Storage Industry Outlook for 2025-2026: HBM Dominates The Era

$Bank of America(BAC)$ The latest Global Storage Technology Report indicates that starting in the second half of 2025, the storage industry will formally exit its previous adjustment cycle and enter a recovery phase characterized by structural differentiation. The NAND market will be the first to enter a mid-to-upward cycle, while DRAM will see robust growth driven by high-bandwidth memory (HBM), though average selling price (ASP) increases will be limited. Meanwhile, small-cap Korean semiconductor equipment and materials stocks face multiple growth pressures. Currently, the industry's core growth momentum has shifted from traditional storage to HBM. Coupled with the sustained recovery of downstream demand for servers, solid-state drives (SSDs), and other end products, the storage industry is undergoing a restructuring where the strong grow stronger. $Micron Technology(MU)$ $SanDisk Corp.(SNDK)$ $Western Digital(WDC)$

The overall market recovery trend has been established, with significant structural divergence.

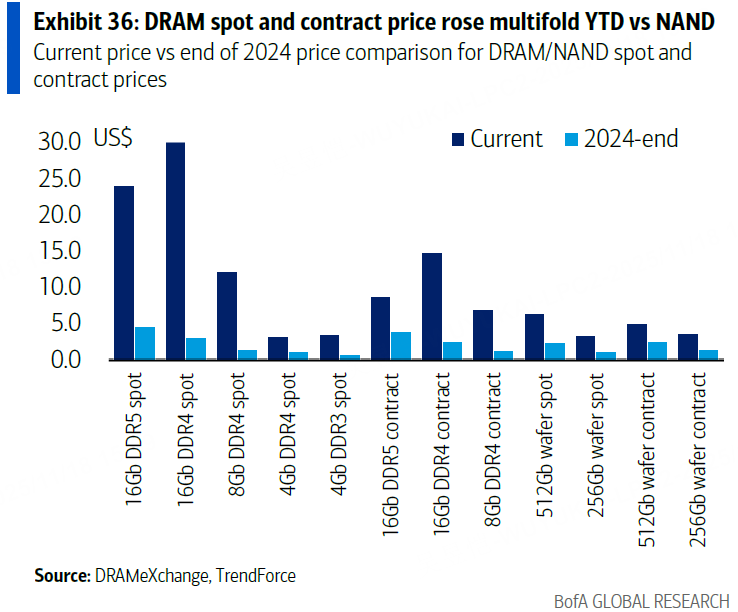

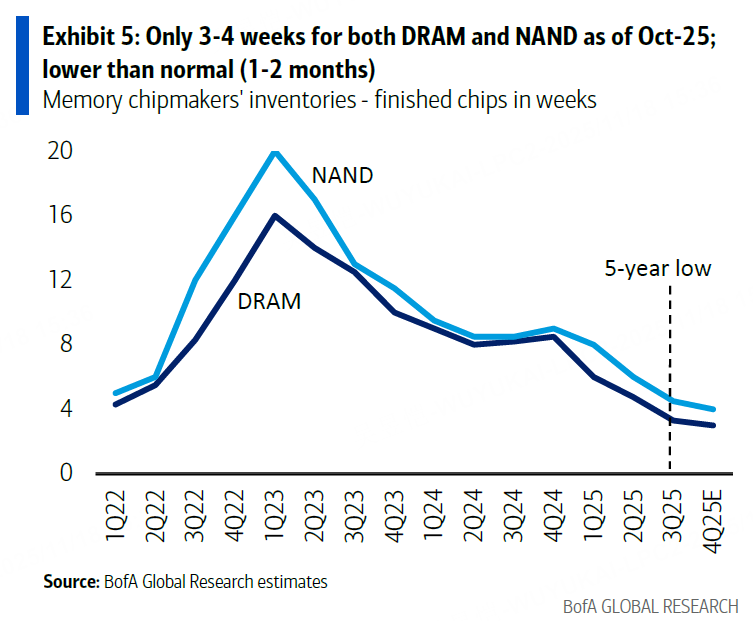

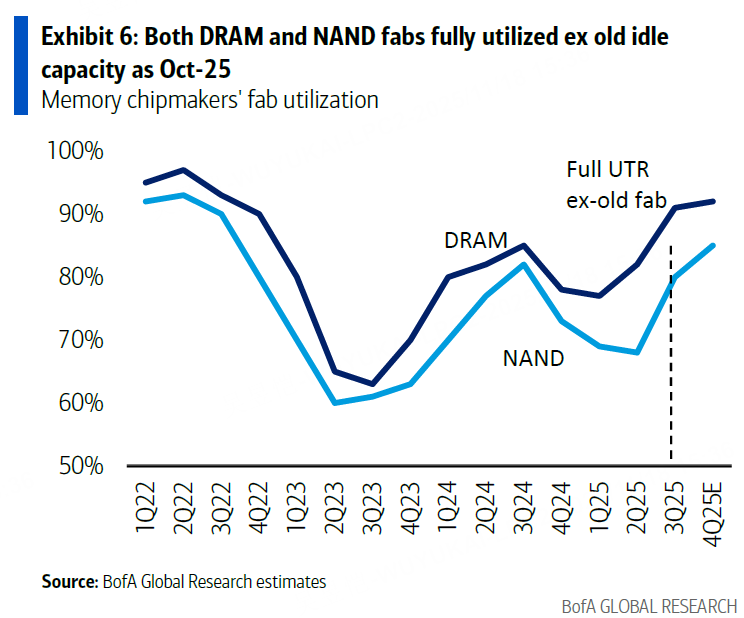

Clear signs of an overall recovery in the storage industry have emerged. Since 2025, spot prices for DRAM and NAND have continued to surge significantly. Chip manufacturers' inventories have remained at low levels of 3-4 weeks (below the normal range of 1-2 months), while foundry capacity utilization rates approach full capacity (excluding outdated idle capacity). The supply-demand dynamics continue to improve.

DRAM Market: HBM Emerges as Growth Driver, ASP Growth Faces Headwinds

The DRAM market is experiencing simultaneous growth in both volume and price, though this expansion remains highly concentrated in high-value-added segments. In Q4 2025, spot DRAM prices continued their explosive surge, with 16Gb DDR5 prices climbing 17% weekly and nearly 300% quarterly. The spot price of 16Gb DDR4 surged over 970% year-on-year, hitting a 25-year historical peak. However, in contrast to the spot market frenzy, contract price increases remained relatively moderate. Bank of America forecasts the DRAM ASP increase for Q4 2025 to range between 13% and 18%, unlikely to reach the rumored 30% to 40% market estimates.

This price disparity stems primarily from three key factors: First, HBM prices saw a slight quarterly decline, pulling down the overall ASP level; Second, leading original equipment manufacturers (OEMs) resisted excessive contract price hikes, with increases of 30% to 40% yet to be confirmed; Third, limited spot market transaction volumes prevented extreme pricing from permeating the mainstream contract market.

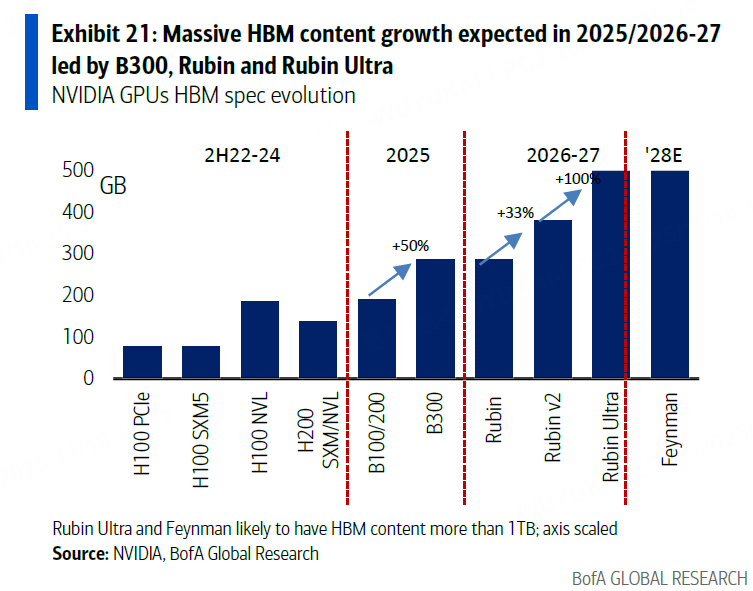

From a demand structure perspective, servers have become the largest consumer segment for DRAM, accounting for 55% of the market by 2026, with HBM playing a particularly crucial role. As a core component of AI servers, HBM is emerging as the growth engine for the DRAM industry. HBM sales are projected to reach $34.5 billion in 2025 and surge to $55 billion in 2026. Its share of total DRAM sales will rise from 19.8% in 2024 to 30.9% in 2026, further increasing to 33.1% by 2027. Technologically, 12-layer stacked HBM3e has become the current mainstream standard. HBM4 is scheduled for mass production in the second half of 2025 and will see large-scale adoption in 2026, with continuous iterations driving improvements in data transfer rates and bandwidth.

In the competitive landscape, SK Hynix holds a dominant position, with its HBM sales market share reaching 61% by 2025. Leveraging its mass production advantage in 12-layer stacked HBM4, it continues to lead the industry. Samsung, meanwhile, focuses on NVIDIA's secondary clients and tech giants like Amazon and Google, with its market share expected to rise to 24% by 2026. Other manufacturers are rapidly emerging, with a compound annual growth rate (CAGR) of 141% from 2024 to 2027, though their overall market share remains relatively limited.

NAND Market: Growth Forecast Revised Upward, Entering Mid-to-High Growth Cycle

Driven by Kioxia's robust bit volume growth in Q3 2025 (up over 30% quarter-on-quarter), Bank of America raised its global NAND sales forecasts for Q3 and Q4 2025 by 2.8% and 2.5%, respectively. Although Kioxia's ASP declined slightly quarter-over-quarter, the growth in bit volume fully offset pricing pressures, driving an overall industry recovery.

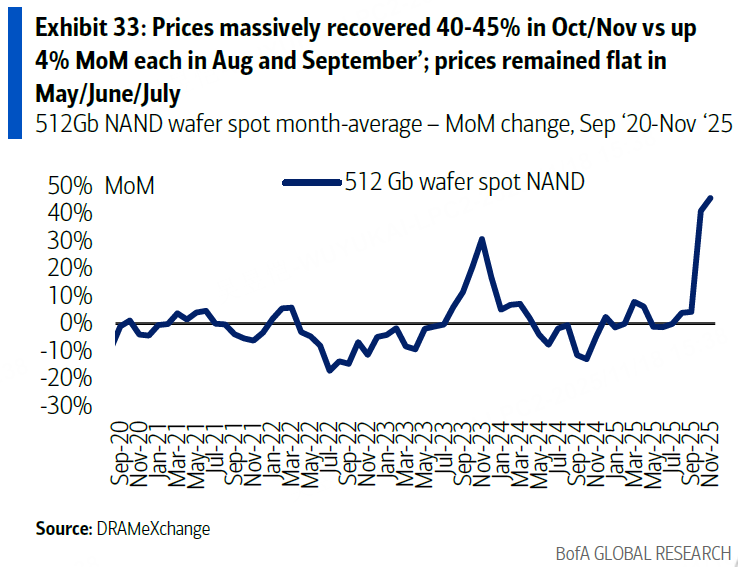

Industry fundamentals continue to improve, with NAND entering a mid-to-high growth cycle in the second half of 2025—a stark contrast to the bottoming phase from late 2024 to mid-2025. By the fourth quarter of 2025, the NAND sector will exhibit a pattern of "modest bit volume growth (against a backdrop of low inventory) and ASP increases of approximately 10%," with rising commodity NAND prices becoming the prevailing trend. Global NAND sales are projected to grow by 28% year-over-year in 2026, driven by an 11% increase in ASP and a 16% rise in bit volume. While the growth rate falls short of DRAM's, the recovery trajectory remains solid.

On the demand side, SSDs and smartphones remain the core application areas for NAND flash memory, accounting for 49% and 41% of total demand respectively by 2026. In October 2025, NAND-related sales revenue surged by 262% and 90% year-on-year for manufacturers such as NAND Flash Technology and Phison Electronics. South Korea's semiconductor exports grew by 18% year-on-year during the first ten days of November. These figures collectively confirm the robust recovery momentum in the NAND market.

Risk Focus: Triple Pressure on South Korea's Small-Cap Semiconductor Stocks

Unlike the robust performance of leading DRAM and NAND manufacturers, small-cap Korean semiconductor equipment and materials stocks face significant downside risks. Bank of America has assigned an "Underperform" rating to Seoul Semiconductor (LED sector) and Soulbrain (etching materials), while assigning a "Neutral" rating to Hanmi Semi (bonding equipment).

Core risks stem primarily from three areas: First, weak LED demand coupled with intense price competition from Chinese suppliers continues to pressure Seoul Semiconductor's core business. Second, HBM's pull on material demand remains limited—relatively low HBM sales volume combined with lengthy manufacturing cycles and low yield rates make it difficult to generate large-scale material procurement, resulting in limited benefits for material suppliers like Soulbrain. Third, industry capital expenditures are concentrated on technological upgrades and node transitions rather than TCB (thermocompression bonding) back-end equipment, leaving Hanmi Semi's core business growth without robust support.

Based on the above assessment, Bank of America lowered its target prices for Soulbrain and Hanmi Semi: Soulbrain's 2026 target price was reduced from KRW 270,000 to KRW 240,000 (corresponding to an 11x P/E ratio), while its earnings per share (EPS) forecast was cut by 6%; Hanmi Semi's target price was lowered from KRW 150,000 to KRW 140,000 (corresponding to a 35x P/E ratio), with a 10% reduction in its 2026 EPS forecast.

Capital Expenditures: Leading Players Ramp Up HBM Investments, NAND Expansion Remains Cautious

Capital expenditure trends clearly reflect the industry's future development direction. In the DRAM sector, SK Hynix's capital spending has nearly matched Samsung's, projected to reach $19.7 billion in 2026—surpassing Samsung's $17.4 billion. Funds will primarily finance new factories (Korea's M15X and Yongin plants) to expand HBM production capacity. Samsung's capital expenditures remain relatively steady, maintaining an average annual growth rate of 14%-11% from 2025 to 2027. Micron, however, is significantly ramping up its investments in the DRAM sector, with capital expenditures surging 99% year-over-year in 2025 and increasing another 28% in 2026.

Capital expenditure recovery in the NAND sector remains relatively sluggish, primarily constrained by low profit margins and the technical challenges of transitioning from 128/178-layer to 200-300+ layer nodes. $Samsung Electronics (SMSD.UK)$ remains the leader in NAND capital expenditures, projected to reach $10.3 billion by 2026, followed by Kioxia and its joint ventures, and Micron. Constrained by U.S. government entity list restrictions, Yangtze Memory Technologies' capital expenditure growth is limited, making large-scale expansion difficult.

Overall, capital expenditures in the memory industry are shifting toward HBM and advanced process technologies. Leading manufacturers are leveraging their financial and technological advantages to increase investments, which is expected to further consolidate market concentration.

Investment Outlook: Focus on High-Growth Sectors and Top-Tier Targets

Bank of America's investment ratings clearly reflect the industry's divergent landscape: We strongly recommend leading memory manufacturers benefiting from HBM and industry recovery, while maintaining a cautious stance on small-cap Korean semiconductor stocks.

In the memory chip sector, companies like SK Hynix, Samsung Electronics, and Nanya Technology have received strong ratings. The core rationale lies in the high growth of HBM business, profit improvements driven by industry recovery, and solid market share. Within the semiconductor equipment and materials segment, only a handful of companies possessing core technological barriers and deep ties with leading memory manufacturers warrant attention. Meanwhile, small-cap stocks reliant on traditional businesses face valuation downgrade risks.

From a valuation perspective, the current storage sector demonstrates strong profitability factors, while stocks with compelling narratives but lacking valuation support underperform. The market increasingly favors targets with high earnings certainty. DRAM/NAND spot prices in the memory chip segment show a clear upward trend, and related targets exhibit high earnings realization. In the current uncertain market environment, these assets hold greater allocation value.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- cheerio·2025-11-18HBM's growth momentum looks unstoppable, solid allocation choice! [看涨]LikeReport

- Venus Reade·2025-11-18据报道,人工智能主导的DRAM供应紧缩导致摩根士丹利下调了主要原始设备制造商的评级——内存价格飙升可能会侵蚀服务器和个人电脑的利润LikeReport

- Valerie Archibald·2025-11-18NVDA will cause ripples this week. Non of these events will change the MU roadmap. MU is solid well into 2026 and probably longer.LikeReport