🔥 COIN Stock CRASHES 8%! Bitcoin Rally FAILS Coinbase? The SHOCKING Subscription Flop

$Coinbase Global, Inc.(COIN)$ Q2 results highlight the theme of "long term logic intact, but short term growth momentum switching".Core valuation repricing triggers are Q3 subscription revenue rebound (validating AOP conversion) and derivatives debut performance (determining 2025H2 revenue resilience).Market expectation boundary has shifted from "beat/miss" to strategy execution, we suggest focusing on the layout opportunities during the pullback period, upside catalysts include institutional cooperation volume and AI-driven efficiency improvement.In terms of industry impact, if Coinbase succeeds in platformization, it may accelerate the integration of cryptocurrency and traditional finance, and reshape the competitive quadrant of exchanges.

Performance and Market Feedback

Overall divergence pattern of "profit surged but revenue fell short of expectations".

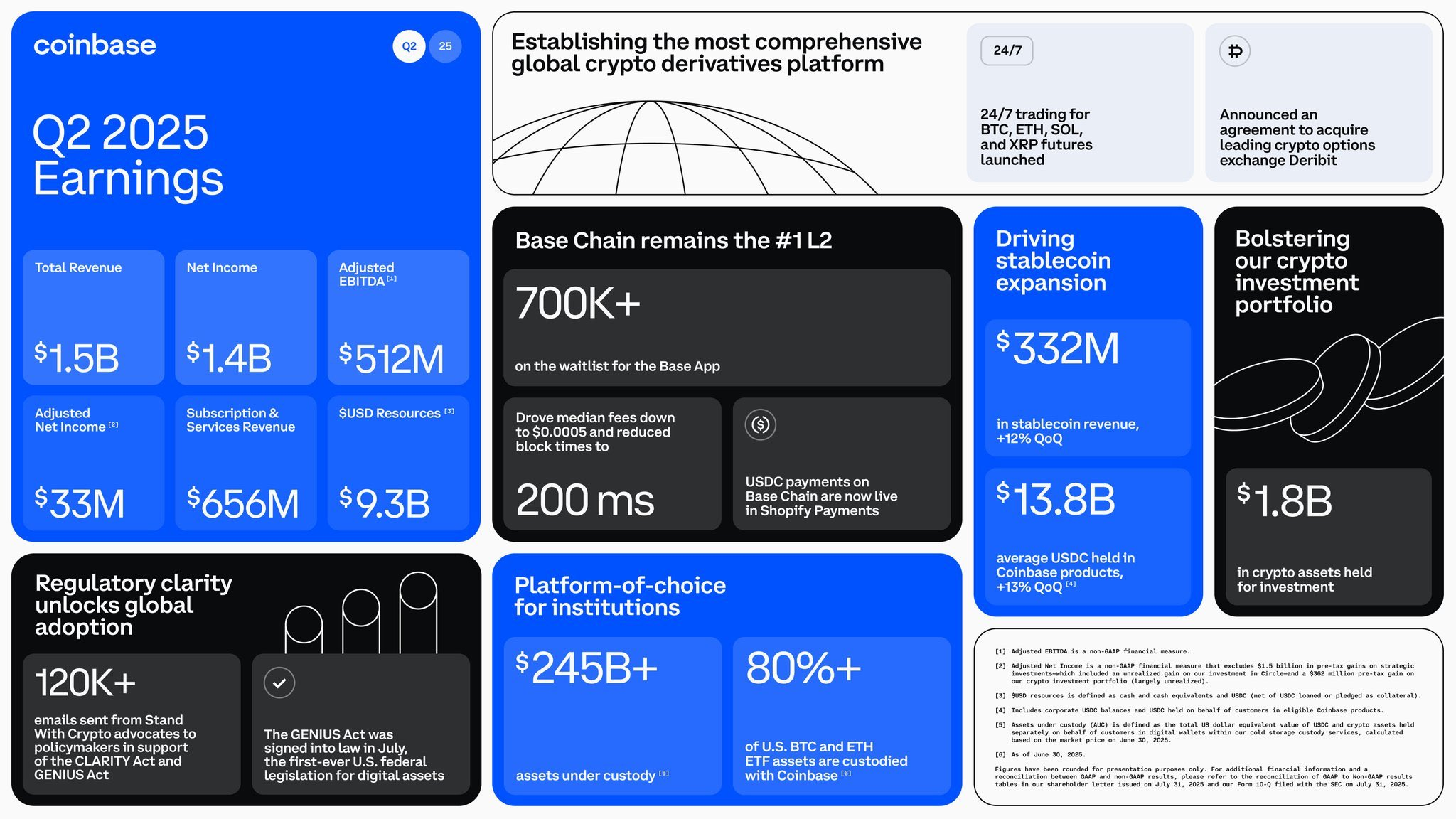

Revenue and EPS: Total revenue of $1.5B was lower than expectation of $1.59B, +3.4% YoY ($1.45B in Q2 2024), -26% QoQ ($2.03B in Q1), and GAAP EPS of $5.14 was driven by investment income (e.g., unrealized gain of $1.5B on Circle).1.26, showing that core business profitability remains resilient.

Segment revenue change: trading revenue $764M, down 40% YoY (Q1 $1.26B), subscription and service revenue $656M, down 6% YoY (Q1 $698.1M), the share increased to 44%, showing subscription-based trend.Adjusted EBITDA was $512M, down 45% YoY ($930M in Q1), reflecting the drag on earnings from lower trading revenue.

Shares fell 9% after hours , reflecting investor concerns over declining trading revenue.Sentiment turned cautious as revenue misses, particularly subscription revenue, highlighted weak growth in the core business.Market interpretations focused on "profits supported by one-off gains, but a weakening of the sustainable revenue engine", fueling concerns about dependence on cryptocurrency volatility.YTD shares were up 52% by quarter-end (benefiting from Trump's policy catalysts), but market capitalization retreated post-earnings, reflecting a valuation premium that needs to be validated by performance.Market interpretation tends to be cautious in the short term, analysts are concerned about subscription business growth and improvement in the regulatory environment, Coinbase as the industry weathervane, its performance may affect the overall valuation of the crypto sector.

Investment highlights

The core insight of Coinbase's quarterly results is that short-term volatility (revenue miss, earnings pressure) has not subverted its long term logic (AI-driven platformization, derivatives expansion), but has exposed structural weaknesses in its core business, which may trigger a mild repricing of valuations.Market expectations are shifting from "transaction-led" to "multi-subscription + derivatives"-driven, and if the new strategy is not well executed, competitive and regulatory risks may depress valuations.The following is an in-depth analysis, integrating cause-and-effect logic and data support.

1. Profit surge masks weak core revenue, trading ecosystem faces revenue challenges

Profit of $1.4B beat estimates, mainly due to Circle IPO gain (investment book gain), but core revenue of $1.5B miss 90Mest. after exclusion, down -$26764M YoY, mainly due to lower market volatility (attributed by management) and adjustments to stablecoin strategy: the company proactively reduces USDT pairs (penetration >60%) and promotes USDC to increase long-term revenue share, but short-term drag on trading volume.) and promoted USDC to increase long-term revenue share, but short-term drag on trading volume.Volume of $237B yoy +5% suggests resilience in user activity, but yields are down (revenue per unit traded is slipping), reflecting pricing pressures in a cryptocurrency bear market cycle.

Valuation Implications: This divergence highlights Coinbase's sensitivity to the macro environment, and if volatility remains low (e.g., BTC/ETH prices move sideways), trading revenues could come under further pressure, depressing near-term PE multiples (current Forward PE 30x higher than traditional exchanges).However, the market has been partially price-in, and Q3 trading revenue is expected to stabilize YoY.

2. subscription revenue is less than expected, exposing the AOP growth fat and pledge ecological weaknesses

Subscription revenue of $736Mmiss780M est. is a record high for customer asset size (AOP), but 80% of incremental growth comes from bitcoin appreciation (70% of BTC vs 66% qoq), not new deposits.Bitcoin appreciation does not directly drive subscription revenues (e.g., stablecoin rates and pledge revenues), and core contributor ETH/SOL prices fell 10% yoy on average in Q2, leading to weak pledge revenues.Meanwhile, USDC promotion strategy of rebate subsidies accounted for 40% (50% in Q1), although optimized YoY, but still erode high margin subscription revenue (target gross margin >60%).

Valuation: subscription business is the key to long logic (target ARR of 50%+ of revenue), this quarter's miss may trigger sell-side to lower future quarterly guidance (current 2025E subscription revenue growth rate of 25%).If AOP growth fails to translate into paying behavior (e.g., new institutional clients), it may depress the premium supported by the platformized narrative.However, cooperation with JPMorgan/PNC may accelerate B-side deposit and boost 2026E subscription conversion rate, which is a positive sign.

3. Earnings double-dip and cost rigidity, EBITDA margin decline warns of operating leverage risk

Causal chain: Adjusted EBITDA margin 34% vs 38% qoq, main reasons for decline: ① deterioration of revenue structure (decline in the share of high-margin trading revenues); ② cost rigidity: staff costs +15% yoy (AI/compliance team expansion) + one-off $300M FCA fine (data leakage incident).Despite stablecoin rebate optimization (subsidy ratio down to 40%), fixed costs such as bandwidth/depreciation rose as a percentage, amplifying the impact of revenue volatility on earnings.Core operating profit growth slowed to 10% yoy vs. 30% + historical average.

Valuation impact: This data validates Coinbase as a "highly operationally leveraged model" with short-term earnings sensitive to revenue.No improvement in Q3 revenue could trigger sell-side downgrade of 2025E EBITDA margin to 30%-35% (current consensus 35%).However, in the long run, cost optimization (e.g. AI automation) and derivatives on-line (July perpetual futures) could improve operational efficiency and support forward EBITDA rebound to 40%+.

4. Derivatives and diversification strategy become key inflection points, intensified competition may redraw the industry landscape

Cause and effect chain: the highlights of this quarter are in strategy execution: ① derivatives to fill the gap (75% of crypto trading volume is derivatives, Coinbase's acquisition of Deribit has not been consolidated, but the launch of perpetual futures in July, which is expected to increase the market share); ② tokenization and cooperation with banks (e.g., JPMorgan) to accelerate the real assets on the chain.But the risks emerge: Trump's policy catalyzes the entry of traditional institutions (such as Goldman Sachs), increased competition may compress transaction rates, 2025E industry share may drop from Coinbase's current 30% to 25%.

Valuation impact: this dynamic constitutes a core variable in valuation repricing.If derivatives go live and contribute revenue in Q1 (expected to be 20% of trading volume in Q4), it could push up 2026E growth expectations and support current price; conversely, if execution is delayed or competition exceeds expectations, forward P/S (currently 8x) could fall back to 5x-6x (industry average).Regulatory friendly environment (e.g., rectification after FCA fine) is supportive, but need to monitor legislative progress in Congress.

Earnings guidance and management tone

Q3 Guidance: Subscription and service revenue guidance of $600M-$680M, slightly lower than Q2 actual of $656M, indicating management's caution in light of market volatility, with no specific guidance on trading revenue, reflecting the uncertainty of volume recovery.CEO Brian Armstrong expressed optimism about the improving regulatory environment in the earnings call, emphasizing the framework benefits for the industry from the CLARITY Act and GENIUS Act, which are expected to attract institutional capital.and the GENIUS Act are framework benefits for the industry and are expected to attract more institutional capital.The tone is skewed towards long-term growth, while the short-term focus is on volume recovery and expense control.

Deviation from market expectations: Guidance did not exceed market expectations and subscription revenue guidance is conservative, which may put some pressure on valuation, but stablecoin and derivatives growth is seen as long-term support.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·08-01It’s not often you find a company in the AI sector offering cost-saving solutions to major industries and still trading this low.1Report

- Merle Ted·08-01if it drops to $250 I will nibble again1Report