Google's Small-Cost Bearish Strategy Ahead of Earnings

$Google (GOOG) $Will be onFebruary 4thpublishFourth Quarter Fiscal 2025 Earnings。 Against the background of the recovery of advertising demand and the accelerated growth of cloud business, the market generally expects the company's performance this quarter to maintain a steady expansion trend.

From the perspective of core financial indicators, the market consensus expects revenue for this quarter to be approximatelyAround $110 billion, year-on-year growth of approximately15%; Earnings per share (EPS) are expected to be inAround $2.6。 Search advertising is still the pillar of revenue. Benefiting from AI technology to improve advertising conversion efficiency, related businesses are expected to continue double-digit growth; YouTube advertising revenue is expected to maintain steady growth.

Business level,Google CloudIt is still the main highlight of investors' attention. Driven by generative AI and enterprise computing power demand, cloud business revenue growth is expected to remain atAbout 30%, and continue to improve profitability, further increasing its contribution to the overall performance.

Furthermore,Capital Expenditure GuidanceBecome the key point of this financial report. The market expects Alphabet to continue to significantly increase the construction of AI infrastructure, including investment in data centers and self-developed chips. The impact of high capital expenditures on short-term free cash flow and margins, as well as management's presentation of investment returns, will directly affect market sentiment.

Overall, if the advertising business remains resilient, the high growth of the cloud business continues, and the company gives a clear path between AI investment and profitability, Google's financial report is expected to continue to strengthen its long-term growth logic.

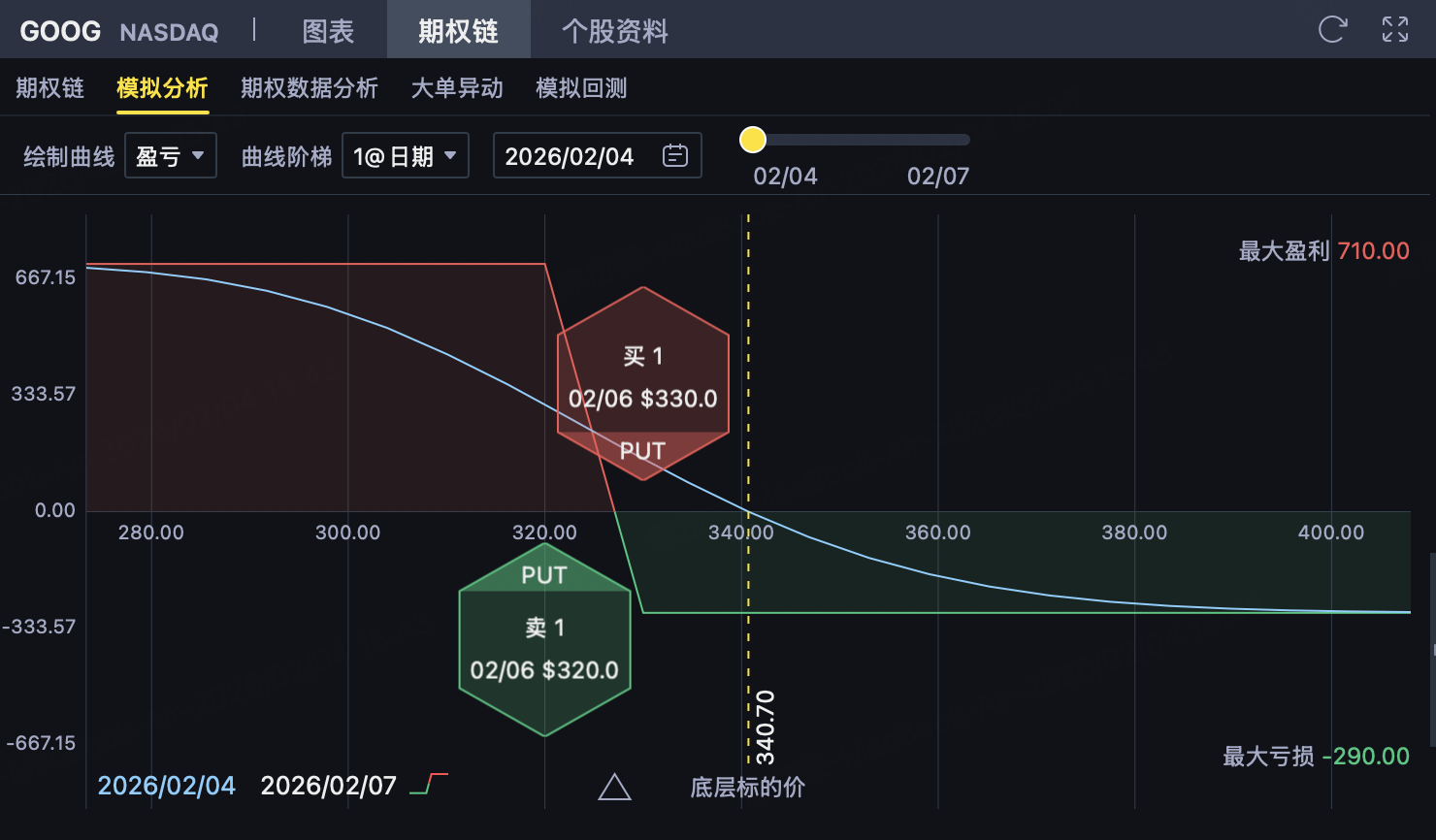

Google (GOOGL) Bear Market Bearish Spread Strategy Profit and Loss Analysis

1. Strategy structure

Investors in$Google (GOOG) $Build aBear Put Spread Bear Put SpreadStrategy. The strategy belongs toExpenditure Type (Net premium)、Limited benefits, limited risksDirectional strategy, suitable for judging GOOGL before expirationThere is a decline, but the decline is limitedSituation.

1 ️ ⃣ Buy higher strike price Put (main directional position)

-

Buy 1 share strike priceK ₂ = 330Put of

-

Payment premium$5.95/Share

This Put is closer to the current stock price and is the core source of falling gains for the strategy. When GOOGL falls below 330, the option will quickly enter the money and generate gains.

2 ️ ⃣ Sell at a lower strike price Put (reduce costs, lock in the upper limit of income)

-

Sell 1 strike priceK ₁ = 320Put of

-

Premium received$3.05/Share

This Put is used to hedge part of the cost, while limiting the maximum benefit and maximum risk, and avoiding the high premium expenditure caused by buying Put alone.

3 ️ ⃣ Put-side net expenses (per share)

Net premium Expenditure = Buy Put − Sell Put = 5.95 − 3.05 =$2.90/Share

2. Maximum profit

When GOOGL Expires Price≤ $320Time:

-

Both Put are in-the-money

-

Strike spreads are fully locked

Calculation method:

-

Strike spread width = 330 − 320 =$10

-

Maximum Profit (Per Share) = Strike Spread − Net Expense = 10 − 2.90 =$7.10/share

-

Per contract (100 shares):$710

📉Occurrence condition: GOOGL expiration price ≤ $320

3. Maximum loss

If GOOGL expiration price≥ $330:

-

Both Put are out-of-the-money

-

All options lapse

At this time, investors lose all premium expenditures:

-

Max loss (per share) =$2.90

-

Maximum loss per contract =$290

📈Occurrence condition: GOOGL expiration price ≥ $330

4. Break-even point

Breakeven = Buy Put Strike Price − Net premium = 330 − 2.90 =$327.10

Maturity judgment rules:

-

GOOGL < 327.10 → Profit

-

GOOGL = 327.10 → NO PROFIT, NO LOSS

-

GOOGL > 327.10 → Loss

5. Strategic characteristics and applicable situations

Strategy Characteristics

-

UnambiguousBearish Directional Strategy

-

Belonging toExpenditure-type structure, pay premium first

-

The maximum profit and maximum loss can be determined when opening a position

-

Compared with buying Put naked,Lower costs and more manageable risks

Applicable situationsWhen investors judge:

-

Google under the influence of financial reports or macro factorsThere is downward pressure

-

But thinksThe probability of decline is limited (not far exceeding 320)

-

Hope to startLimited cost gain falling gains within a definite range

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Hom666389·02-04 17:05I’m newbie . What platform apps are you using ?LikeReport