Will Capital Keep Flowing into China After Fed Rate Cuts?

The Resumption of Interest Rate Cuts and the Narrowing US-China Interest Rate Differential Continue to Attract Capital Inflows to China

The Federal Reserve has finally started cutting interest rates again after much anticipation. There are various interpretations in the market—some believe the cut was less than expected (not a 50 basis points cut), while others view it positively. Regardless of interpretation, one fact must be clear: the Fed has indeed cut interest rates. With US rates declining, the interest rate differential between China and the US will narrow, unless the People's Bank of China follows with analogous rate cuts. This narrowing differential likely sustains the ongoing appreciation of the renminbi.

Renminbi Appreciation Cycle Continues

Back in April, it was noted that this year is a cycle year for renminbi appreciation, lasting approximately 17 months. The extent of appreciation has a close relationship with the central bank's intentions. Since the Fed's rate cuts were only a matter of time, the resulting overflow of US dollars needs new investment destinations. Although Sino-US relations remain somewhat unstable, China’s economy—having undergone years of rigorous adjustment—is not currently at its worst phase. Moreover, the scale of China’s economy means that even a bottoming-out rebound can provide enough profit space for foreign capital, making the appreciation of the renminbi a reflection of foreign investors’ favorable sentiment toward Chinese assets.

That said, the central bank is cautious about rapid renminbi appreciation, which could intensify pressure on domestic foreign trade and real estate. Therefore, it aims to control the speed of renminbi appreciation. However, with the continued narrowing of the US-China interest rate gap, the pace of appreciation may accelerate, meriting close attention.

Capital flowing into a region or country inevitably seeks appreciation, driving up prices of profitable assets. Recently, this has been observed in the A-share market and properties with stable rents. Historically, during periods of renminbi appreciation, the A-share index typically performs well. Following this logic, there is still room for the A-shares to rise.

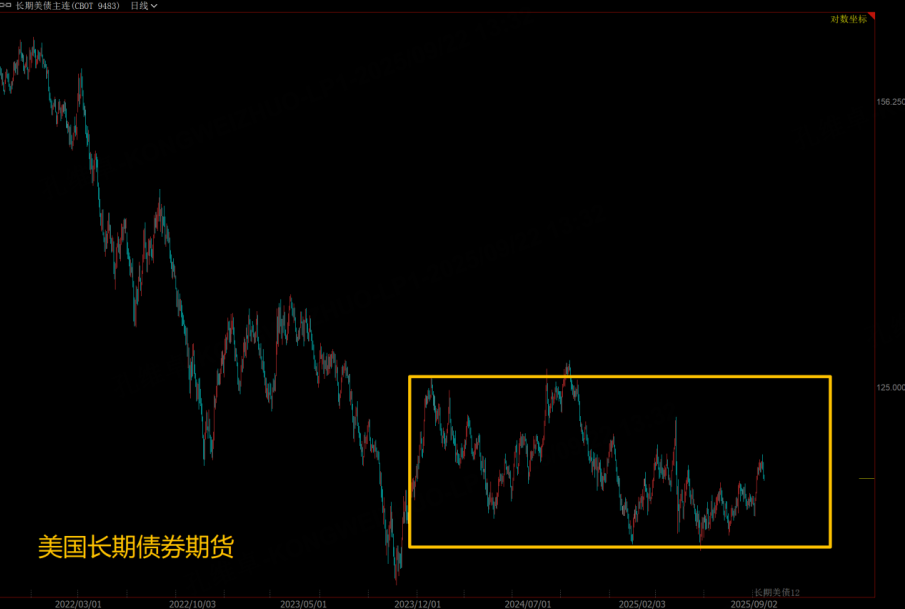

Interest Rate Cuts and US Treasury Bonds Continue to Consolidate at Low Levels

Previously, the media expressed concern about the high yields on US Treasury bonds. With the Fed’s rate cuts, these fears have somewhat subsided. In fact, looking at the prices of US Treasury futures, long-term bonds have remained relatively stable—without surges, but far from the panic some media portray. This indicates that under the Trump administration’s management, the US Treasury bond situation is gradually stabilizing, and holding US Treasuries remains relatively safe.

However, minor rate cuts alone are unlikely to attract major US Treasury buyers’ renewed interest. The signal for a long-term bond bull market would be a noticeable increase in large nations’ holdings of US Treasuries. In the short term, while US Treasury bonds remain relatively stable, the spread between long and short-term bond yields has not reached extreme levels (3%). Therefore, investors holding physical US Treasuries are advised to continue holding patiently and treat them as a defensive asset. Those holding Treasury futures may consider waiting for clearer signals before increasing exposure.

$E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini S&P 500 - main 2512(ESmain)$ $E-mini Dow Jones - main 2512(YMmain)$ $Gold - main 2512(GCmain)$ $WTI Crude Oil - main 2511(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- BlancheElsie·09-23Capital flowsLikeReport