Big-Tech Weekly | AWS Pushes AMZN To All Times High? Google's Big Winner!

Big-Tech’s Performance

Macro Headlines This Week:

September seasonality and event-driven risks. Investors remain cautious on September’s historically weak performance — the month that has often been the worst for equities. Key events included preliminary announcements on the Russell index reconstitution, heightened sensitivity to upcoming labor market data and the Fed’s policy decision. Equity trading volumes were thin around the holiday, but tech and growth stocks led the market higher.

Labor market weakness boosts rate cut expectations. ADP private payrolls added only 54k jobs (below consensus 69k). Initial jobless claims spiked to 237k (vs. 229k expected), showing persistent upward momentum and pressure in the labor market. Meanwhile, the ISM Services PMI climbed to 52, signaling expansion, though employment components remained weak. Markets significantly increased their bets on a September Fed cut, with dealers now viewing a rate cut as almost certain and expecting at least 50 bps of total easing by year-end.

S&P 500 powered higher despite post-holiday volatility. After opening lower following the long weekend, the S&P 500 set new record highs. While expectations around Nvidia’s earnings disappointed, investor focus shifted toward other AI narratives — namely Broadcom, Amazon, and Google. AI remains the market’s structural driver.

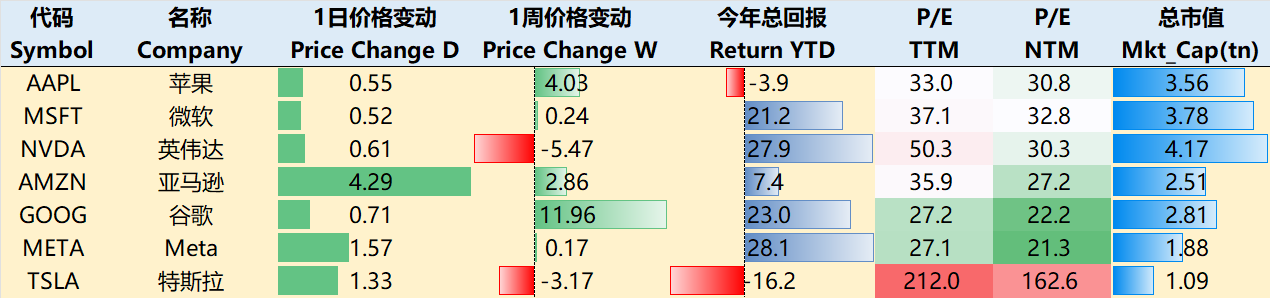

Weekly Big Tech Moves (as of Sept 4 close): $Apple(AAPL)$ +4.03%, $Microsoft(MSFT)$ +0.24%, $NVIDIA(NVDA)$ –5.47%, $Amazon.com(AMZN)$ +2.86%, $Alphabet(GOOG)$ +11.96%, $Meta Platforms, Inc.(META)$ +0.17%, $Tesla Motors(TSLA)$ –3.17%

YTD returns: Only AAPL (–3.9%) and TSLA (–16.2%) remain underwater.

Big-Tech’s Key Strategy

AWS’s New Narrative Could Push Amazon to Fresh Highs

This week’s market leadership came from two sources: Google (benefiting from favorable Chrome antitrust rulings) and Amazon.

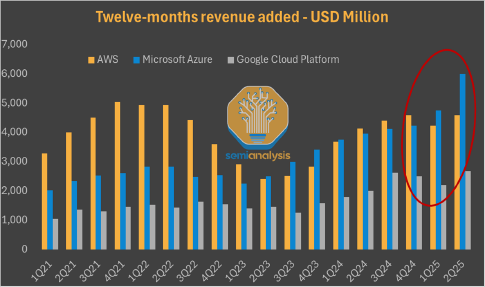

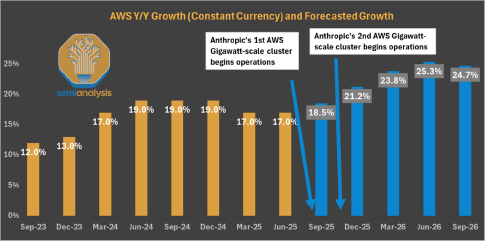

Amazon’s rally was primarily driven by a SemiAnalysis report highlighting an AWS turnaround in the AI cloud race. The key call: with Anthropic as a deep anchor partner, AWS could re-accelerate growth above 20% YoY by end-2025 (up from mid-teens).

Why AWS Lagged the AI Cycle Over the Past Two Years:

Network bottlenecks. AWS’s custom Elastic Fabric Adapter (EFA) networking underperformed Nvidia InfiniBand/Spectrum-X and RoCEv2, resulting in higher latency and inferior UX. EFA v4 brought improvements but still trails peers.

Strategic positioning. In the split between “bare-metal wholesale customers” (large AI labs) and “managed cluster customers” (startups), AWS’s ClusterMAX ranking is only “Silver,” below CoreWeave and Crusoe’s “Platinum.” This weakens pricing power and competitiveness in multi-tenant GPU markets.

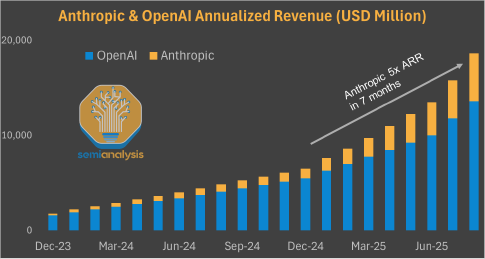

Lack of anchor customers. Unlike Microsoft-Azure’s lock-in with OpenAI, AWS failed to secure a flagship AI partner early, leading to slower revenue momentum.

The Inflection Point – Anthropic as the Anchor Client.

AWS is now building its AI rebound strategy around Anthropic, deploying multi-GW scale Trainium capacity to compete head-on with Nvidia/TPU ecosystems.

In Sept 2023, Amazon invested $1.25B in Anthropic (expandable to $4B). In Nov 2024, it added another $4B, making AWS the primary LLM training partner.

AWS is executing its fastest-ever datacenter build-out — three campuses (over 1.3GW total capacity) nearing completion, expected to contribute revenue by end-2025. These facilities will host nearly 1M Trainium2 chips with advanced air-cooled designs.

Anthropic, though less public-facing than OpenAI, is focused on scaling laws and reinforcement learning workloads — highly memory-intensive and well-suited to Trainium’s design. It is the only large external Trainium user, echoing Google DeepMind’s integrated hardware-software model.

Trainium’s Trade-offs – Technical Drawbacks but TCO Advantages.

Performance gap. Trainium2 trails Nvidia GB200 in raw compute and bandwidth.

Cost efficiency. However, Trainium delivers better total cost of ownership (TCO) on “memory bandwidth per $” and “cost per million tokens,” aligning with Anthropic’s reinforcement learning and post-training workloads. AWS’s Teton PDS/Max + NeuronLink v3 architectures aim to maximize horizontal bandwidth at rack scale.

Shortcomings remain.

Networking: EFA still lags InfiniBand/RoCE in latency/experience.

Bedrock limits: tight default rate caps (e.g., 2 RPM for new Opus accounts) and inconsistent GPT-OSS integrations reduce enterprise migration willingness.

Weak in-house models: Nova/Titan trail competitors; Alexa increasingly tied to Anthropic’s Claude.

Demand-side dynamics: Anthropic’s 2025 run-rate revenue could reach ~$5B, with ongoing contract expansion. Yet overall cloud spend is still below OpenAI’s, and much inference traffic remains with Google Cloud. Medium-term risk: by 2027, if AWS fails to broaden beyond Anthropic, Trainium may face overcapacity and lower ROIC.

Bottom Line: In 2025–26, AWS’s bandwidth/TCO positioning plus Anthropic could accelerate training market share gains. But to sustain momentum, AWS must (1) improve Bedrock UX and quotas, and (2) land a second-tier anchor client. Success here could transform Trainium from “bespoke Anthropic platform” into a scalable mainstream solution.

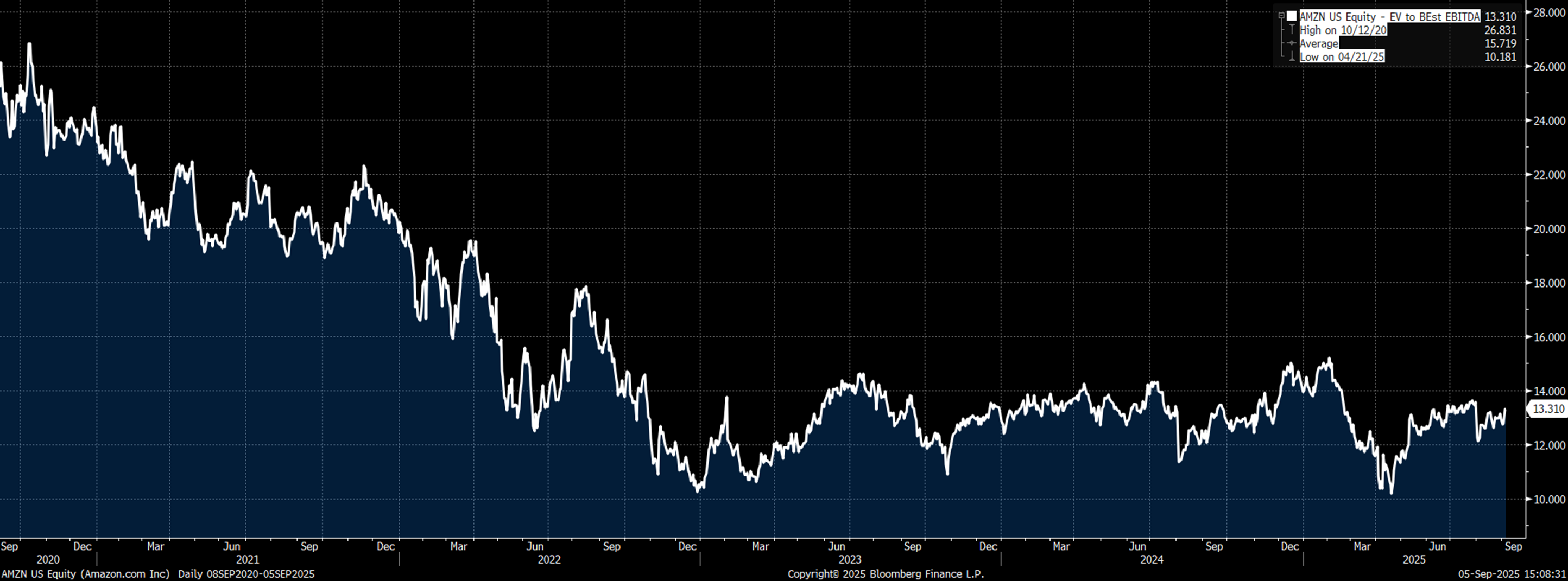

Valuation impact: AWS re-acceleration could lift AMZN’s operating profit and justify multiple expansion. With AWS growth stuck in the teens, AMZN’s valuation has compressed toward mid-2023–25 ranges. If >20% growth materializes, multiples could re-rate back toward 15–20x EBITDA.

Big Tech Options Strategies

Google dominated options flow this week.

GOOG surged 9.11%, far outpacing the Magnificent Seven. Drivers included:

Antitrust ruling: Court allowed Google to continue paying Apple TAC for search engine defaults, provided no exclusivity clauses — theoretically opening devices to rival search providers.

AI advances: Strong buzz around Google’s Nano Banana text-to-image model, plus the unveiling of Ironwood TPU at Hot Chips 2025.

Ironwood is Google’s first inference-only TPU, optimized for LLMs, MoE, and reasoning tasks. A 9,216-chip SuperPod supports 1.77 PB global shared memory. Its dual-chip design achieves 42.5 Exaflops FP8 performance at 10MW load, now deployed across Google Cloud clusters.

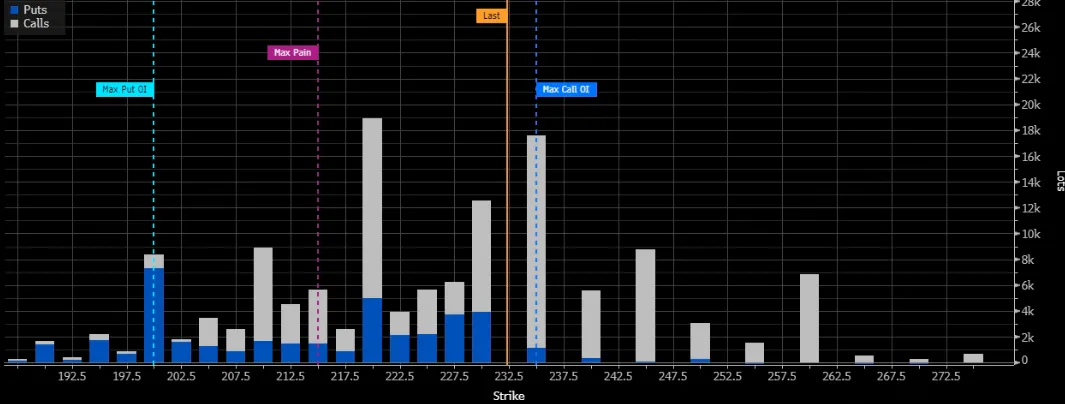

Options market reaction:

Implied vol ticked higher.

Surge in large call activity, particularly 235-strike short-dated calls.

Beyond mid-September, flow was relatively muted.

Big Tech Portfolio

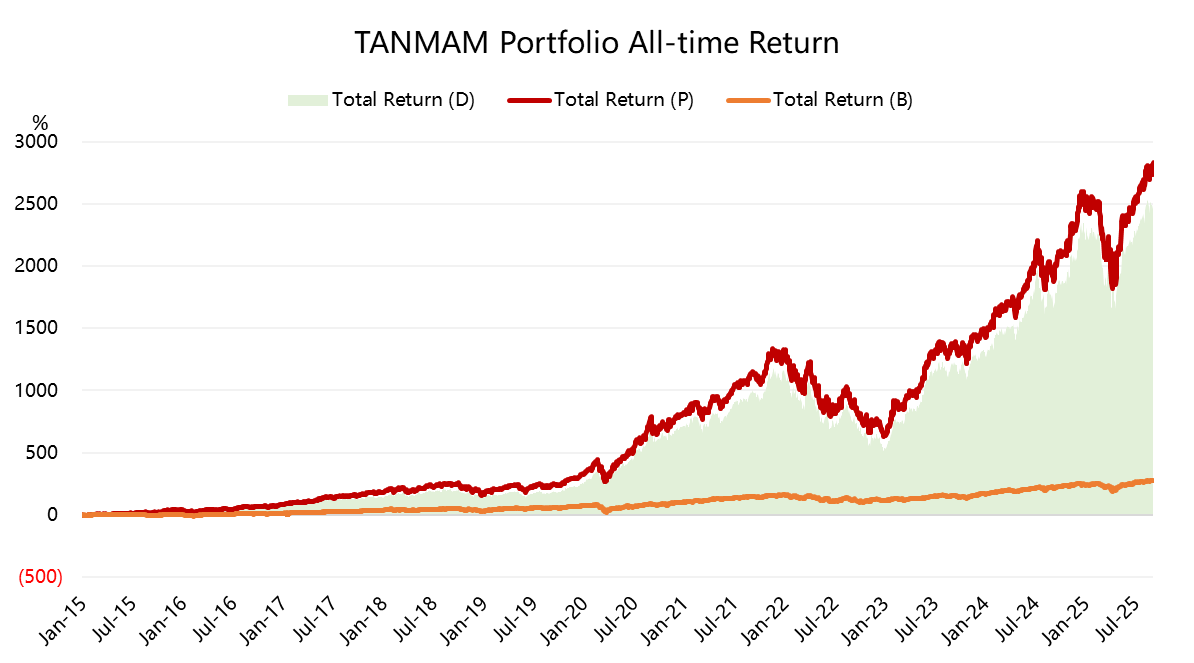

The Magnificent Seven, equal-weighted and rebalanced quarterly, continues to outperform the S&P 500.

Backtest results since 2015:

TANMAMG total return: +2,833.23%

SPY total return: +278.69%

Excess return: +2,554.54% — a new record.

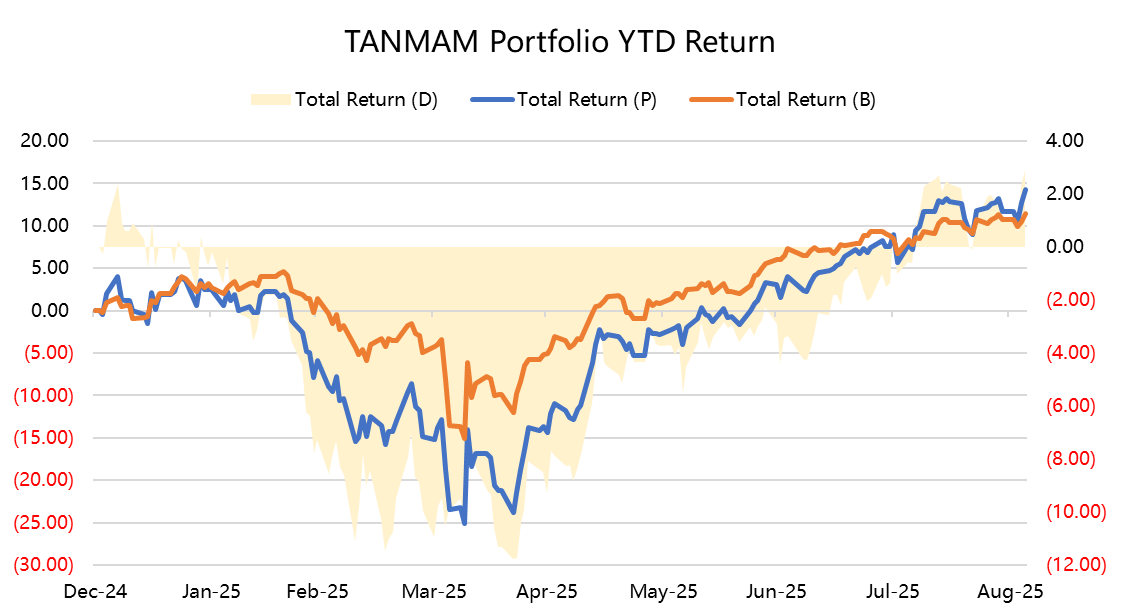

2025 YTD:

TANMAMG: +14.33%

SPY: +11.42%

Big Tech’s leadership in AI, scale, and earnings growth keeps the basket firmly ahead of the broader market.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Merle Ted·2025-09-06$235 is no longer resistance for Amazon. A pause at $237 on a back and forth and consolidation - $242 next week then to $247.1Report

- Valerie Archibald·2025-09-06Amazon could easily do another 4% price increase. It is an entire new business complimentary to not only Prime membership but cross-sales as well. I shall hold.1Report

- Brando741319·2025-09-06Good1Report

- YueShan·2025-09-06Good ⭐⭐⭐LikeReport