$NVDA$

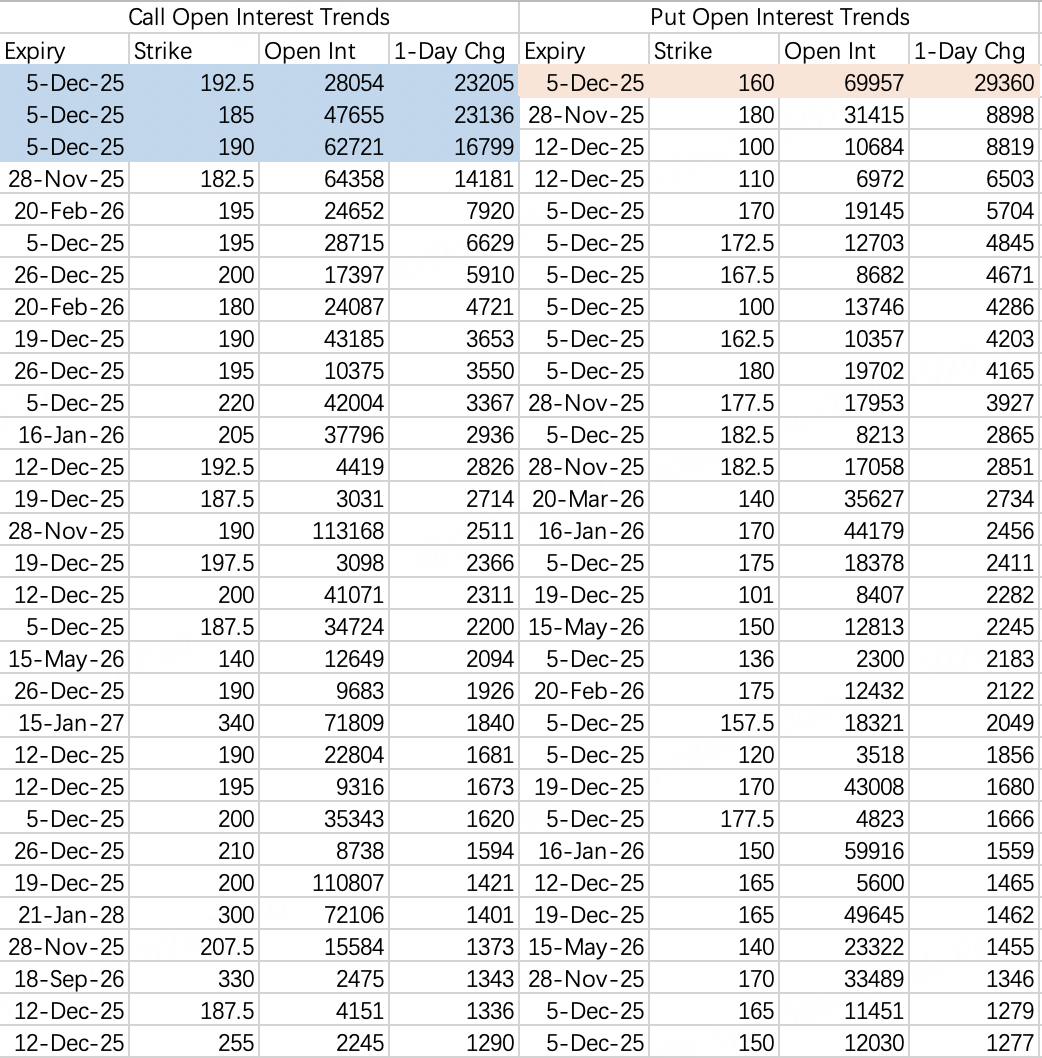

This week's closing range: $170–185. Expected range for next week is similar, oscillating between $160–190.

Institutions continue selling the 185 call $NVDA 20251205 190.0 CALL$ as a hedge, making a significant breakout above this level difficult.

The 160 put $NVDA 20251205 160.0 PUT$ saw 29k contracts opened with unclear direction, indicating support expectations are shifting lower. Additionally, heavy put opening for next week's expiry suggests strong pullback expectations, potentially creating a volatility selling opportunity. Consider short-dated sell puts if that materializes.

$SPY$

Closed above 680 on Friday. Likely tests 690 next week before pulling back into a consolidation phase. Put flow suggests positioning for a post-FOMC dip.

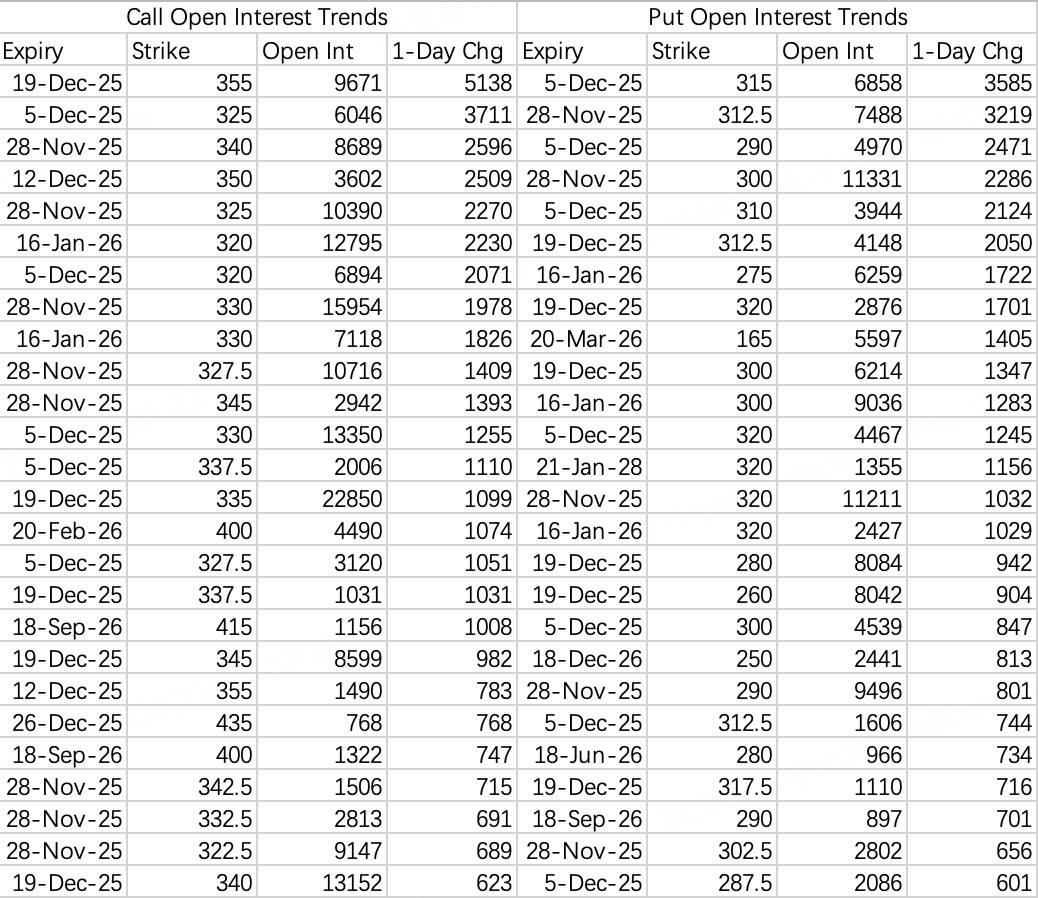

$GOOGL$

Call and put openings indicate near-term strength remains, but chasing the rally aggressively is not advised. Sell puts could be considered at the 300 strike $GOOGL 20251205 300.0 PUT$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.