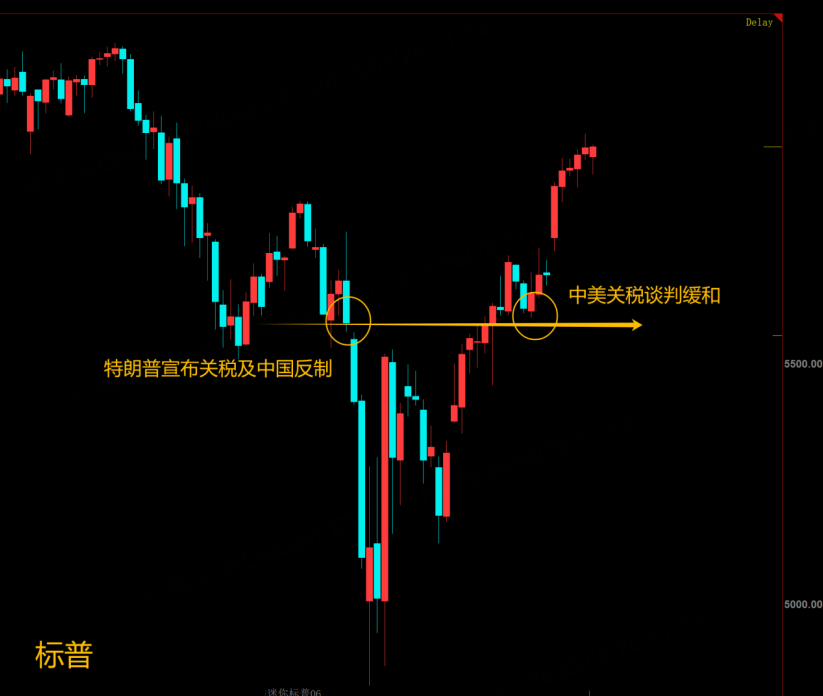

The recent agreement reached in the U.S.-China tariff negotiations has significantly alleviated the market anxiety that had prevailed since April. Meanwhile, although the Russia-Ukraine talks have resumed, a swift resolution remains unlikely; however, signs of progress have also helped ease risk aversion.

Has the worst already passed? Hopefully so, though former President Trump’s unpredictable remarks remain a potential source of volatility. For now, the short-term market climate appears relatively calm. With the 90-day tariff suspension period not ending until late July, there is still time for developments—investors can be cautiously optimistic, but should avoid reckless moves.

1. Key Support for U.S. Stock Indices

May is a critical period for U.S. stock indices, which often experience turning points or accelerations during this month. The unexpected news of a temporary suspension in U.S.-China tariffs broke through the major resistance of the 20-week moving average, signaling that the most dangerous phase for U.S. indices has passed.

The market has returned to a slow bull pattern—advancing two steps and retreating one. However, a pause in the tariff war does not mean the economy is unaffected, and the year’s earlier highs remain out of reach for now. Market volatility is likely to persist as the main feature in the near term.

From a technical perspective, May’s significant tariff news means that the month’s low will be a crucial benchmark for assessing whether the indices might turn bearish again. As long as this low holds, there is no strategic need for shorting or hedging (short-term speculation aside). Investors should wait for concrete developments regarding tariffs around late July before making major moves.

2. Tariff Easing and Russia-Ukraine Talks Weigh on Gold Prices

The recent decline in gold prices has been repeatedly discussed in previous posts, and the latest news flow has only reinforced this trend. Although the long-term outlook for gold remains intact, its rapid short-term rise has made it vulnerable to any negative headlines, which can accelerate corrections—sometimes leading to drops of over 20% within a month. Currently, the news is not particularly bearish for gold (since tariffs are only suspended, not canceled, and the Russia-Ukraine talks have not produced results), so the pace of this gold downturn may be much slower.

Last week’s posts noted that Thursday and Friday would be key points for gold prices. Indeed, after a sharp drop on Thursday night, gold rebounded, validating the timing. However, these time points usually correspond to moves of 100-200 points; for example, if Thursday’s low was 3123, a 200-point rebound would only bring it near 3300. Such a rebound is insufficient to confirm a reversal. If there is no reversal, and more negative news emerges this week (such as a Russia-Ukraine agreement), gold could set new lows. Investors should pay close attention to trading rhythms.

3. Oil Prices Show Upward Potential

Oil prices are expected to gradually rise—not because the current price is the absolute bottom, but because the period of highest risk for crude oil has likely passed. In the short term, a potential U.S.-Iran agreement could put some pressure on the oil market and even push prices slightly lower.

However, with the U.S. suspending tariffs on China, recession fears have subsided, and bearish sentiment for oil has eased. Should the Federal Reserve begin cutting rates in the second half of the year and inflation expectations resurface, oil prices could rise further. Technically, breaking through $65 per barrel is a key threshold for a bullish outlook on oil, so investors should monitor this level closely.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2506(GCmain)$ $WTI Crude Oil - main 2507(CLmain)$

Comments