OPEN: Market Maker Exiting; Above $3.5, It's Up to Fate

Conclusion: As the title suggests, the market maker isn't greedy. They exited around $3.5, and the stock price has a chance of dropping below $2. There’s also a possibility of a second wave of manipulation by another market maker later.

On Monday, $Opendoor Technologies Inc(OPEN)$ stock surged by 118%, with options trading volume skyrocketing 74 times to a total of 3.38 million contracts, making it the third most traded security after SPY and QQQ.

The implied volatility of the $5 call options expiring this week once reached 737%, with an annualized yield of 1,492% from selling these contracts!

The reason behind OPEN's rally is reportedly because the founder of EMJ Capital gave it a price target of $82, citing OPEN's business transformation.

Frankly, that’s just a fantasy.

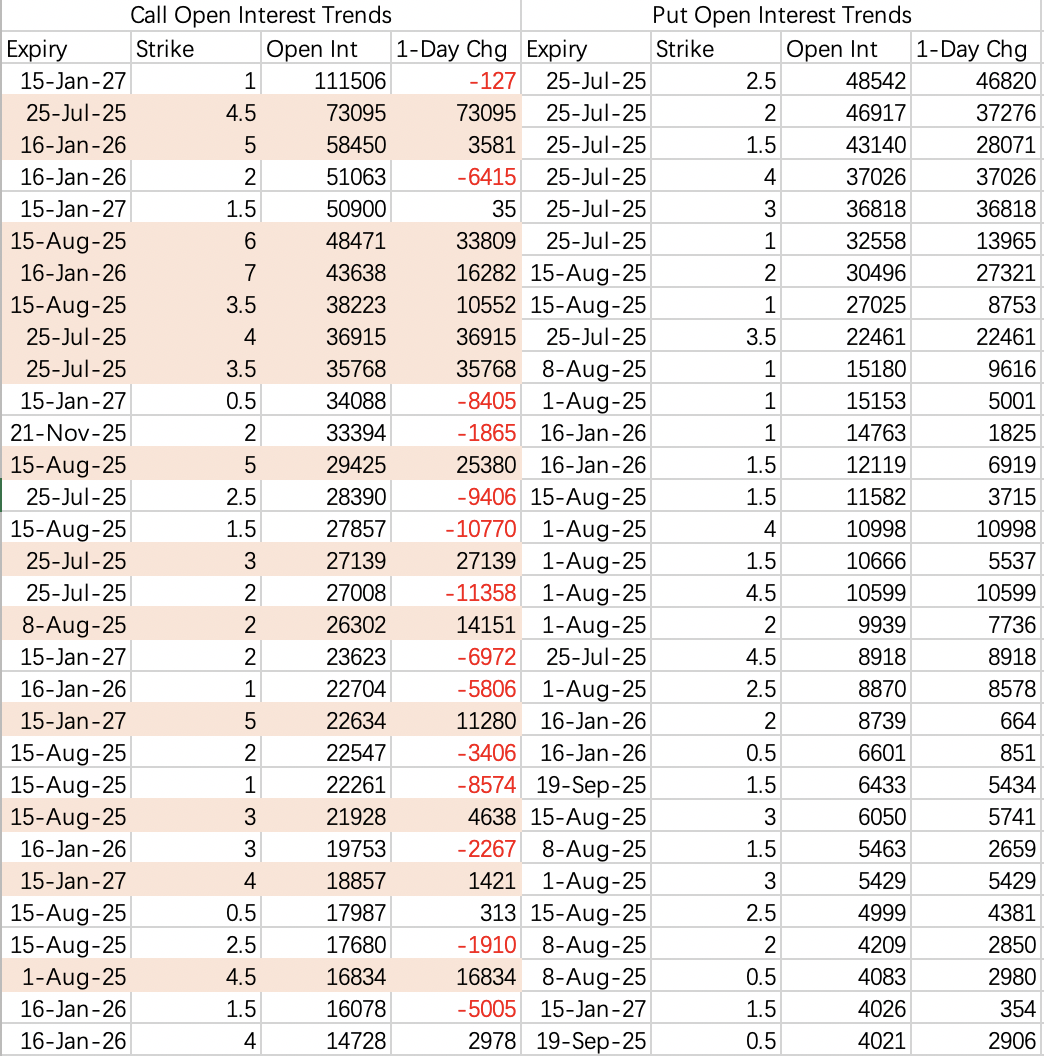

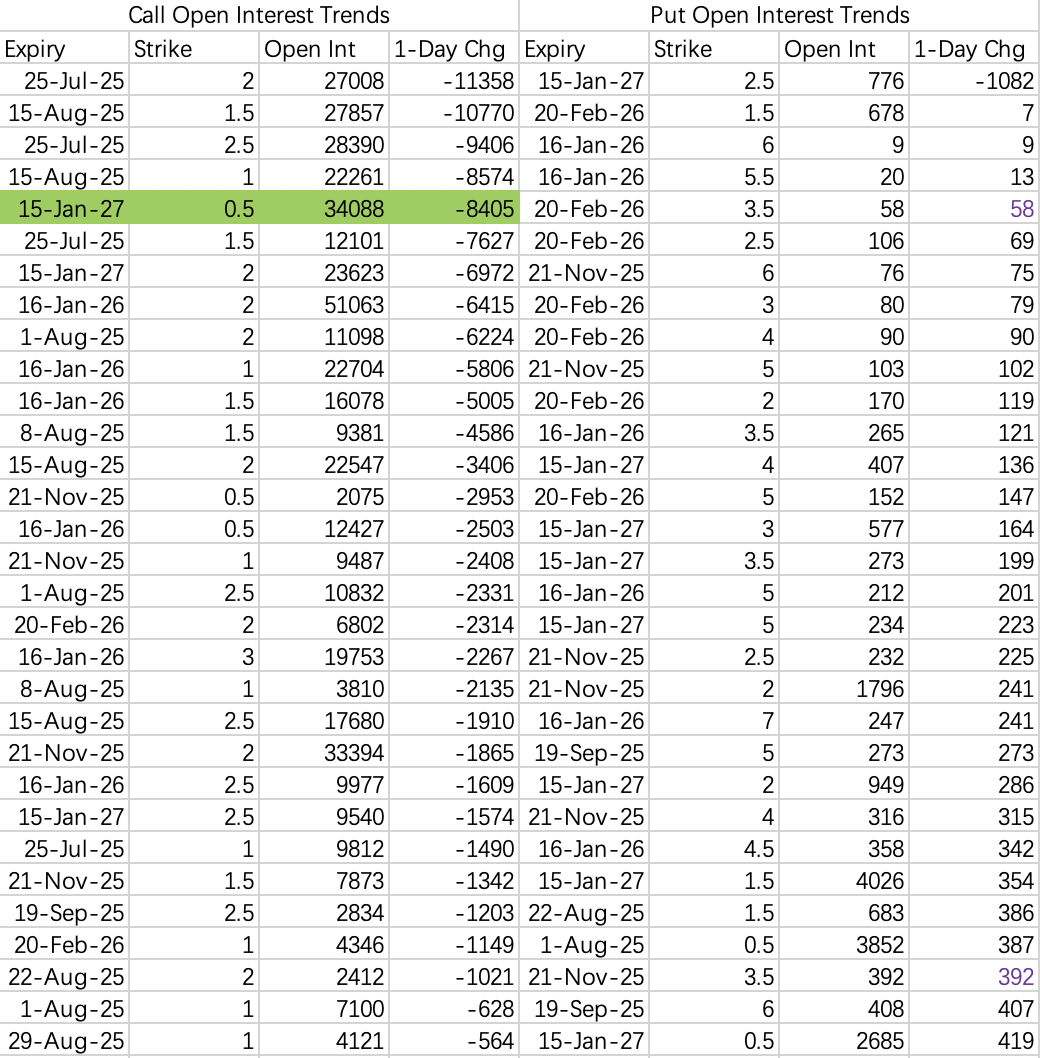

Looking at the updated options data, we can see that after Monday’s surge, early long call positions were heavily reduced. For example, the $OPEN 20270115 0.5 CALL$ saw an 8,405-contract reduction. Are you seriously telling me this is the attitude of someone expecting the stock to hit $82?

This specific $OPEN 20270115 0.5 CALL$ was first positioned on May 14, two months ago. For those in the know, this was clearly a setup by the early market maker. If they truly believed in $82, why rush to close their position now?

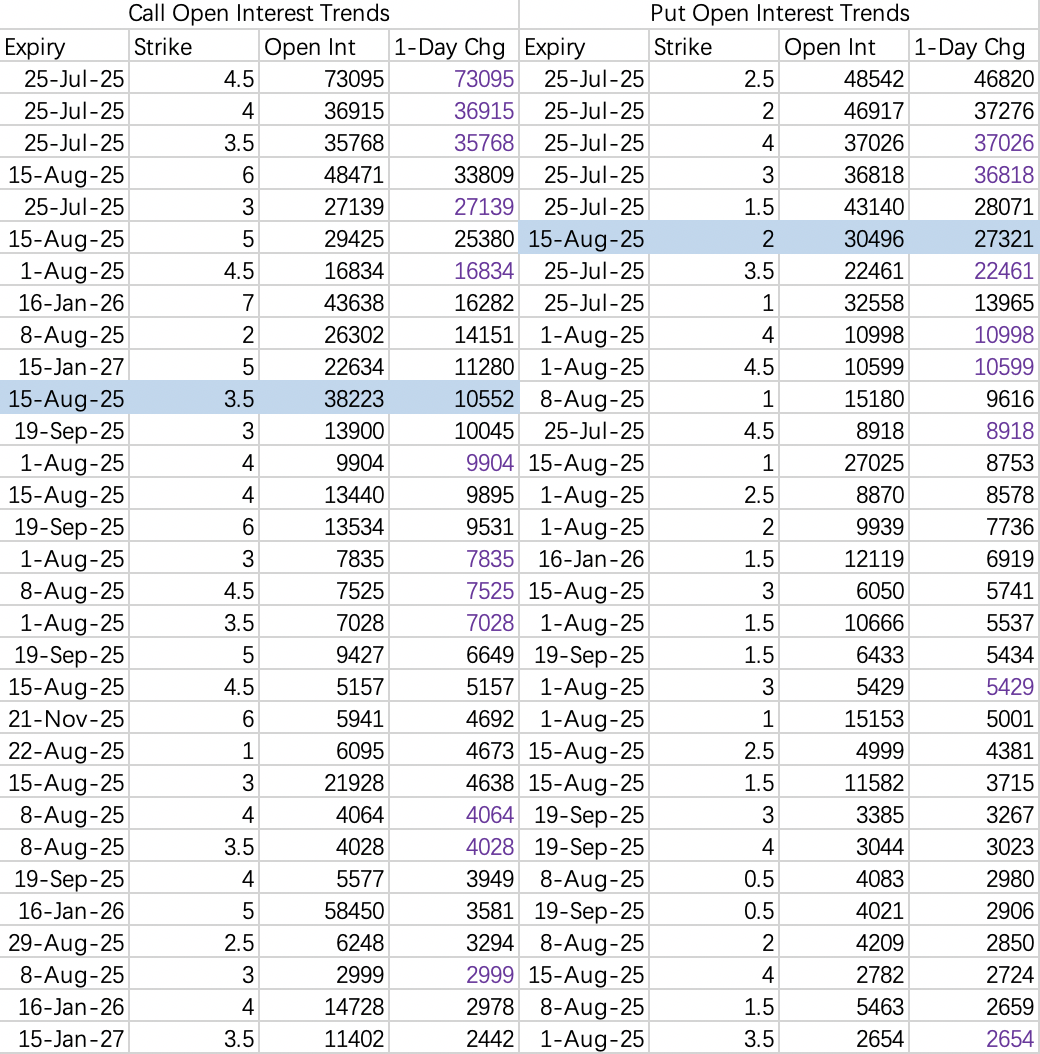

The reduction rankings make it even clearer: far-dated low-strike price calls were heavily closed, while put options saw mostly new openings, with significant volumes.

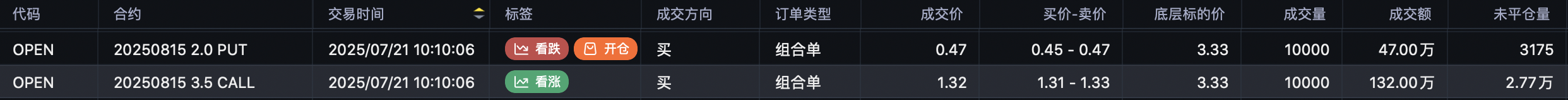

Of course, rolling positions can’t be ruled out. But here’s my second piece of evidence confirming the market maker’s exit: the largest transaction on Monday:

1,000,000 shares held

Sold $OPEN 20250815 3.5 CALL$ , 10,000 contracts traded.

Bought $OPEN 20250815 2.0 PUT$ , 10,000 contracts traded.

From the options data, the August 15 $3.5 call and $2 put don’t have the highest open interest, but they did include the day’s largest single transaction.

What’s the hidden agenda behind this large trade?

The strategy of holding shares + selling calls + buying puts is called a collar strategy. It’s commonly used to hedge against downside risks when holding a stock but expecting a bearish trend.

While this is a typical hedging strategy, applying it to $Opendoor Technologies Inc(OPEN)$ raises some interesting questions.

First, OPEN is a manipulated stock. Why hedge instead of just selling shares outright?

This suggests that the holder has a reason preventing them from selling immediately. For example, they could be company management or an institutional investor. It’s reasonable to speculate that the holder knows a bit about the price rally and believes the current price level is unsustainable, but they’re unable to sell directly.

Second, the cost of hedging. Selling the $OPEN 20250815 3.5 CALL$ generated an astonishing $1.32 million in premiums, with an implied volatility of 561% and an annualized yield of 2,740%!

If the trader is restricted from selling shares, it’s likely they also faced restrictions when buying them. Considering that OPEN’s surge happened recently, we can deduce that the 1 million shares are likely held at a cost basis below $1!

Even if the stock drops to $0, the holder can still profit handsomely by selling calls.

In this context, their purchase of the $OPEN 20250815 2.0 PUT$ likely reflects their belief that the stock price will fall significantly. Selling calls provides limited profits, while buying puts amplifies gains from a decline.

Why not trade shorter-term options?

Some may ask: if they’re eager to act, why choose options expiring August 15 instead of the weekly contracts?

The reason is that the $3.5 strikes for July 25, August 1, and August 8 just opened for trading on Monday, July 21, at 10:10 AM. It’s likely that the trader didn’t notice these new weekly options and stuck to their original plan.

Conclusion: The rally in OPEN is essentially over. The market maker has exited with significant profits.

Trading Strategy

Although the market maker has exited, this doesn’t necessarily stop OPEN’s stock price from continuing to rise. Interestingly, the highest price reached $4.9, which aligns closely with the market maker’s break-even price of $3.5 + $1.3 (premium) = $4.8. This is consistent with the expected price volatility.

On Tuesday, implied volatility slightly decreased. The current expected range for the week is $2.1–$4.9. However, small-cap stocks have low prediction accuracy due to heavy human manipulation.

Despite high volatility and annualized returns, selling options (even multi-leg strategies) isn’t recommended due to the high risk.

That said, I still took a small position with a vertical spread:

After all, I’m here to play.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

...