Investment behaviors in the US market differ to some extent from those in China, mainly because of:

In the US market, information disclosure tends to happen at fixed and predictable times. Although the timing norms have been somewhat disrupted by social media since Trump took office, especially with his frequent use of such platforms, major economic data are still released according to a regular schedule. These calendar-based trading opportunities are thus relatively easy to spot and capture in overseas investments.

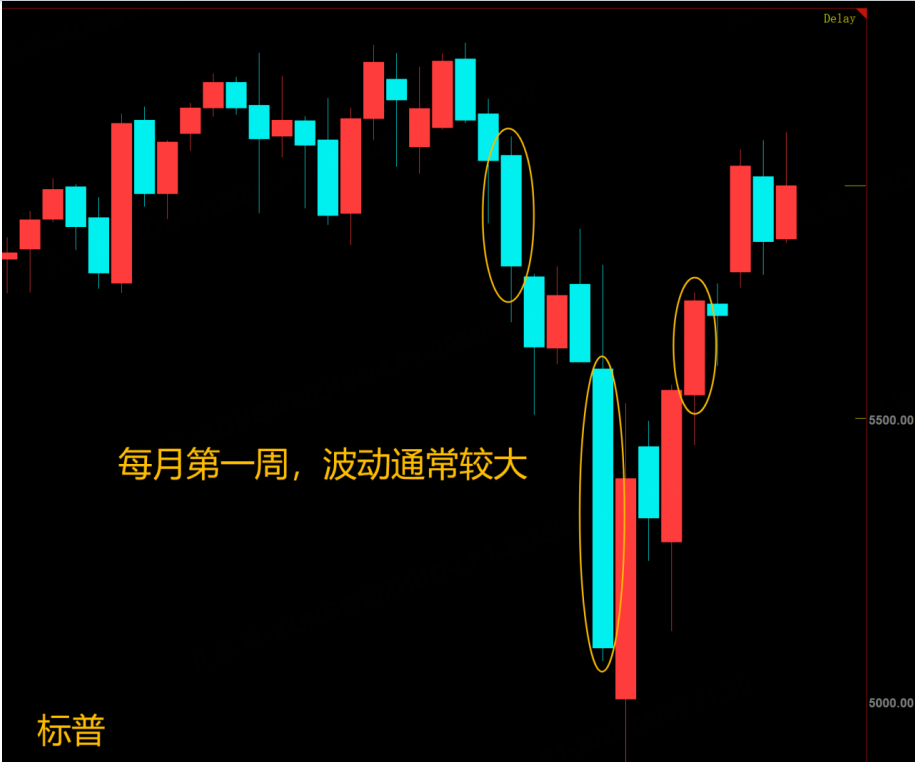

Next week is the first week of June. It is notable for the release of both the regular and ADP non-farm payroll reports, as well as the announcement of OPEC’s oil production plans (which will be released over the weekend and reflected in prices the following week). Typically, these events lead to increased price volatility in commodities and US stock indices. This expectation is also reflected in option market quotes, which tend to indicate higher volatility. Increased volatility benefits short-term traders by providing more speculative opportunities, as it usually means prices are moving strongly in one direction—larger gains when prices rise, and sharper declines when they fall, depending on the week’s news. For short-term traders, the best approach is to follow the market's movement accordingly.

1. Tariffs Remain the Core Issue Affecting US Indices

Tariff actions are entirely at the discretion of Trump, who announces related information unpredictably. The situation remains difficult to forecast, and currently, it’s not advisable to underestimate the impact of tariff news. If disappointing payroll data coincides with negative tariff developments, market volatility could be significant. The S&P 500 index has rebounded to around 6,000, which is not far from previous highs, but still faces considerable resistance. The market has reasons to move in either direction, so it ultimately depends on which way investors choose. For short-term trades, if the market does not move as anticipated, it’s best to exit quickly.

2. Russia-Ukraine Negotiations and Their Impact on Gold

This week, negotiations between Russia and Ukraine have resumed. If they reach an agreement, it could lessen upward momentum for gold prices. If not, it is an expected outcome, but at least it means the situation is not worsening, which could put pressure on high gold prices. It is possible that a sudden breakthrough in negotiations could cause gold prices to drop sharply, especially since the major correction in gold prices that was previously anticipated has been delayed. It remains to be seen whether this round of talks will finally trigger such a move. There are still short-term opportunities for traders here; the predicted rebound in gold has already played out and gold is currently hovering around the 20-day moving average. A downward break could trigger substantial volatility, so pay close attention to near-term risks.

3. Oil Prices Remain Weak

As previously mentioned, there is no need to be bullish on oil unless prices break above $65. As expected, at the OPEC+ meeting held over the weekend, it was decided to further increase production. Eight OPEC+ countries—Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria, and Oman—held an online meeting and agreed to boost production by 411,000 barrels per day in July. This is a significant increase and will definitely put pressure on forward contracts for oil prices, likely resulting in a difficult week ahead for oil prices. However, the Iran issue remains unresolved, so bearish factors have not yet been fully priced in. Thus, it is still too early to attempt bottom-fishing in oil, and one should refrain from acting hastily.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2508(GCmain)$ $WTI Crude Oil - main 2507(CLmain)$

Comments