The recent market has become highly disorderly due to fluctuations in Trump's tariff policies, with dramatic falls and rises triggered by mere words. In this emotional market environment, news can only determine short-term trends. Despite significant volatility, these large fluctuations do not represent medium to long-term market directions. Therefore, Trump's statement about delaying tariff policy implementation by 90 days alone cannot confirm that US stock indices have entered a reversal pattern - what if he changes his mind again in the near future?

Technical Observation of US Stock Indices

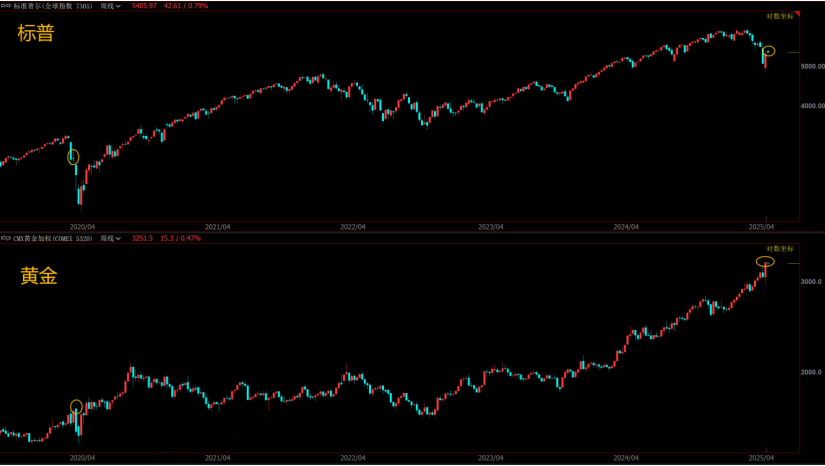

With neither news nor fundamentals yielding clear conclusions, it's evident that the market is heavily influenced by emotions. Therefore, tracking the market using technical analysis methods will be more effective. Although US stock indices experienced one of the largest rebounds in history last week, this was merely an emotional correction following the tariff-induced plunge. So far, US stock indices have not broken through the 20-day moving average.

Friends who have followed my articles and videos for a long time know that the 20-day moving average is almost the minimum parameter to distinguish between bullish and bearish conditions in US stock indices. The index must at least break through this moving average to discuss stabilization or reversal. Otherwise, slightly negative news could immediately create new lows.

Do not expect too much from short-term rebounds. At minimum, wait for the S&P to break through the 20-day moving average before repositioning, or take advantage of the current rebound to buy put options to protect your stock assets as low-cost insurance.

Gold's New Highs: Continuation of Uptrend or Last Chance to Exit?

Gold, as a safe-haven asset, often maintains its strong hedging function (other assets fall while gold prices rise) in the early stages of market crises. However, historically, the true method to withstand crises has always been cash. When market crisis risks spread and most assets fall, gold is viewed as a liquid asset that can be converted to cash and is heavily sold off. So during the middle to late stages of a crisis, even the strongest gold prices will experience significant adjustments.

Whether the current tariff crisis will develop further or even escalate depends entirely on Trump's words. Therefore, if the market falls sharply again and affects the margins of financial institutions, gold prices may also follow with a sharp decline.

This situation closely resembles conditions during the 2008 financial crisis and the 2020 COVID-19 pandemic crisis. Gold price peaks lag behind US stock index peaks, and gold price peaks often occur in the middle of US stock index declines. Therefore, no matter how much gold prices reach new highs now, be mentally prepared to avoid sudden shocks and losses.

From a long-term perspective, gold prices still show a long-term bullish trend. After adjustment, they remain a good opportunity for buying the dip, but remember to avoid market volatility caused by liquidity droughts.

Conclusion

The current market situation requires careful analysis beyond emotional reactions to news headlines. For US stocks, the 20-day moving average serves as a critical technical indicator that should guide investment decisions. Meanwhile, gold's traditional safe-haven status comes with important caveats during different phases of market crises. Investors should maintain realistic expectations about both assets and prepare contingency plans for various market scenarios, especially considering the unpredictable nature of policy announcements from key figures like President Trump.

$NQ100指数主连 2506(NQmain)$ $道琼斯指数主连 2506(YMmain)$ $SP500指数主连 2506(ESmain)$ $WTI原油主连 2506(CLmain)$ $黄金主连 2506(GCmain)$

Comments