U.S.–Venezuela Conflict: Why Silver Broke Out—and How to Chase It Properly

As expected from last week’s outlook, after silver posted its first “top-and-drop” move, silver futures have staged another sharp rebound exactly one week later. As discussed previously, silver rarely tops out with a clean inverted-V reversal based on its historical price behavior; more commonly, it forms a second rebound on the weekly chart and only then peaks again and rolls over, and that second rebound often appears about one week after the first peak-and-selloff.

Review: Can the trading distribution of silver futures options “leak” the future path for silver?

$白银主连 2603(SImain)$ $微白银主连 2603(SILmain)$ $微黄金主连 2602(MGCmain)$ $黄金主连 2602(GCmain)$

This week’s price action has aligned with last week’s read. From a technical-model perspective, after finding short-term support around the 5-week moving average, silver did not complete a weekly engulfing pattern; instead it formed a “false” weekly bullish candle, and this week it rallied from the lower area near the 5-week moving average and printed a long bullish candle. This implies that, in the near term, silver futures still have a relatively high probability of producing a second rebound leg to the upside

If this second rebound can break above the previous high, then silver futures may be entering a phase with even larger volatility potential. Conversely, if the second rebound fails below the prior high, tops out, and then sells off sharply again, a major drawdown in silver is likely to begin. Last week, based on the ordering/distribution of open interest in silver futures options, the expectation shared was that the likely volatility range over the coming weeks would be roughly 60 to 85.

After one week, the question is whether the distribution in silver futures options has changed.

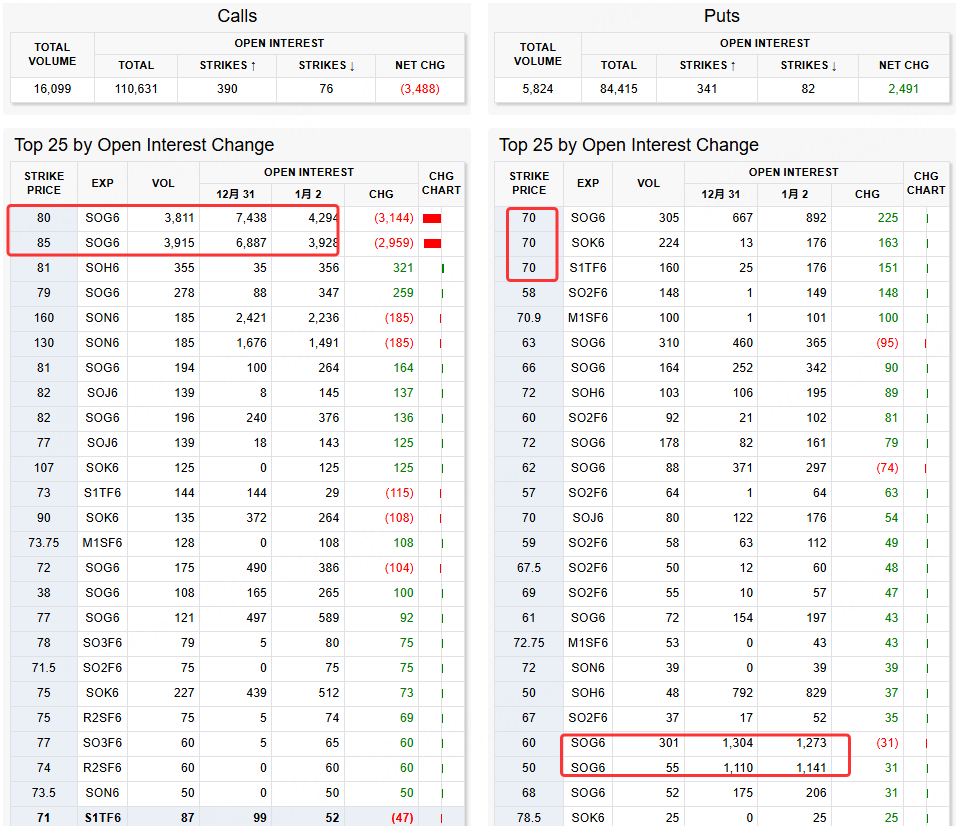

The latest data shown is for January 2, and from this data it can be observed that, for the SOG6 contract (the nearest-to-expiry futures options contract), trading in deep out-of-the-money calls has declined significantly. This is clearly because, after silver’s sharp drop, positions that had previously sold out-of-the-money calls to “bet the top” took profits and closed out. Even so, the 80 and 85 strike areas still carry the highest positioning, indicating that, consistent with the estimate from a week earlier, the market still considers 85 the most likely “top endpoint” for the next week’s swing range

Next, looking at put activity: there has only been a small increase in positions, with limited change compared with pre-holiday levels. The increases in out-of-the-money puts are concentrated above 70, which reasonably implies traders still view 70 as a likely floor for the coming week. Combining this with the pre-holiday futures-options positioning distribution, the view remains that 60, 66, 70, and 85 are the most important levels; for the coming week, the expected fluctuation range is likely 70 to 85

$白银主连 2603(SImain)$ $微白银主连 2603(SILmain)$ $微黄金主连 2602(MGCmain)$ $黄金主连 2602(GCmain)$ $白银主连 2603(SImain)$

If price breaks above the prior high at 82.6, then next week’s expected top for silver will almost certainly be pulled higher. So how should retail traders participate if they want to follow the move? The approach is straightforward: stay bullish as long as price remains above the 5-day moving average. Silver has broken above the 5-day moving average and is still accelerating upward, which signals that the rebound may be moving to test 85. If price approaches 82.6 but does not break through that prior high and instead reverses lower again, then the probability is very high that this phase of sharp upside is over.

Given this, it is reasonable to hold a light, short-term bullish position, take profit around 82, and stop out if price breaks below the 5-day moving average. Below the 5-day moving average, the preferred approach is still to sell the January contract and buy the May or March contract to implement a calendar-spread arbitrage strategy

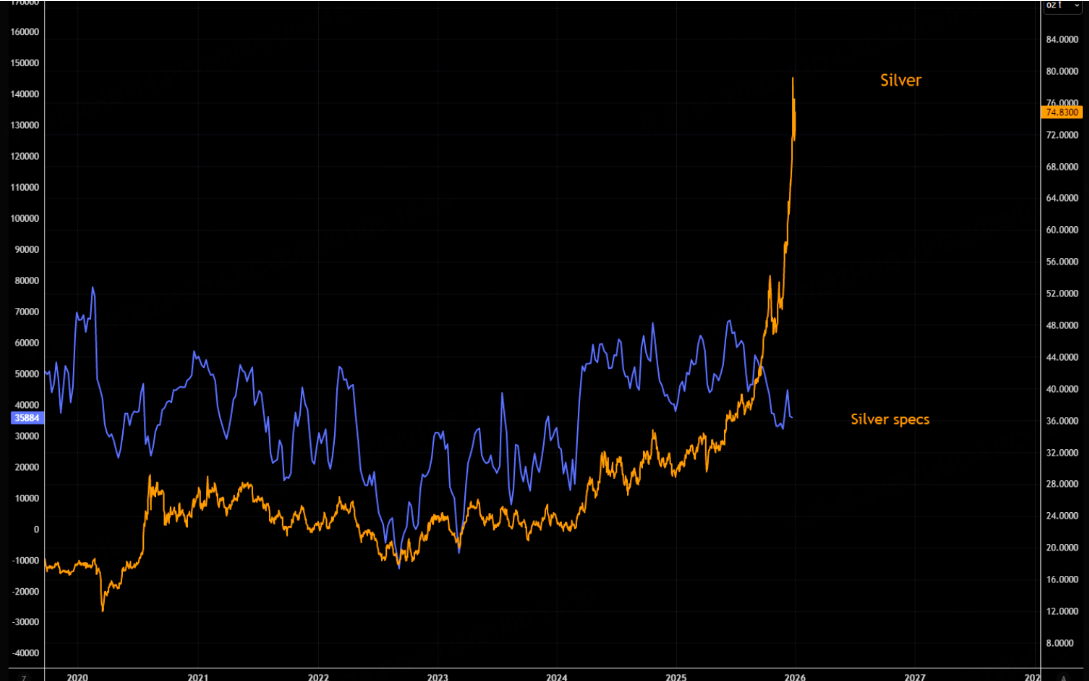

One key point must be emphasized: this silver move is detached from fundamentals. Even though silver and gold have risen aggressively in recent months, CFTC non-commercial speculative positioning shows that the size of bullish bets in silver and gold remains relatively small.

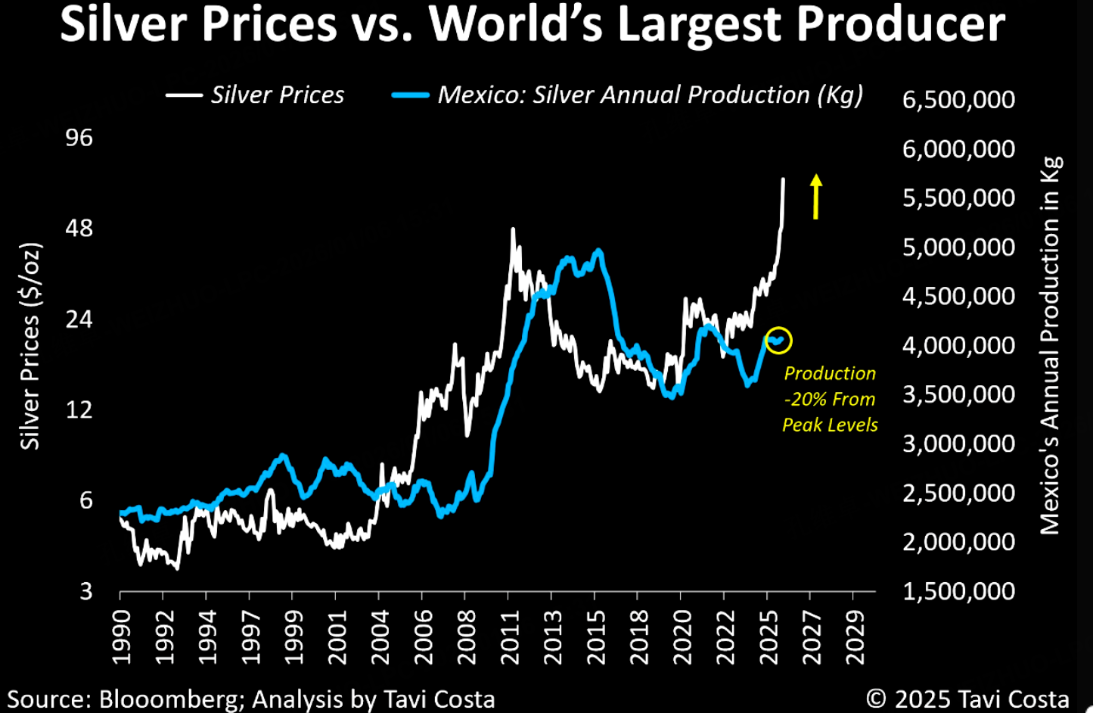

In addition, when comparing silver prices with Mexico’s annual silver production, silver’s price clearly reflects a path detached from fundamentals, and Mexico is the world’s largest producer of silver.

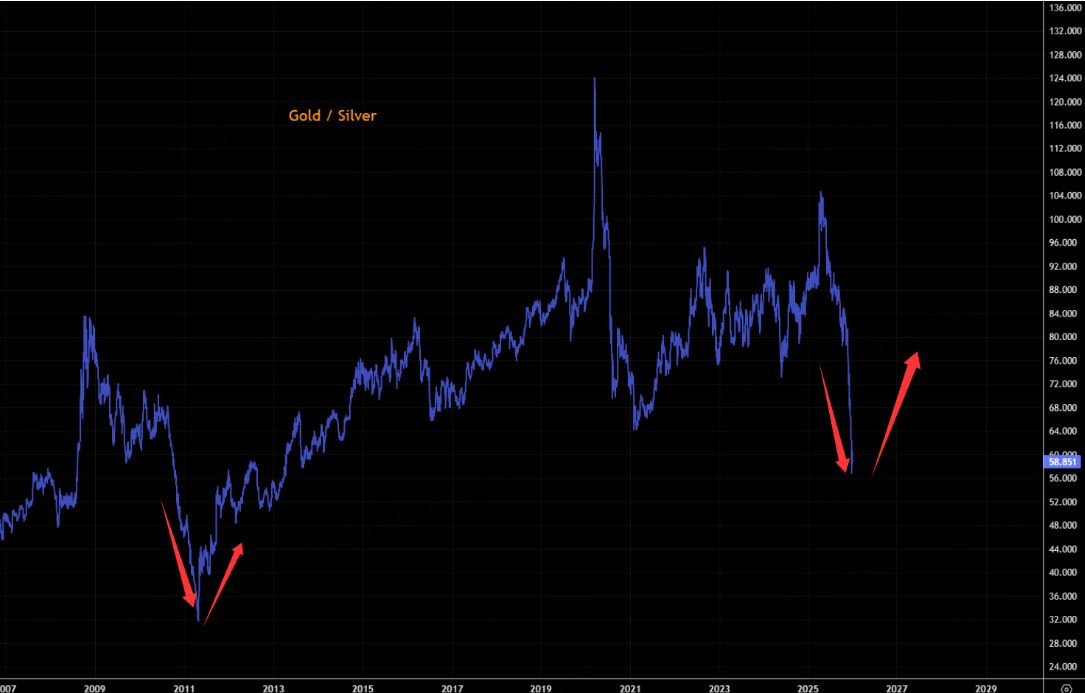

(Chart/source note in the document: “Source: Bloomberg; Analysis by Tavi Costa.”) Furthermore, looking at the gold–silver ratio, the magnitude of the recent drop is rare over nearly the past 20 years, which often implies a subsequent reversal;

therefore chasing highs requires caution. It is better to wait patiently for silver to top out, and then use calendar spreads as the most suitable way to position short.

Finally, turning to crude oil.

For crude, a key moving average is the 60-day moving average. Even though Venezuela’s crisis does not appear to have impacted global supply–demand dynamics in the short term, in the longer term there is an expectation for increased production, so this is viewed as a bearish factor for oil. The plan is to treat the WTI crude oil futures 60-day moving average as the “ceiling” and attempt to position short, using a break above the 60-day moving average as the stop-loss; the risk–reward currently looks attractive.

Alternatively, a covered put strategy can be used: sell WTI crude oil above the 60-day moving average while also selling a put at the 55 strike. If price breaks below 55, then stop out the put position

It is also worth noting that the U.S. action toward Venezuela exposed a strong desire to reinforce the dollar–oil system, and it also showed a willingness to arrest a country’s leader at reputational cost to its “policing” image, which harmed the credibility of the U.S. dollar. After the U.S.–Venezuela crisis erupted, the U.S. Dollar Index declined.

From a long-term perspective, the Dollar Index may break below a long-term support line and begin a new downtrend,Even though this move may still be in its early stages, it is important to watch closely: if a new leg down in the Dollar Index begins, the commodity bull market could accelerate, and Hong Kong and A-share markets may also continue to rise as hot money flows back.

As an example, many mining stocks in the A-share market rallied today. This again validates the earlier judgment made several weeks ago:

$白银主连 2603(SImain)$ $微白银主连 2603(SILmain)$ $微黄金主连 2602(MGCmain)$ $黄金主连 2602(GCmain)$ $A50指数主连 2601(CNmain)$ $恒生指数主连 2601(HSImain)$ $NQ100指数主连 2603(NQmain)$ $COMEX铜主连 2603(HGmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

[USD] [USD]