$TSLA$

Tesla reports earnings after the market closes on Wednesday. Currently, anxiety outweighs expectations. There might be little news on autonomous driving, but 2026 delivery figures may not be very optimistic, likely slightly higher than 2025 deliveries.

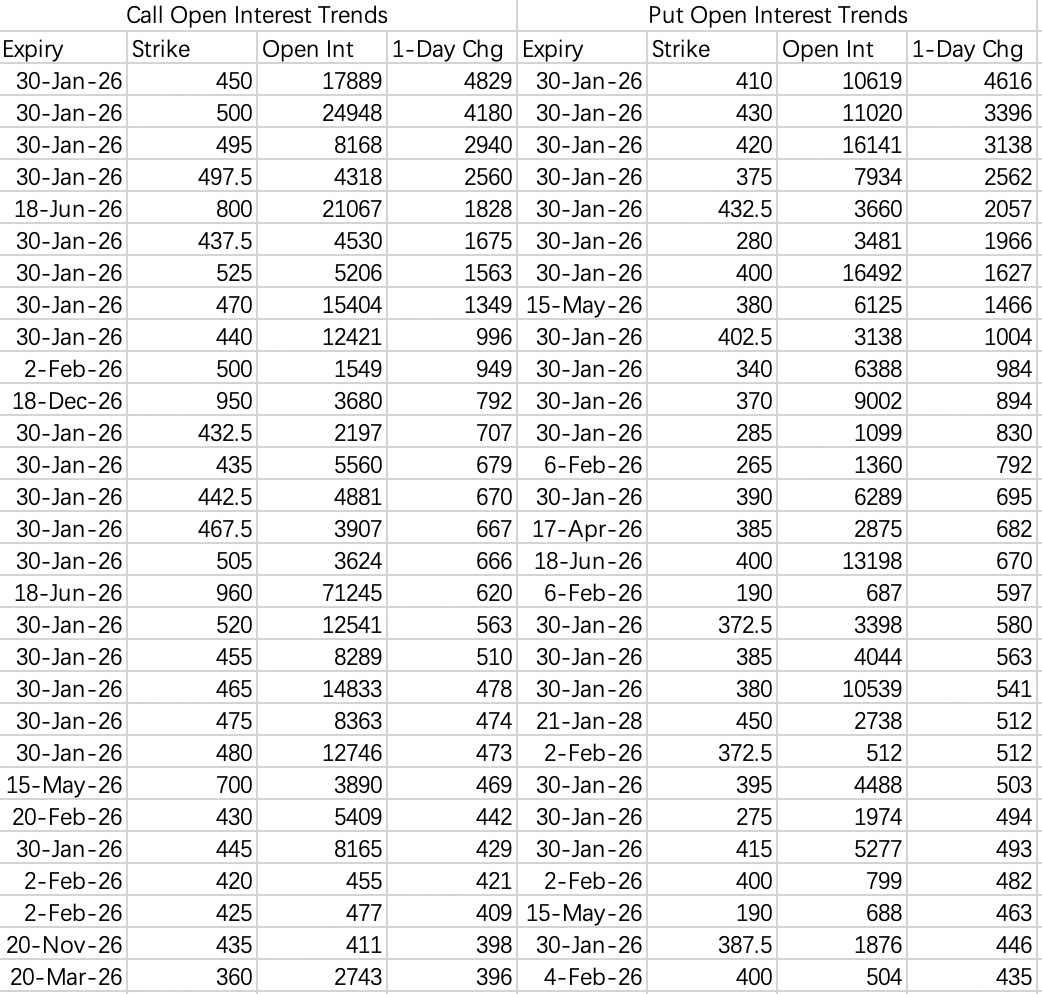

The expected trading range is between 400 and 465. If the stock price drops after earnings tomorrow, it would be more suitable for selling puts.

$MSFT$

Earnings prospects are not particularly optimistic. The focus is on cloud business growth, Copilot monetization, and capital expenditures. The latter two have a probability of being underwhelming. If Microsoft's capex disappoints, it could weigh on other tech and chip stocks. Of course, a pullback also presents an opportunity.

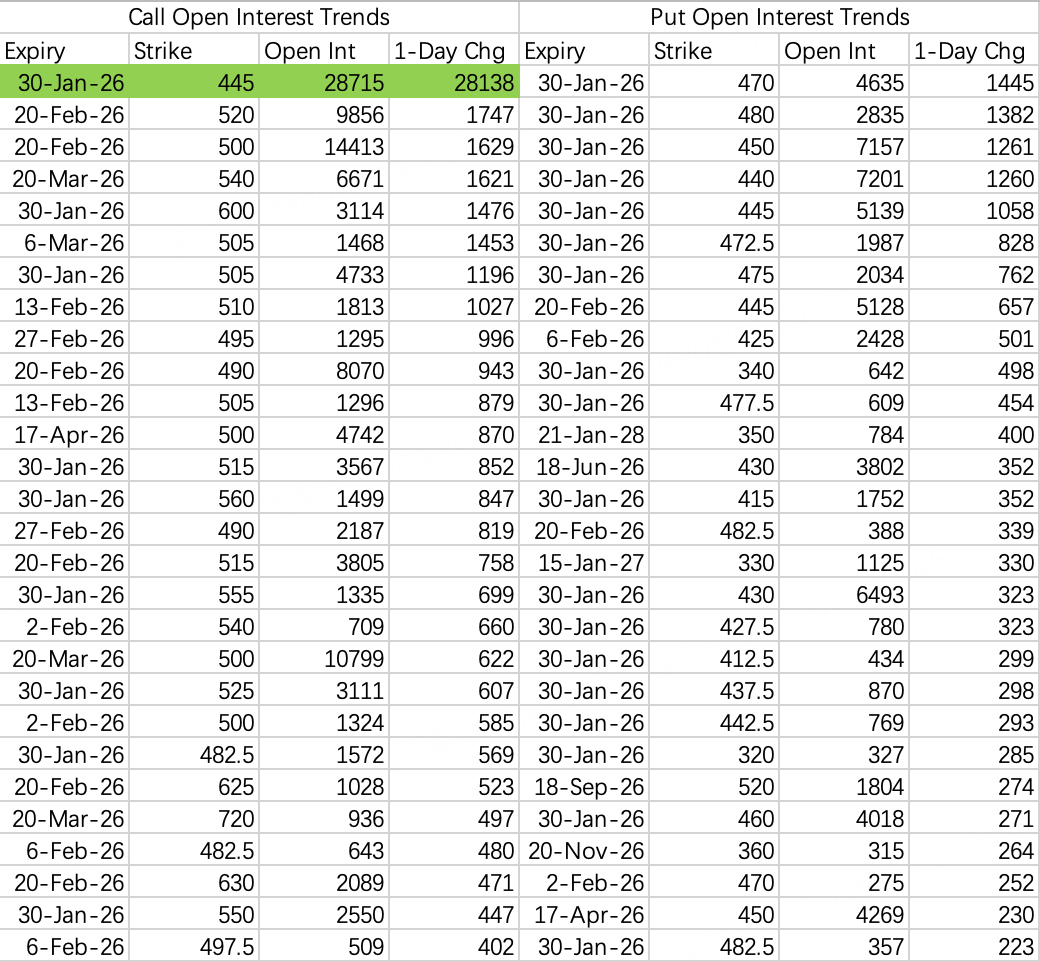

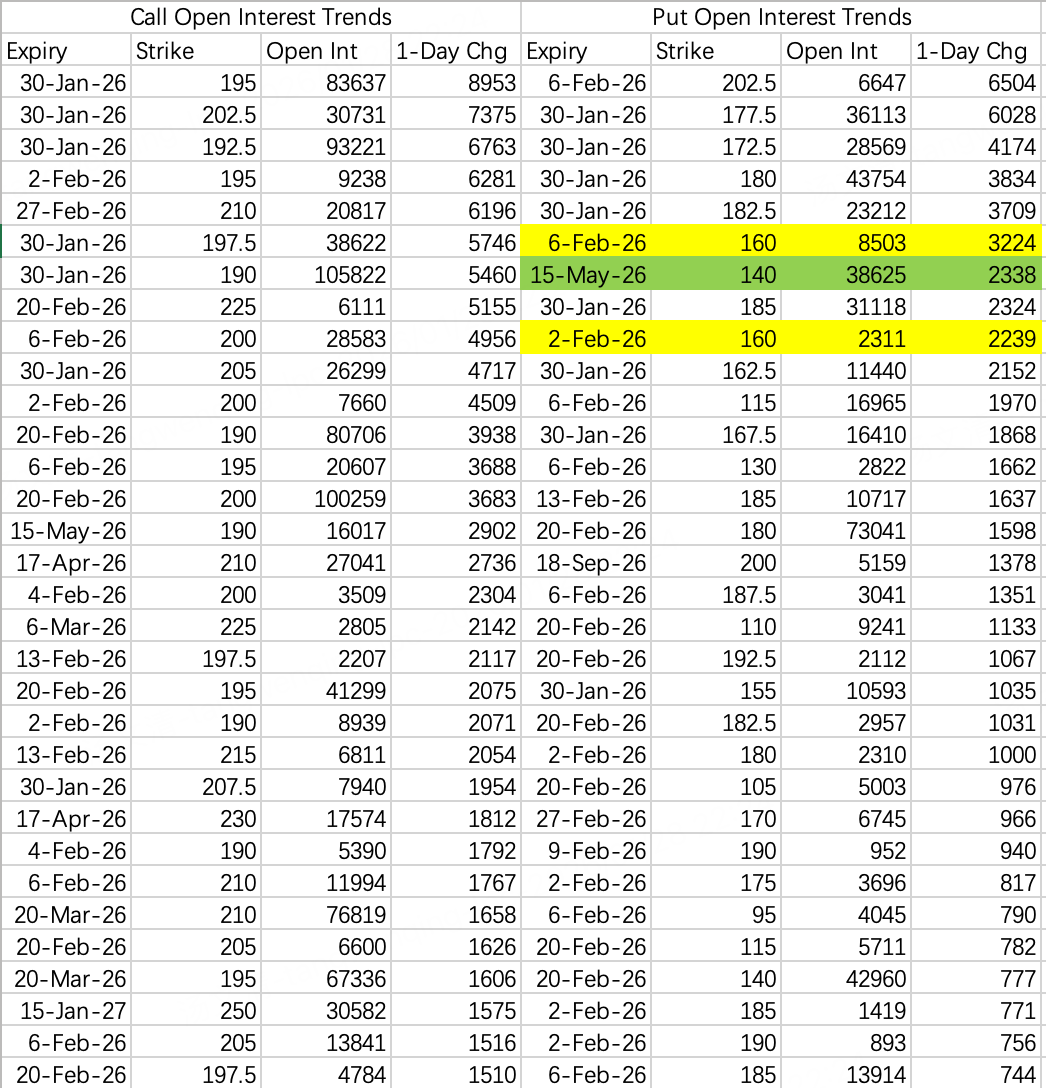

The weekly expiry 445 call $MSFT 20260130 445.0 CALL$ saw 28,000 contracts opened, mostly sold. Generally, whether bullish or bearish, in-the-money call openings often suggest limited upside or even a decline. I think it's possible cloud service positives are offset by other negatives.

$UNH$

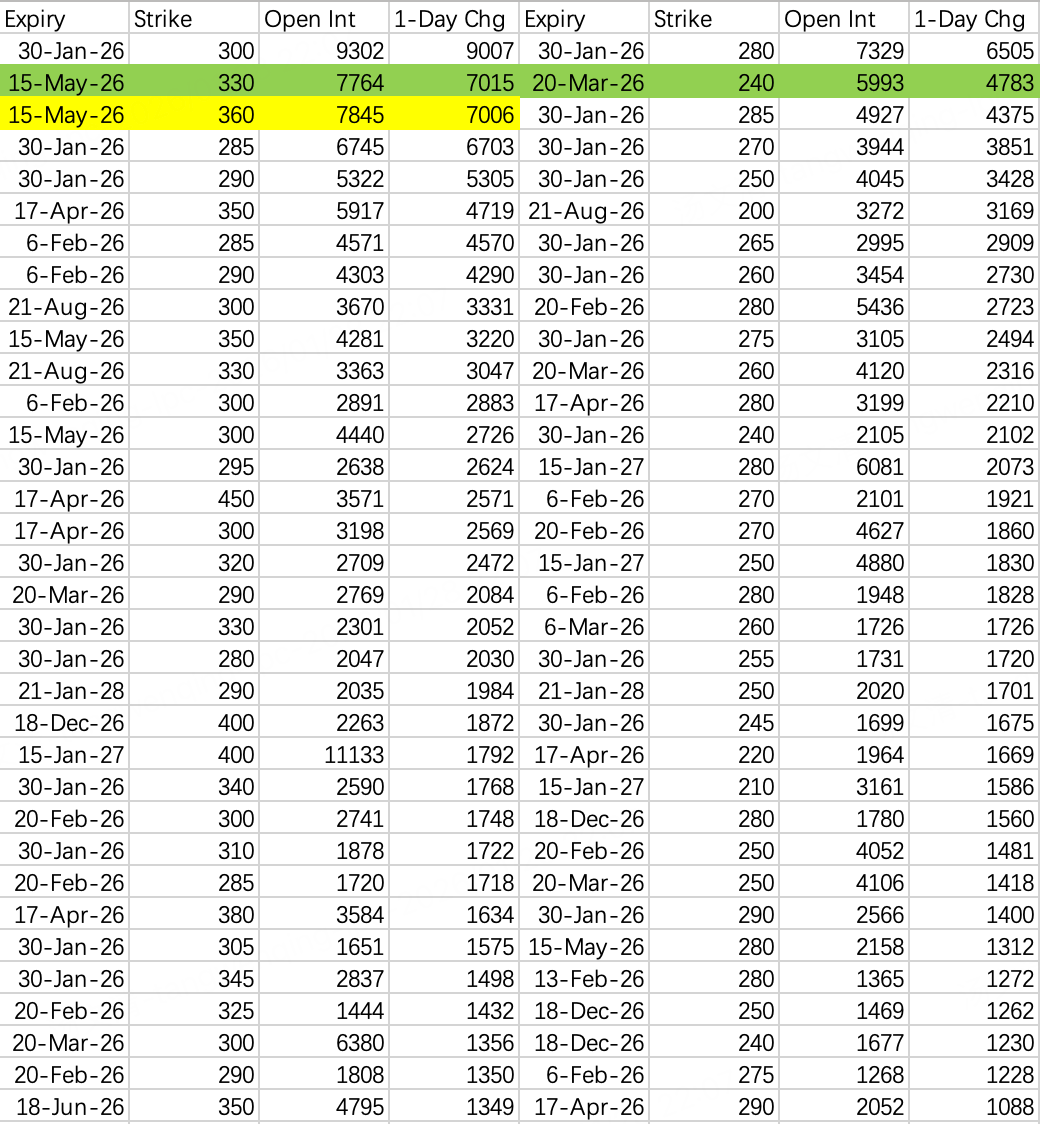

Another post-earnings plunge. Filling the gap is expected to take at least a quarter or more. Consequently, a large bullish order involved selling the 330 call $UNH 20260515 330.0 CALL$ and hedging by buying the 360 call.

The bottom is expected to be tested in the 260-270 range.

$CRWV$

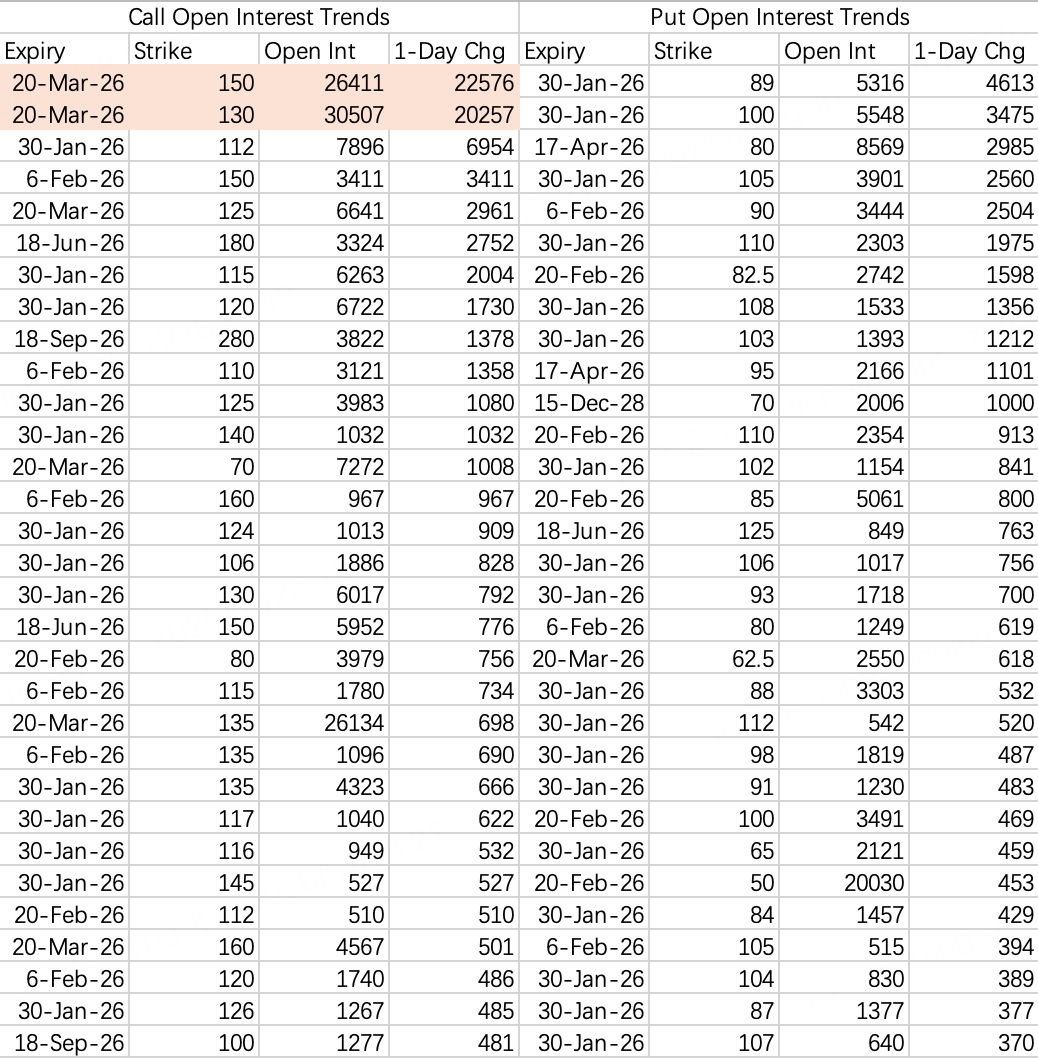

At this elevated price level, large orders are typically less frequent. However, I'm curious that the insider bullish large order $CRWV 20260320 100.0 CALL$ hasn't been rolled, suggesting the stock price is likely to continue rising.

The 130 and 150 calls each saw over 20,000 contracts opened $CRWV 20260320 130.0 CALL$ $CRWV 20260320 150.0 CALL$ , single-leg, direction leaning towards the sell side.

$NVDA$

Continues to maintain its range-bound consolidation. If bullish on semiconductors and looking to chase momentum, selling puts is an option. For a neutral strike price, 180 is a choice.

Browsing groups today, I saw someone long NVIDIA by continuously buying calls, incurring significant losses. Leveraged long positions require perfect timing and conditions. Most of the time, selling puts is a more effective strategy with a higher probability of profit.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.