On April 4, China announced a series of countermeasures against the United States' imposition of tariffs, including a decisive move to impose a 34% tariff on all imported goods originating from the U.S. This unprecedented response caught global markets off guard, highlighting China's preparedness since the 2018 trade war and revealing vulnerabilities in Western financial markets. As news spread, commodities faced significant sell-offs, and global markets began pricing in a potential economic recession. The U.S. stock indices’ sharp decline echoed patterns seen during the initial outbreak of the COVID-19 pandemic in 2020, signaling growing pessimism about the global economy.

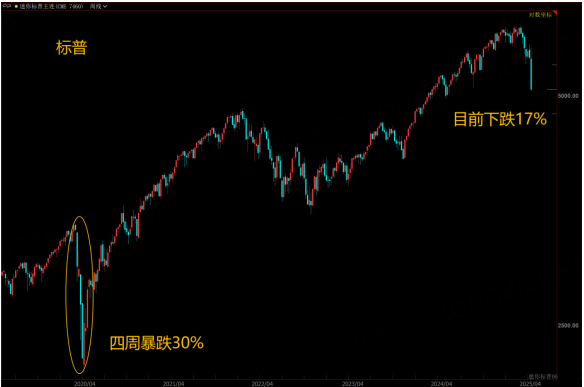

U.S. Stock Indices Enter Recession Mode, Resembling 2020 Pandemic Trends

Though skepticism toward U.S. stock performance persisted earlier this year, the market was expected to follow a gradual downward trajectory. However, the surprise announcement of tariffs caused the U.S. stock market to plunge sharply by 6% in a single day. This panic closely mirrors the uncertainty experienced during the COVID-19 pandemic, where investors scrambled to assess the severity of the crisis, resulting in widespread sell-offs.

The continuation of tariff policies may prompt other countries to adopt hardline stances similar to China’s, amplifying disruptions to global supply chains. If this occurs, the only hope for U.S. stock market recovery would lie in President Trump reversing his stance or the Federal Reserve preemptively cutting interest rates—neither of which seem imminent.

From a technical perspective, the sharp downturn in April suggests May as a potential rebound period, coinciding with the upcoming Federal Reserve meeting. While an aggressive rate cut could ease market pressures, current sentiment remains bleak, making specific market predictions increasingly unreliable. Investors are advised to monitor fundamental economic indicators closely.

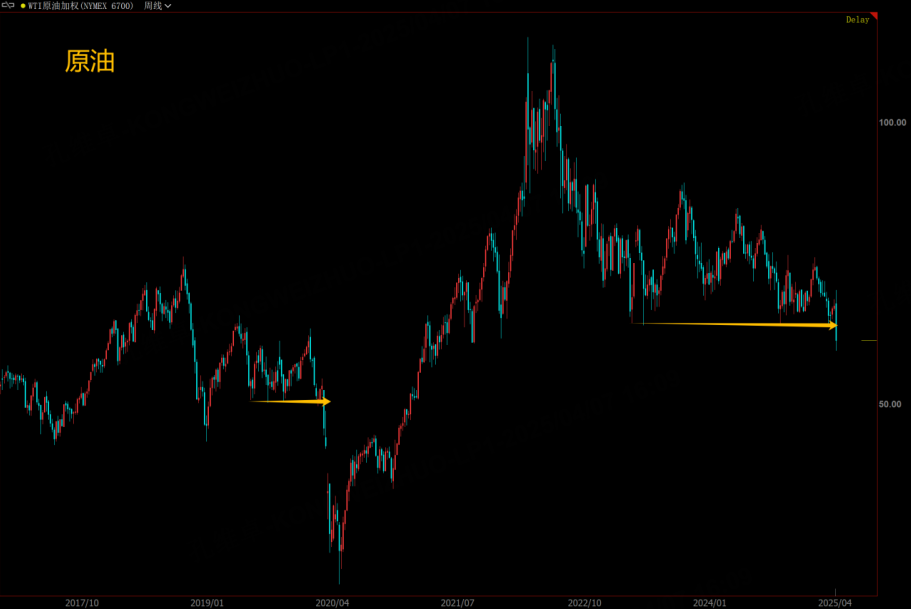

Commodities Face Synchronised Collapse

The tariff announcement induced a chain reaction across commodity markets, as fears of economic recession led to broad-based corrections. Historical precedent shows that in synchronized downturns, few assets escape unscathed—even traditional safe havens like gold. For instance, during the 2008 financial crisis, institutions facing margin calls sold off gold en masse to maintain liquidity, resulting in a price drop exceeding 30%. Similarly, the current turbulence offers little refuge for most commodities.

Oil prices, having hovered within a narrow range for an extended period, finally broke below the $65 threshold following OPEC+’s decision to increase production. This movement aligns with expectations: best-case scenario, oil prices drop by one-third; worst-case, they lose two-thirds of their value. Early indications suggest a prolonged decline, and investors are cautioned against attempting to catch the falling knife prematurely.

Conclusion

China’s swift and robust retaliation to U.S. tariffs marks a pivotal moment in global trade dynamics, reflecting years of preparedness and signaling its resolve to uphold international norms. Meanwhile, global financial markets grapple with heightened uncertainty, facing patterns reminiscent of previous crises. Investors must tread carefully in these tumultuous times, staying informed to navigate the ripple effects across stocks, commodities, and broader economic prospects.

$NQ100指数主连 2506(NQmain)$ $SP500指数主连 2506(ESmain)$ $道琼斯指数主连 2506(YMmain)$ $黄金主连 2506(GCmain)$ $WTI原油主连 2505(CLmain)$

Comments