Morgan Stanley predicts that the Fed is about to be "dovish". Is it time to go long on U.S. debt?

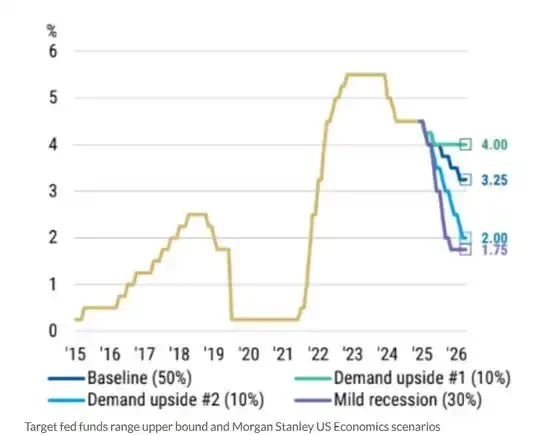

According to Morgan Stanley's forecast, the Fed could cut interest rates more than the market currently expects. Economists on the bank's interest rate strategy team came to the above view after updating their forecast scenario from now until the end of next year.

Their current base forecast is that the Fed will cut interest rates by 25 basis points at its meeting this month and make similar cuts at every other meeting until December 2026.However, after assessing other possibilities for the U.S. economy, Morgan Stanley believes that the "balance point" of these possibilities should be more dovish.

Regarding Federal Reserve Chairman Powell's previous speech at the "Global Central Mothers Annual Meeting", the market generally interprets that the Federal Reserve will adopt a looser stance in the future and pay more attention to the weakness of labor market data rather than stubborn inflation data.

Morgan Stanley believes,Federal Funds rate could decline faster than expected in 2025 and 2026, possibly as low as 2.25%. However, there may be a slight recovery at the end of this period, around 2.75%.

However, Morgan Stanley's report emphasizes thatDue to the risk of a recession, or the Fed taking less hawkish measures on inflation, traders may think a more dovish outcome is more likely.Based on this picture, Morgan Stanley predicts that,The market pricing of the fed funds could be 100 basis points below the 3.25% final rate currently assumed.

At present, the bond market sees only a 20% probability of a series of more "dovish" events happening. "That's a very small number given the growing risks in the U.S. labor market," Hornbach and his team argue.

For investors who want to take advantage of the low level of U.S. bonds to buy U.S. bonds at the bottom, they can consider using the diagonal spread strategy.

What is a diagonal spread?

diagonal spread refers to the spread established using options with different strike prices and different expiration dates. Generally, the duration of the long leg in the spread is longer than that of the short leg. Diagonal spreads include diagonal bull spreads versus diagonal bear spreads.

The diagonal bull spread is basically similar to the bull subscription spread strategy, except that it has been upgraded and improved again.The difference is that the two options for the diagonal spread have different expirations, the trader buys a longer-term call option with a lower strike price and sells a shorter-term call option with a higher strike price. The number of call options bought and sold is still the same.

TLT Diagonal Spread Case

Assuming investors are bullish for the next year$20 + + Years US Treasury Bond ETF-iShares (TLT) $, you can directly buy the call option with an exercise price of 86 and an expiration date of August 21, 2026. This option becomes our long leg, which costs $483 at the latest transaction price.

After the long leg is established, we can establish the short leg according to a shorter cycle than the long leg. Here, we can choose to establish it on a weekly basis. Choose to sell the call option with an exercise price of $88 and an expiration date of September 10 and get premium of $18.

Here, if the call option sold is not exercised, it will generate a profit of $18, which is about 3.7% relative to the cost of $483 on the long side. However, the short leg can be executed once a week. When the remaining date of the long leg is as long as 353 days, investors can sell dozens of call options. If some sold call options can successfully obtain premium, it will greatly reduce the cost of buying the call option itself, and even get the call option for free.

Compared with buying bulls alone, the diagonal spread obtains an additional premium income, which reduces the overall net premium expenditure of the strategy, and the break-even point of the strategy is also shifted to the left, and the winning rate is also increased accordingly. AdditionallyThe selling point of the diagonal spread can be controlled by investors themselves, so different short-selling efforts can be selected in different cycles to facilitate investors to control risks. Diagonal spreadEssentially, it is a low-cost call option strategy that is worth investors studying.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·2025-09-03Historically, major TLT bull runs often followed periods of very heavy short interest. The logic: once everyone is leaning bearish, the trade is crowded. Any catalyst (Fed cut, recession fears, crisis) forces covering, and TLT rallies hard.LikeReport

- Venus Reade·2025-09-03this is going to take out the 83 low in the face of lowering of short term rates and move quietly to 75LikeReport