Diet Drug Disaster: Novo Slashes Growth Forecasts

$Novo-Nordisk A/S(NVO)$ was scheduled to report Q2 earnings on Aug. 6, but chose to issue an early earnings warning.There has also been a change of CEO, with Maziar Mike Doustda replacing Lars Fruergaard Jørgensen on August 7th.

Earnings warning and market reaction

Sales & Profit Adjustments: Full year 2025 sales growth estimate is lowered to 8%-14% (CER ) from 13%-21% (CER) and operating profit growth is lowered to 10%-16% (CER) from 16%-24%, which is significantly lower than analysts' expectations of 16.6%. In Danish krone terms, sales and profit growth fell by a further 4% and 7% respectively, mainly due to the depreciation of the US dollar.

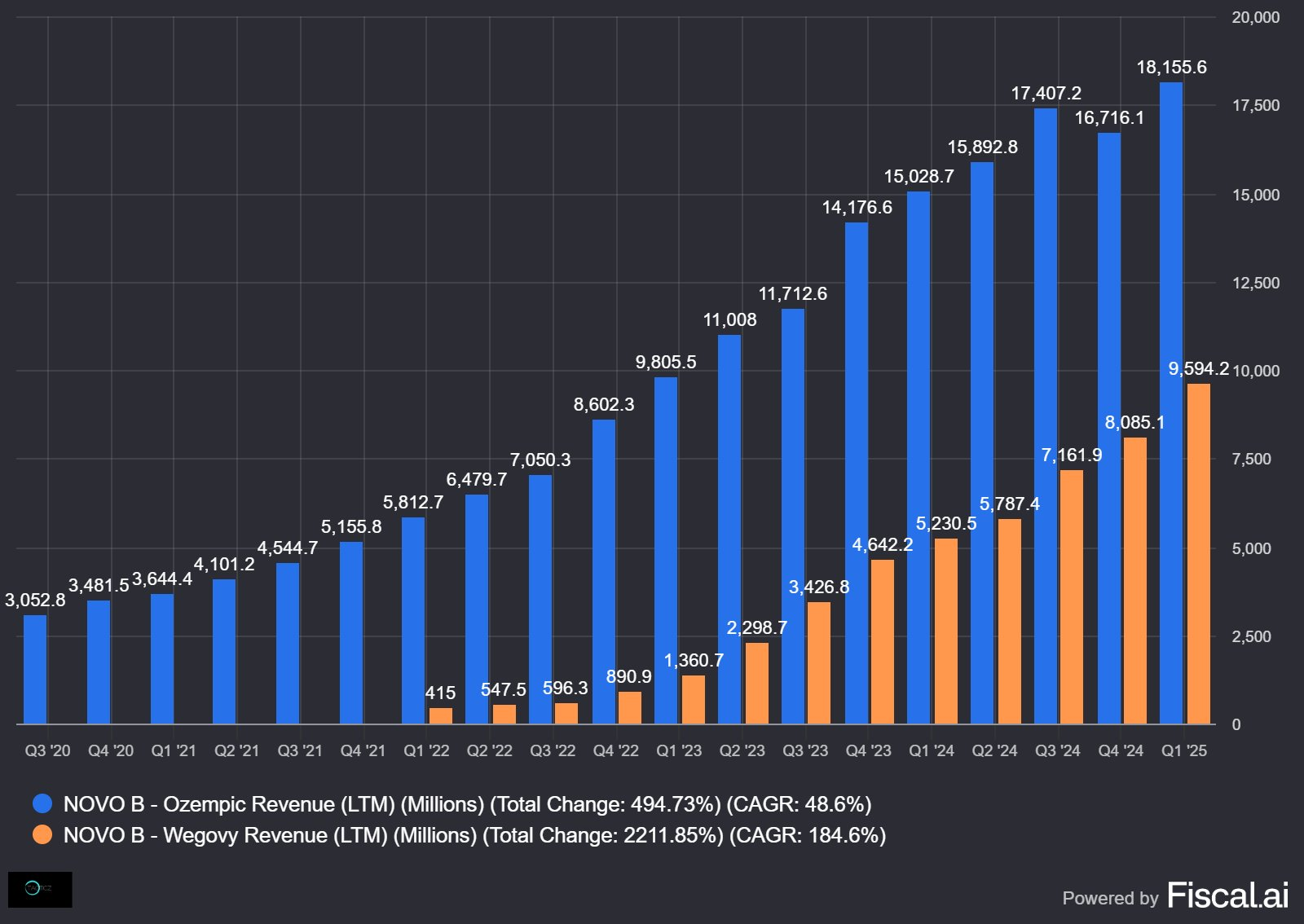

The core driver of the downgrade stems from Wegovy, with lower-than-expected penetration in the out-of-pocket channel (Cash Channel), the continued onslaught of illicit generics (accounting for ~20,000 prescriptions/week) and slow expansion in the insurance coverage channel.Meanwhile diabetes drug Ozempic also suffered a share squeeze due to increased competition in the US market (competitors such as Eli Lilly Zepbound).In addition, Wegovy penetration in some of the international markets (e.g. Europe) was less than planned.

The market voted directly with its feet, plunging 25% pre-market, 28% at one point, and ultimately narrowing the decline to ~25%, the largest one-day drop since 2022.The downgrade was viewed by the market as a material shakeup of the company's growth logic, with the sustainability of Wegovy in particular as a core growth engine being called into question.Coupled with the change of CEO (effective August 7), management stability is also under scrutiny.

How to understand Wegovy's growth stall?

1. The continuing onslaught of illegal generics.Despite the FDA ending the grace period for GLP-1 drug shortages on May 22, 2025, research shows that illegal compounding continues, circulating as "personalized medications" and directly diverting patients from the self-pay channel. novoCare Pharmacy (self-pay channel) has only 11,000 prescriptions per week, but the retail self-pay channel: approximately 20,000 prescriptions are diverted by generics.NovoCare pharmacy (self-managed channel ) has only 11,000 prescriptions per week, but the retail self-pay channel: about 20,000 prescriptions are diverted by generics. $Hims & Hers Health Inc.(HIMS)$

2. Worsening competitive landscape: $Eli Lilly(LLY)$ Zepbound is rapidly capturing the market with superior weight loss (21% weight loss in clinical trials) and pricing strategy. at one point in Q1 2025, Zepbound had ~175,000 weekly prescriptions ahead of Wegovy.Oral drug threat: Lilly's oral GLP-1 drug Orforglipron is expected to be available in 2026 and could further disrupt the injectables market.

3. slow insurance coverage and market expansion.Despite the agreement with $CVS Health(CVS)$ (Wegovy became the only GLP-1 drug covered by health insurance for obesity treatment from July 1), it will take time for penetration to increase, and part of it is still not covered by commercial insurance.The contradiction between the patient base and the treatment rate: only a few million of the world's one billion obese patients receive treatment, but the company failed to effectively convert demand into sales.

4. Growth logic and valuation repricing for long-term impact.Previously valuation anchored Wegovy 65%+ y/y growth (2025Q1 data), but after full year estimate downgrade, 2025H2 growth threatened to fall to low double digits, price/earnings (PE) ratio under downward pressure from 30x+ to 20x range.Free cash flow expectation downgrade: 2025 estimate reduced to DKK 35-45bn from original DKK 40bn+, mainly due to slower US sales growth.However, if the growth pivot moves down to 10%-15%, valuation may need to be revised down further.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- keke006·07-29Wow, quite a turnaround for Novo! [Surprised]LikeReport