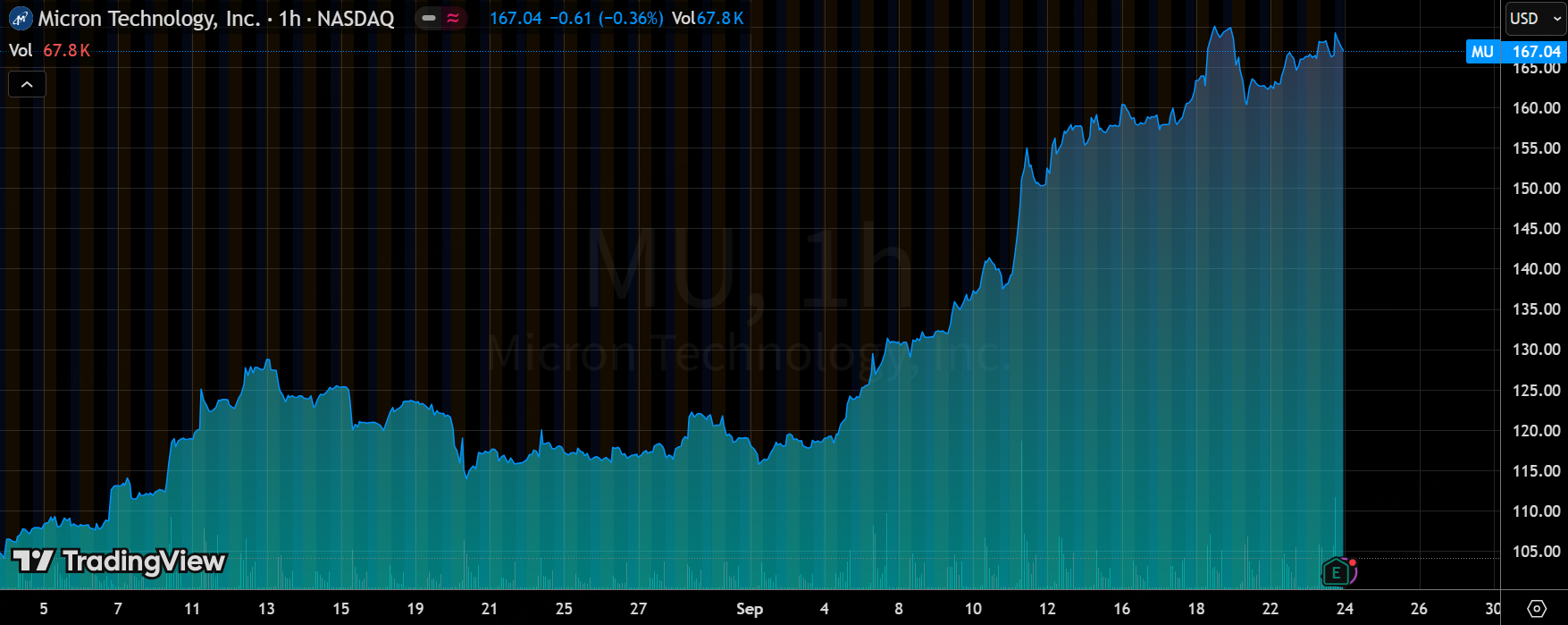

💡Investment Insight: Micron Shifts from Cyclical to Growth Stock – Valuation Double?

$Micron Technology (MU)$ capped off fiscal year 2025 with a comprehensive beat of expectations in its quarterly results. Not only did revenue, EPS, but also delivered record-breaking guidance for the next quarter, underscoring its dominant position and exceptional execution in the AI memory sector.

The explosive growth in this quarter's performance was primarily driven by surging demand for high-bandwidth memory (HBM) in AI servers, a broad-based rebound in memory chip prices, and optimized product mix. Notably, HBM business revenue approached $2 billion in a single quarter, emerging as the standout highlight. However, underlying concerns persist regarding potential cash flow pressures stemming from the company's significantly increased capital expenditures, as well as debates over whether its valuation has become excessive after the stock price surged over 95% year-to-date.

Specifically, let's examine the core information in the financial report.

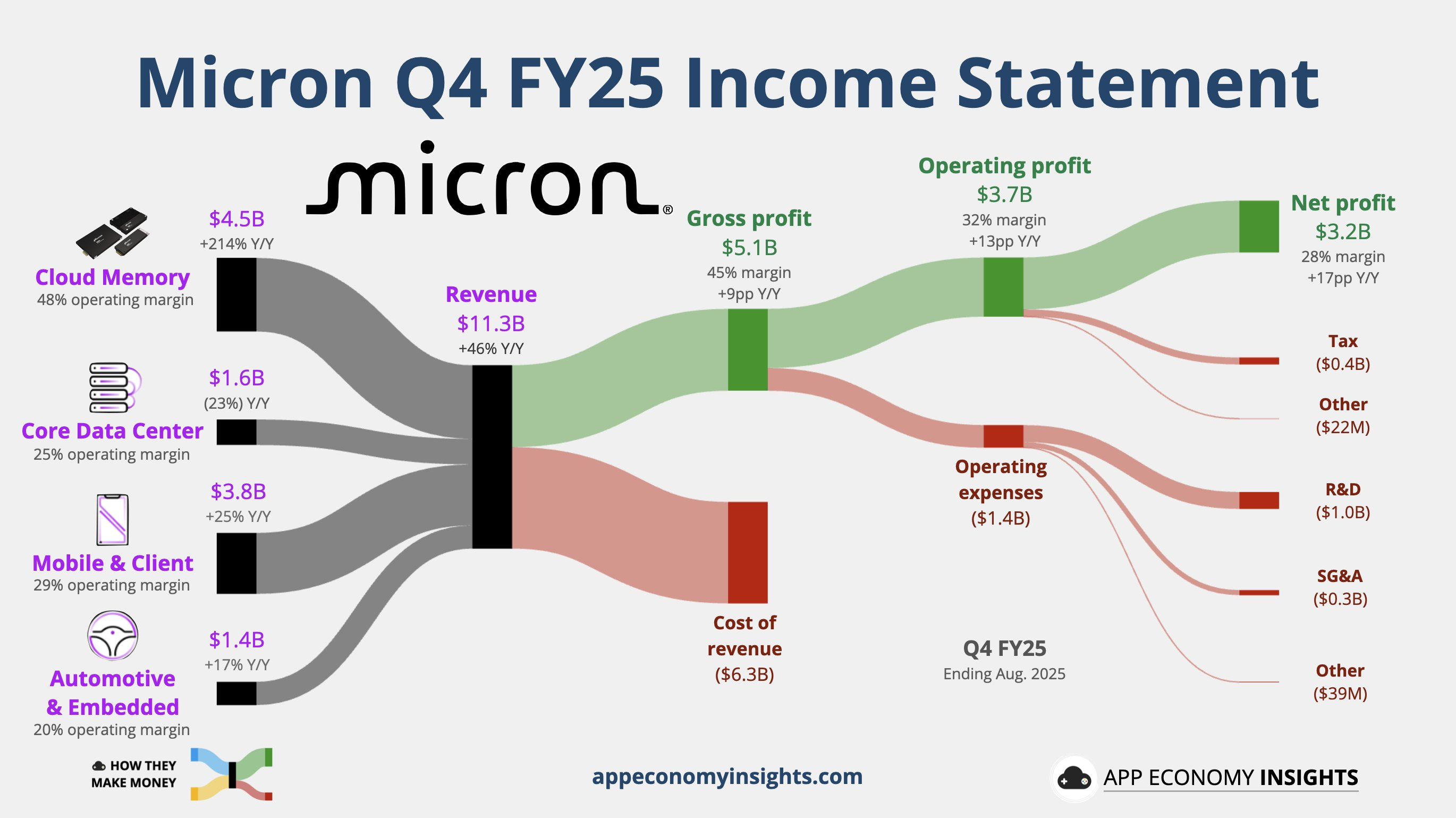

1. Revenue and profitability have surged significantly.

Revenue: $11.32 billion (QoQ +22%, YoY +46%), exceeding the upper end of the company's guidance range ($11.1–11.3 billion) and market expectations ($11.21 billion). Key drivers included explosive demand for HBM, low double-digit percentage increases in DRAM prices, and high single-digit percentage increases in NAND prices. The data center business accounted for 54% of total revenue, reflecting a clear strategic shift toward higher-value segments.

Non-GAAP EPS: $3.03 (up 157% year-over-year), exceeding market expectations of $2.84 by 6.7%, marking the eighth consecutive quarter of beating forecasts. Growth primarily stemmed from revenue expansion, improved gross margins, and operational leverage effects.

Gross Margin: Non-GAAP gross margin reached 45.7% (up 670 basis points quarter-over-quarter and 920 basis points year-over-year), exceeding the upper limit of guidance (45%). This was driven by a triple-pronged approach of pricing, mix, and cost optimization: increased contribution from HBM and high-end server DRAM, price increases across the entire product portfolio, and cost efficiency gains from the 1β process.

2. HBM business has become the core growth engine.

HBM Revenue: Quarterly revenue neared $2 billion (annualized at approximately $8 billion), showing significant quarter-over-quarter growth. HBM production capacity for 2026 (particularly HBM3E) is largely sold out through locked-price agreements. HBM4 samples have been shipped, with performance metrics (bandwidth >2.8TB/s) leading the industry.

Technology Collaboration: Partnering with TSMC to customize HBM4E substrate logic chips. Such customized products yield higher gross margins, laying the foundation for sustained margin growth in the future.

3. Optimization of Business Segments and Product Structure

Cloud and Memory Business Unit (CMBU): Revenue of $4.5 billion (40% share), with a gross margin as high as 59%, making it the most profitable segment.

DRAM vs NAND: DRAM revenue reached $9 billion (79% share, +27% quarter-over-quarter), driven by both volume and price growth; NAND revenue totaled $2.3 billion (20% share, +5% quarter-over-quarter), primarily fueled by price increases (bit shipments declined quarter-over-quarter).

4. Capital Expenditures and Cash Flow

Capital Expenditures: FY2025 capital expenditures totaled $13.8 billion (up 70% year-over-year), with further increases projected for FY2026. Q1 capital expenditures amounted to approximately $4.5 billion, primarily allocated to 1γ DRAM mass production and HBM capacity expansion.

Cash Flow: Operating cash flow of $5.73 billion, free cash flow of $803 million. Despite rising capital expenditures, management anticipates a significant improvement in free cash flow for FY2026.

Earnings Guidance and Management Statements

Management delivered its strongest-ever guidance for FY2026 Q1: revenue of $12.5 billion ± $300 million (midpoint +43.5% YoY), non-GAAP gross margin of 51.5% ± 1 percentage point, and non-GAAP EPS of $3.75 ± $0.15. This guidance comprehensively surpasses market expectations (revenue $11.94 billion, EPS $3.05), reflecting management's extreme confidence in AI-driven demand.

During the conference call, CEO Sanjay Mehrotra's remarks were filled with strategic confidence and rich in detail, repeatedly emphasizing "Micron's unique position as the sole U.S. memory manufacturer in the AI era." He disclosed that the company's HBM customer base has expanded to six clients and stated that "all HBM capacity for 2026 will be sold out within the next few months." This statement transcends typical optimistic reassurance, bordering on a forceful declaration of competitive dominance. It aims to reinforce market confidence in Micron's technological leadership and its ability to capture market share.

CFO Mark Murphy took a more pragmatic approach, noting that "the DRAM market remains extremely tight while NAND continues to improve." He acknowledged the impact of increased capital expenditures on near-term free cash flow but emphasized that "free cash flow will see a significant year-over-year increase by 2026." This dual-pronged strategy demonstrates growth potential while managing expectations around short-term financial pressures.

Key Investment Considerations

AI-driven high-value businesses are sustainable.

HBM and data center memory represent a clear long-term trajectory rather than a short-term trend. The increasing complexity of AI models drives exponential growth in memory bandwidth and capacity demands. Micron's HBM3E production capacity has been locked in at current pricing through 2026, while its leading HBM4 technology ensures at least 2-3 years of visibility for sustained growth. Unlike the strong cyclical nature of traditional storage, this business segment is demonstrating the characteristics of a sustainable growth stock.

Demand for traditional server and PC memory has rebounded (with the company raising its 2025 shipment growth forecast), providing additional cyclical support. However, this segment remains vulnerable to macroeconomic volatility risks.

Does the valuation fully reflect the AI dividend?

Micron's current stock price corresponds to an FY2026 PE ratio of approximately 11-12 times (based on analysts' earnings forecasts for FY2026). While this valuation exceeds historical peak levels, it remains reasonable when considering the permanent uplift in gross margin driven by HBM operations (shifting from cyclical 20-40% to sustainable levels above 50%) and the growth premium stemming from AI memory demand.

Compared to competitors, Micron is rapidly catching up to SK Hynix in HBM market share, narrowing the technological gap. As the "water seller" for AI infrastructure, Micron offers better value for money than pure AI chip companies (such as NVIDIA with a PE ratio over 40 times).

The market may still be underestimating the pricing power and profit margins of the HBM business. HBM4, with its superior performance and the need to outsource part of its manufacturing to TSMC, will see a significant increase in pricing. The company has the capability to pass on costs through price increases while maintaining profit margins.

Should HBM revenue exceed 30% of total revenue by fiscal year 2026, its valuation still holds room for expansion; however, the current stock price already incorporates a significant amount of optimistic expectations. In the short term, investors should closely monitor the pace of industry capacity expansion and price fluctuation signals to time their investments effectively.

Strategy of Focusing on High-End and Exiting Low-Efficiency Operations

Management decisively halted development of the next-generation "mobile-managed NAND," redirecting resources toward higher-return data center SSDs and HBM—a strategically sound decision. This reflects a shift in business philosophy from chasing market share to pursuing value creation.

The company's collaboration with TSMC on HBM4E (custom interposer layer) is a key signal indicating Micron's evolution from a pure memory chip manufacturer to a customized solutions provider. This shift enhances customer loyalty and premium pricing power, marking a crucial step toward platformization.

The risk lies in aggressive capital expenditures (projected to exceed $13.8 billion in FY2026) potentially creating pressure should the industry face future overcapacity. However, current investments are concentrated in HBM and advanced process DRAM—areas with higher technological barriers—making them essential steps to consolidate competitive advantages.

Key Tracking Metrics and Variable Alerts

HBM Revenue Share and Growth Rate: Tracking the absolute value of HBM revenue and its proportion of total revenue each quarter is key to determining whether it can consistently exceed expectations—a core factor in reshaping valuation.

DRAM/NAND Price Trends: The price elasticity of high-end server DRAM and enterprise-grade SSDs, in particular, is key to determining whether gross margins can remain at elevated levels.

1γ Process Yield and Ramp Progress: This relates to the cost competitiveness of the primary growth driver for 2026.

Potential Catalysts: Official announcement of HBM capacity being fully booked ahead of schedule by 2026; securing H4 supply agreements with additional AI accelerator manufacturers (such as AMD and cloud giants with in-house chip development); and a secondary surge in mobile/PC memory demand driven by higher-than-expected AI penetration at the edge.

Early Warning Signals: Concerns over supply excess due to significant increases in industry capital expenditures; HBM yield improvements falling short of expectations; contraction in corporate IT spending driven by macroeconomic downturn.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·09-24JP Morgan raises target price to $220 from $185LikeReport

- Enid Bertha·09-24BUY and HOLD! THIS IS A GEM of a COMPANY!! This is my PENSION!LikeReport

- doozi·09-24Sounds promising, but keep an eye on those cash flow pressures.LikeReport