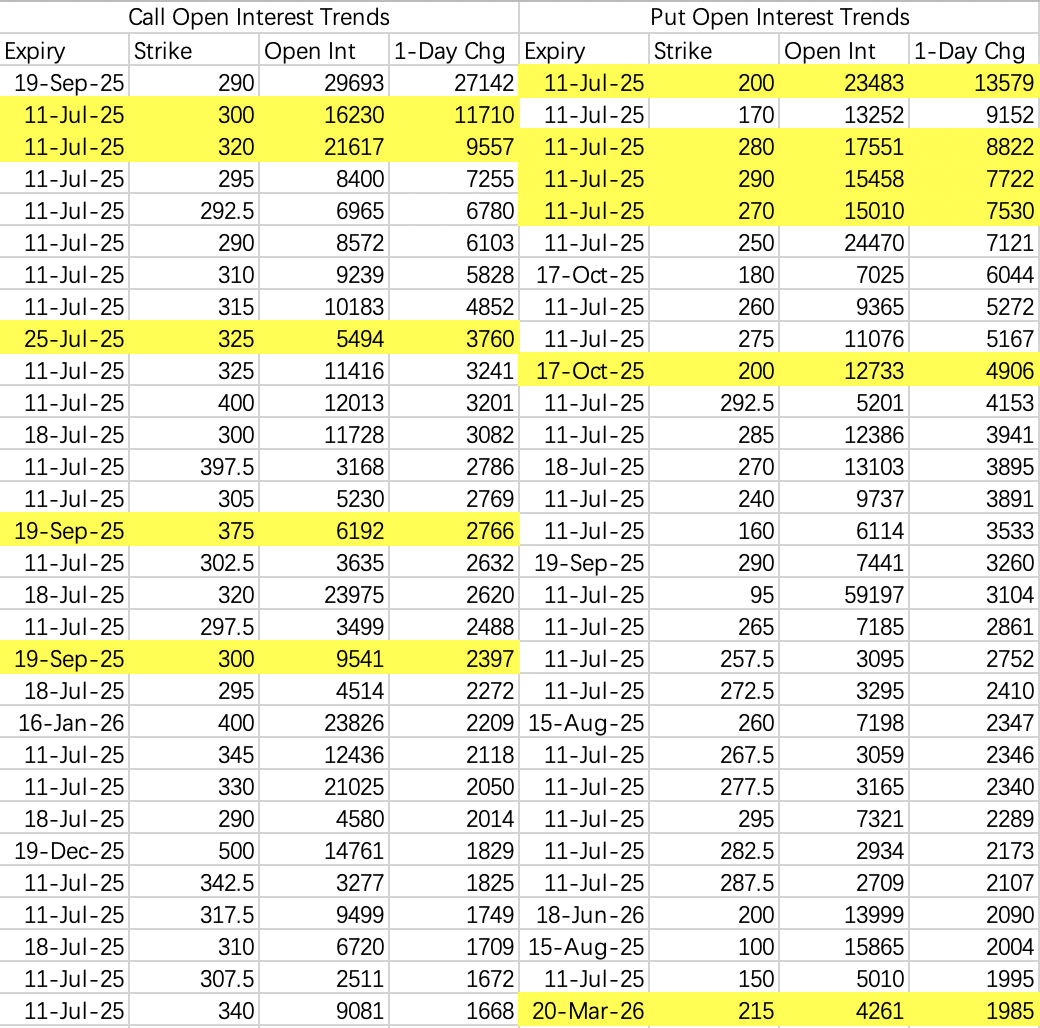

Take advantage of Tesla's rebound by selling calls:

Sell $TSLA 20250711 325.0 CALL$ .

On the bearish side, long-dated puts are concentrated around the 200 level.

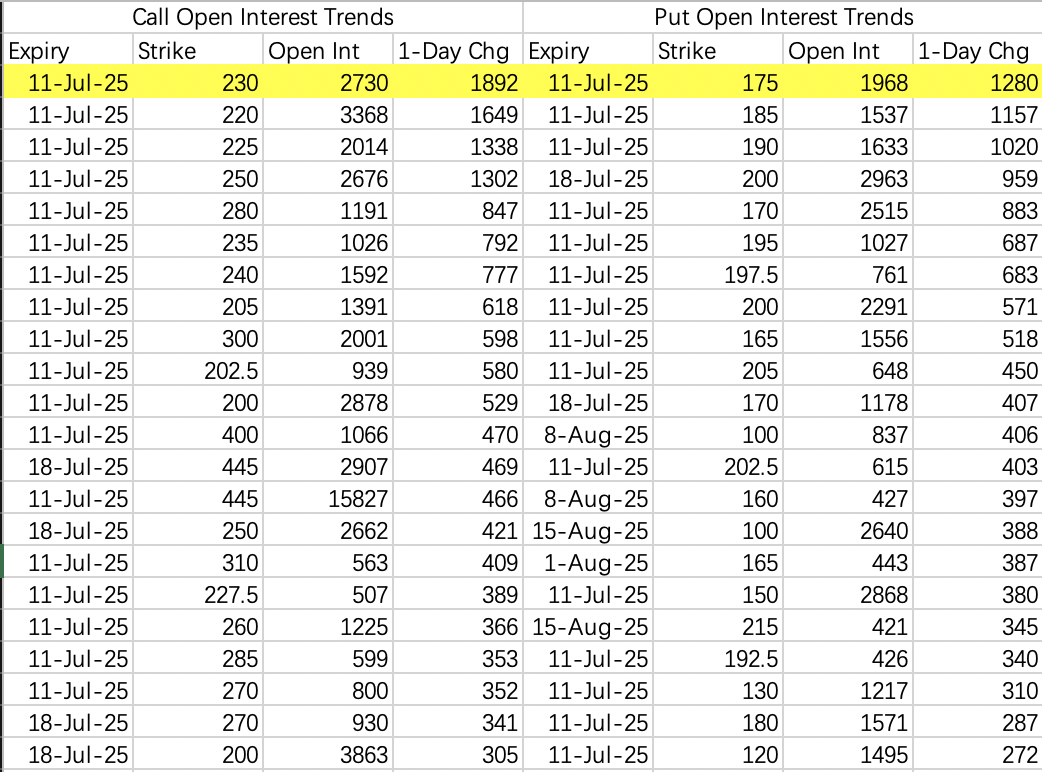

$Circle Internet Corp.(CRCL)$

For a strangle strategy, the 170–240 range is worth considering.

Today’s Trading Plan

Today’s focus is primarily on selling calls:

A 155 straddle for NVIDIA (sell $NVDA 20250711 155.0 CALL$ + sell $NVDA 20250711 155.0 PUT$ ).

Considering the bearish SPY single-leg put orders, I also sold $TQQQ 20250718 86.0 CALL$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.