In June 2025, the COMEX silver futures market saw an unprecedented surge, with spot silver prices successfully breaking above $36 per ounce—a 13-year high. As of the close on June 10, the July contract settled at $36.64 per ounce, marking a year-to-date increase of 22.54%.

Technical Breakthrough and Historical Significance

Silver prices have decisively breached the psychologically significant $35 per ounce resistance level, signaling a major technical breakthrough after years of consolidation. However, historical data indicate that silver is still trading far below its inflation-adjusted peak; the $50 record reached in 1980 would equate to roughly $180 today. From a technical standpoint, silver’s current move has effectively overcome a key resistance zone, setting the stage for further gains.

Supply and Demand Analysis

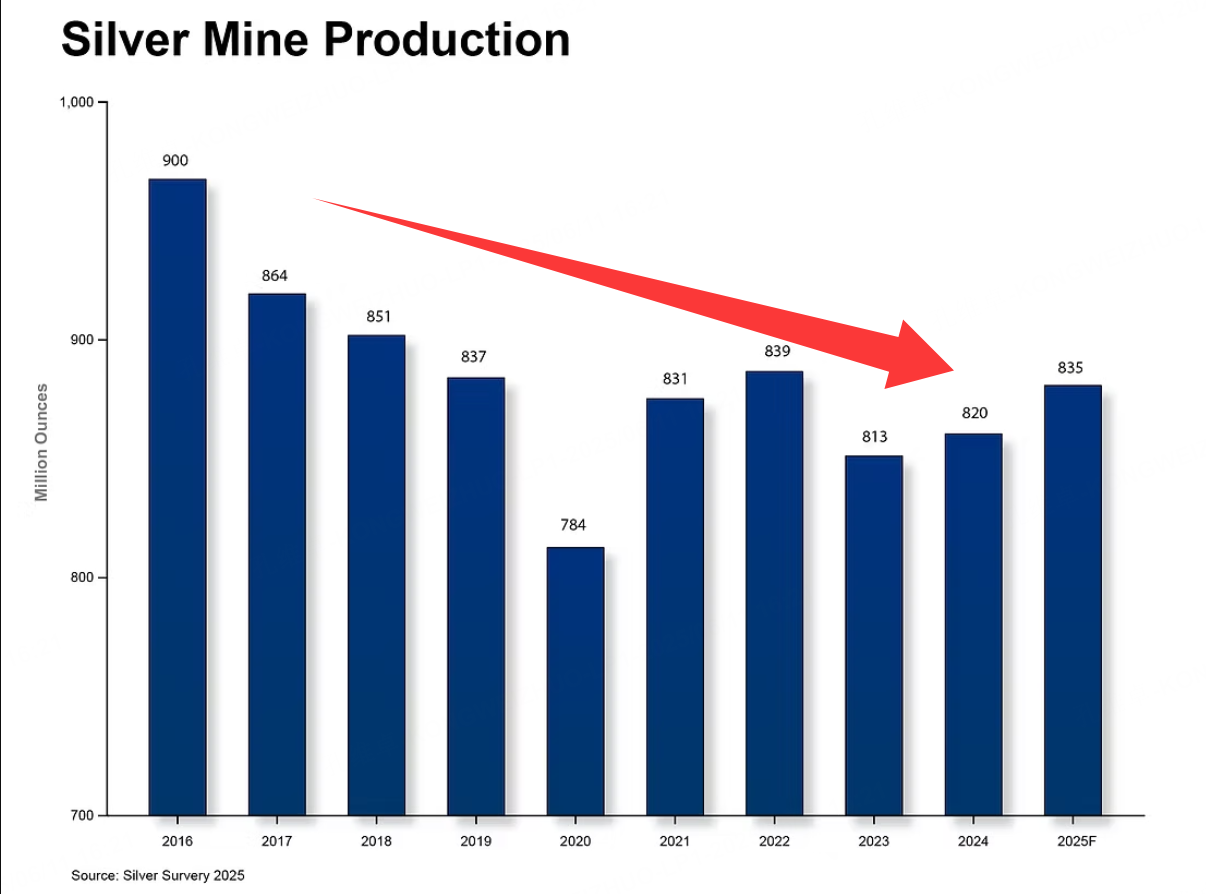

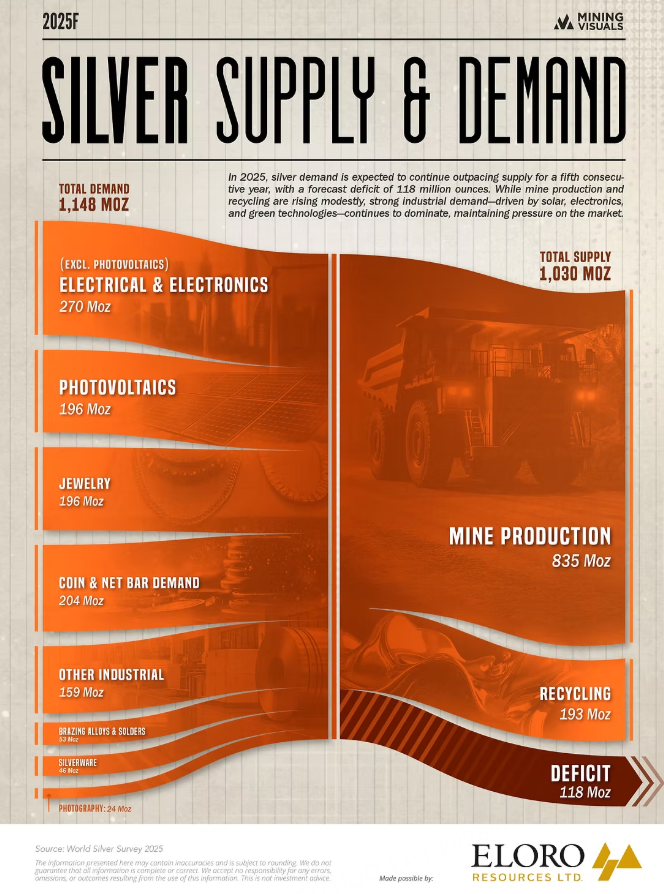

According to the World Silver Survey, global silver mine production is expected to reach 835 million ounces in 2025, representing a 7.23% decline compared to 2016. This long-term downtrend is mainly due to the maturity of major deposits, changes in capital investment cycles, and extended timelines for developing new mines. Although recycled silver output is projected to rise to 195 million ounces—an increase of 24.06%—this is still insufficient to offset the decrease in mined silver.

Persistent Industrial Demand

Projections from the Silver Institute suggest that global industrial demand for silver will surpass 700 million ounces in 2025 for the first time, a year-on-year growth of 3%. Green economy applications continue to be the primary growth driver, with the photovoltaic (solar) sector expected to reach new highs. The electric vehicle industry is also significant, as each EV uses nearly twice as much silver as a conventional vehicle.

Fifth Consecutive Year of Deficit

In 2025, the global silver market is forecast to face a supply deficit of 118 million ounces, the fifth consecutive year of structural shortfall. The cumulative deficit from 2021 to 2024 amounted to 678 million ounces, equivalent to nearly 10 months of mine supply in 2024. This ongoing imbalance between supply and demand provides strong fundamental support for higher silver prices.

COMEX Futures Market Structure

Open Interest and Trading Activity

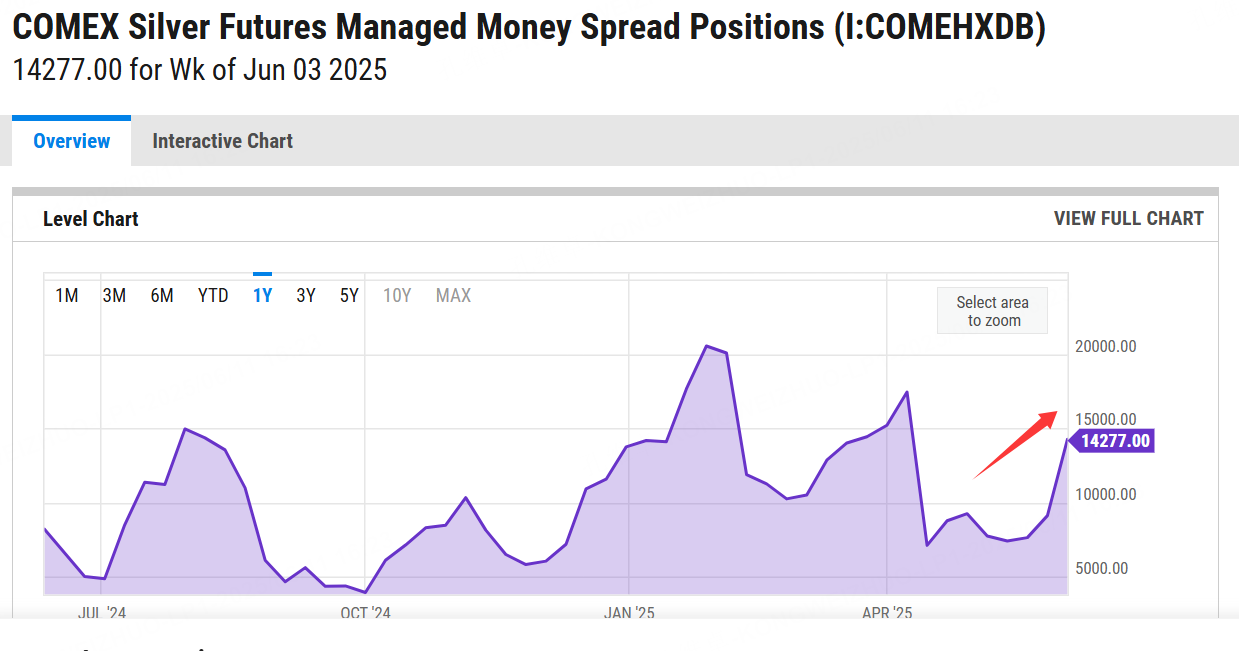

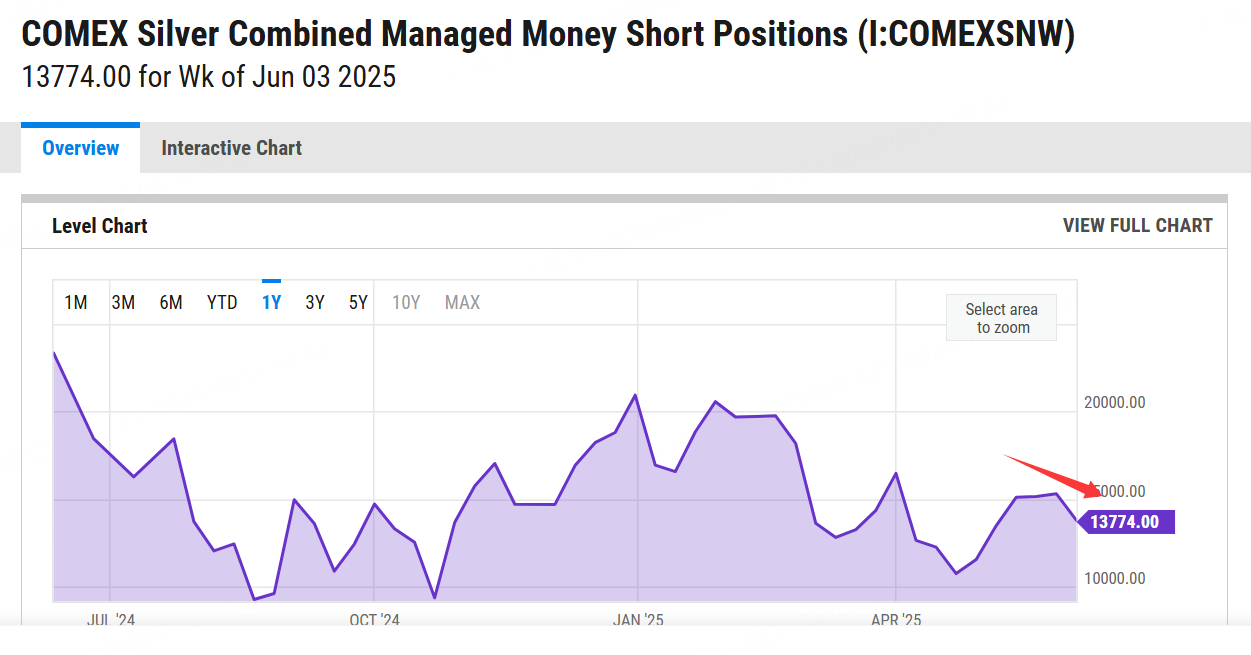

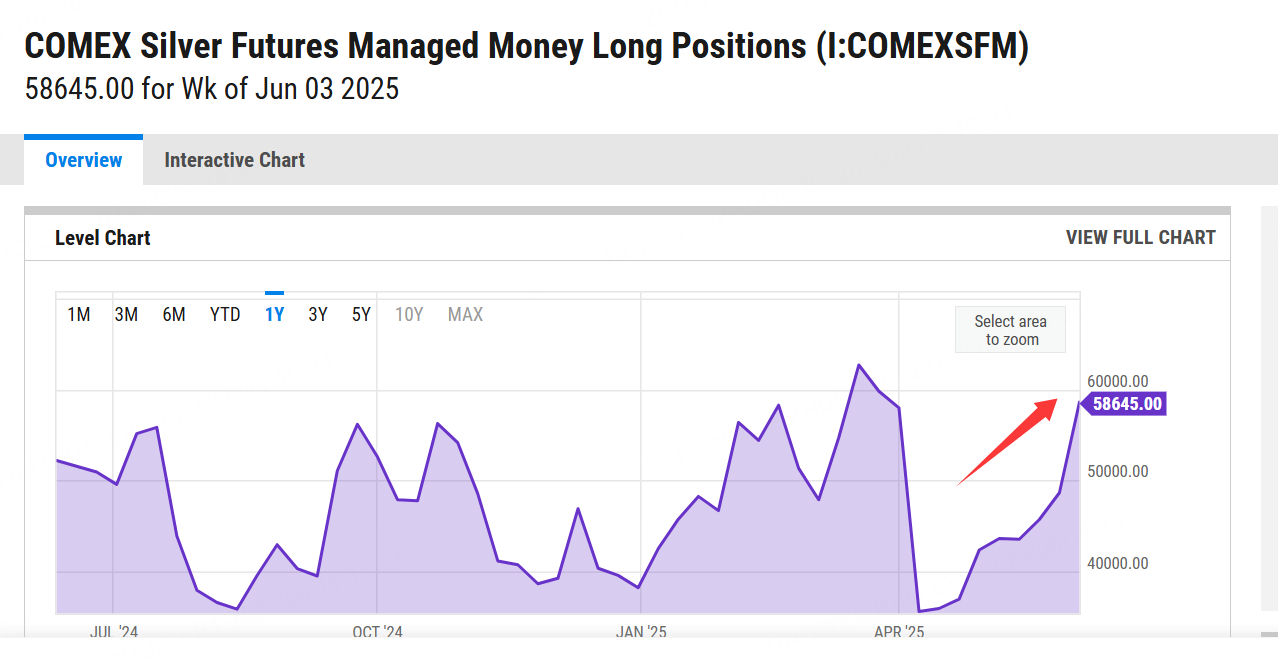

CFTC data as of June 3 show total open interest in COMEX silver futures at 189,056 contracts—a significant weekly increase, reflecting much higher market participation. Decomposition of positions reveals that the "Managed Money" category sharply increased its net long positions while slightly reducing short exposure, signaling growing institutional optimism about silver’s outlook.

Futures Curve Structure

Currently, the COMEX silver futures curve exhibits a slight contango, with the July 2025 contract trading marginally above the spot price. Looking further ahead, the forward curve maintains a typical "normal contango" structure, where later-dated contracts trade at progressively higher prices. This pattern is consistent with the carrying-cost dynamics of precious metals and suggests that the recent rally has not disrupted the market’s forward price rhythm—future expectations remain positive, hinting that the uptrend may not be over.

Macro Environment Analysis

Federal Reserve Policy Expectations

There is currently a divergence of opinion in precious metals markets regarding the Federal Reserve's policy outlook. The federal funds rate remains in the 4.25%-4.50% range, and the probability of a rate cut at the June 17-18 FOMC meeting remains low. Atlanta Fed President Bostic noted that strong economic performance gives the central bank time to observe the impact of tariffs on inflation and growth. This suggests that higher rates may persist for a while. Silver’s breakout amid this backdrop may reflect markets getting ahead of an eventual rate-cut narrative, and there is still risk for silver if broader precious metals trends pause.

US Dollar Index

The dollar index (DXY) is an important influence on silver prices. Analysts point out that a break below the key 98 support level for the DXY would be a major tailwind for precious metals. Historically, a weaker dollar is positively correlated with higher silver prices.

Impact of Inflation Data

The upcoming May CPI data will be pivotal for market expectations. If inflation prints in line with or below estimates, the likelihood of rate cuts in the second half of the year increases, which would be bullish for silver and other precious metals.

Gold-Silver Ratio Analysis

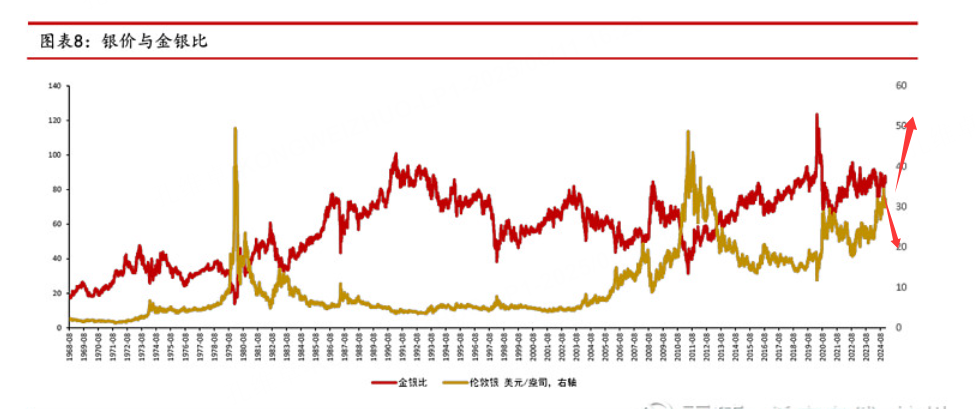

Corrective Trend

The gold-silver ratio fell indicating silver has begun outperforming gold. but current levels are still relatively high, leaving room for further correction.

Relative Value Assessment

In 2025, gold is up about 29% while silver has gained over 20%, narrowing the performance gap. Market analysts observe that silver, often called the "poor man’s gold," tends to stage a catch-up rally after gold breaks out to new highs.

Risk Factors and Market Outlook

Short-Term Risks

Technically, silver is near overbought territory and could face profit-taking pressure in the short term. The uncertain path of Fed policy, shifts in trade policy, and global economic slowing all present potential headwinds for silver.

Medium- and Long-Term Prospects

Fundamentally, the market’s supply-demand imbalance is expected to persist. The ongoing transition to green energy and the broader Industry 4.0 movement will continue to bolster demand. Analysts predict that in the long run, silver prices could target the $40-$50 per ounce range.

Conclusion & Investment Strategies

The robust rally in COMEX silver futures in 2025 is the result of multiple reinforcing factors: a fifth consecutive year of supply deficits, surging industrial demand, marginal improvements in the macro environment, and a decisive technical breakout. While silver may face short-term technical corrections, its medium- and long-term fundamentals remain strong, offering significant investment value and upside potential. Investors should allocate silver holdings according to their risk tolerance in order to capitalize on this precious metals bull cycle.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2508(GCmain)$ $WTI Crude Oil - main 2507(CLmain)$

Comments