$AVGO$ earnings were the polar opposite of Oracle's. While the standard financial metrics were outstanding, the backlog fell short of expectations, and the stock still dropped.

A lower-than-expected backlog could stem from various factors, but the market is leaning towards interpreting it as a slowdown in investment. The next question is why investment is slowing—AI is still figuring out its monetization path. In simple terms, because it's not yet profitable, the pace of cash burn is moderating.

Considering Broadcom supplies the current U.S. AI leader, Google, if even the leader is being cautious, other players likely are too. Therefore, a market pullback seems inevitable.

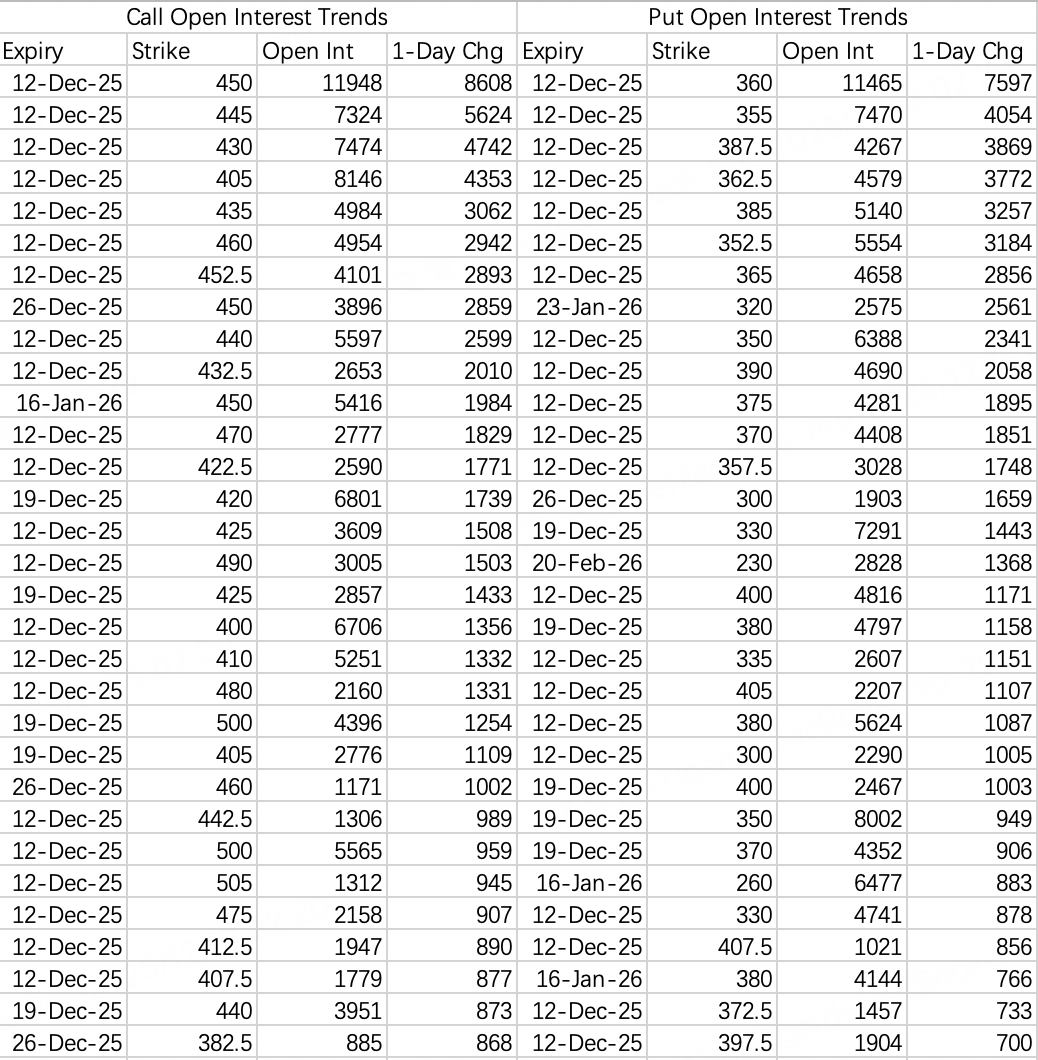

The consensus from put activity suggests the stock will stay above $350, but the market's sell put strike preference is around $320.

$ORCL$ continued to decline the day after earnings.

When might it be time to buy the dip in Oracle? Looking at NVDA's options flow, the process of testing and establishing a bottom could extend into January. Broadly speaking, the AI sector needs some positive monetization news for a catalyst.

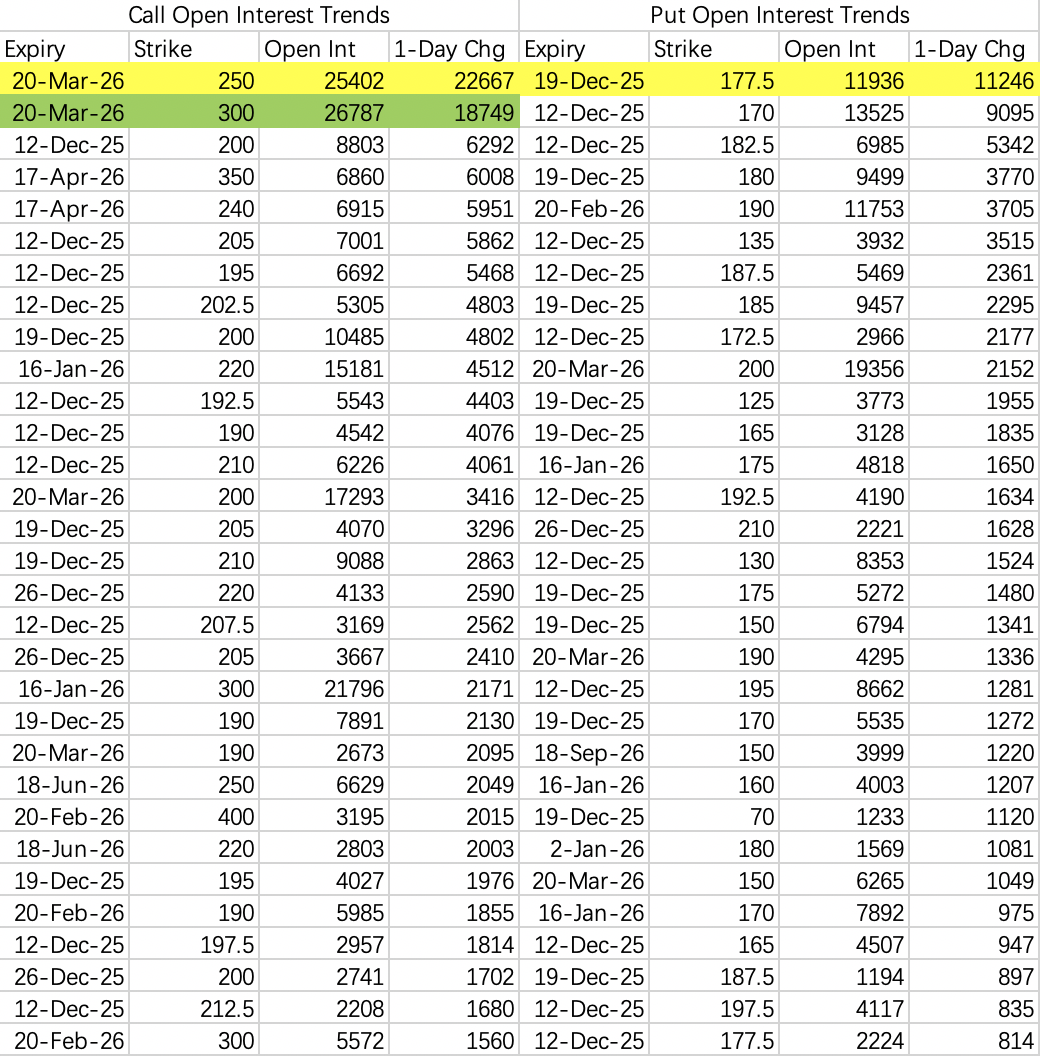

Oracle's flow suggests a potential test below $180 next week, with a large buy order in the weekly 177.5 put $ORCL 20251219 177.5 PUT$ . There's still consensus support around $180 from current put openings, but whether to buy the dip requires further observation.

Notably, a large block bought a bullish call spread on Thursday: buying the 250 call $ORCL 20260320 250.0 CALL$ and selling the 300 call $ORCL 20260320 300.0 CALL$ . Given Friday's negative news about data center construction delays, this likely wasn't an insider trade—possibly just a bet on a low stock price, though it's hard to say for sure.

$NVDA$

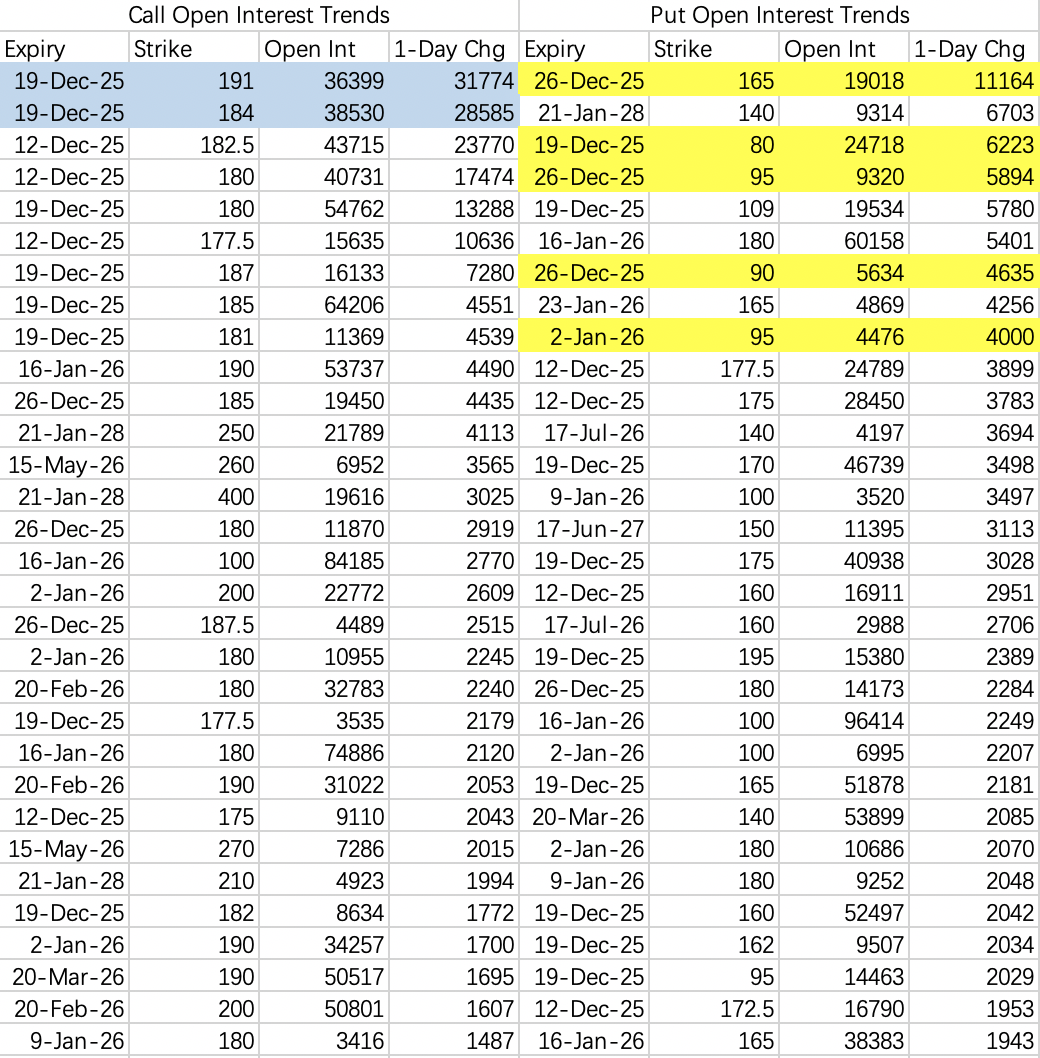

Chip stocks are bearing the brunt for the broader market. Based on put openings, NVDA looks set for a challenging week ahead. The 165 put $NVDA 20251226 165.0 PUT$ saw 11,000 contracts opened on the short side. A flash crash next week is possible, with a sharp increase in openings at deeply out-of-the-money strikes like 90–95.

Institutions' call spread strategy is almost identical to this week's: selling the 184 call $NVDA 20251219 184.0 CALL$ and buying the 191 call $NVDA 20251219 191.0 CALL$ . This week it was selling 185 and buying 190. Not sure what the $1 difference signifies.

The strategy for next week mirrors this week: sell calls on rallies, particularly above $180. Selling puts on dips is less certain given the flash crash risk. However, if the stock reaches $170, consider a small volatility-selling position.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.