特斯拉財報來了!如何賺比大的?

全球矚目! $特斯拉(TSLA)$ 將於美東時間1月29日美股收盤後(即北京時間30日凌晨)公佈2024年第四季度業績。根據市場一致預期,特斯拉Q4將實現營收270.72億美元,同比增加7.57%;每股收益0.65美元,同比減少71.36%。

在上個季度,特斯拉業績給投資者留下了深刻印象,其中剔除“賣碳”收入的汽車業務毛利率升至17.1%,輕鬆超過了市場預期的15.1%,“賣碳”收入同比增超30%創單季次高,超預期的業績助力特斯拉股價單日爆升近22%。

隨着美國大選的到來,特斯拉更是進入到新一輪上行週期,自11月6日以來,特斯拉股價飆升逾60%,並在12月一度觸及488.54美元的歷史高點。最近一個月,特斯拉股價進入區間震盪整理期,因此,Q4的業績的好壞直接決定着股價未來的變盤方向。

特斯拉財報日曆史表現如何?

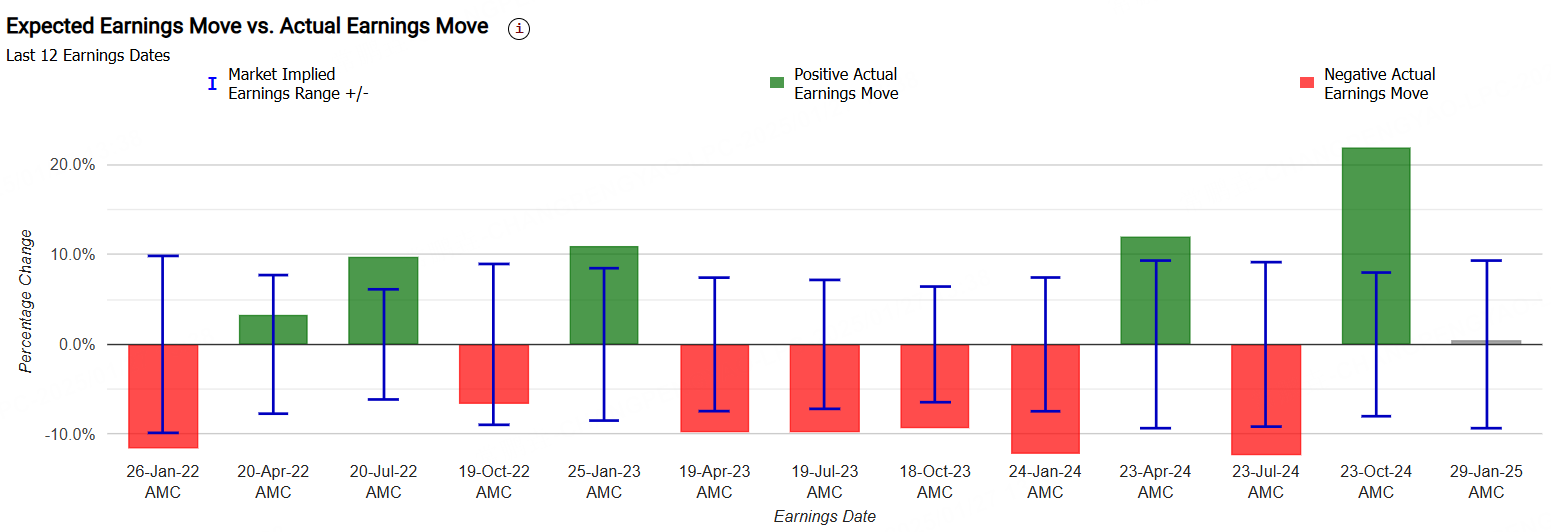

特斯拉在過去幾次的績後波動率都大超市場預期。在前四次業績發佈日,市場預期其績後波動幅度平均爲±8.5%,而最終實際變動幅度達到±14.6%。本次季度,期權市場對其隱含變動的定價則爲±12.9%。

在前一季度,特斯拉業績日表現最爲出色,股價飆漲了22%,上升幅度大大超過了預期波動值,使得看漲期權全數暴賺,多張當週到期的call單權利金壕賺逾20倍。

雙買跨式期權押注財報

特斯拉現價爲395,投資者可以買入行權價爲395的看漲期權,花費2510美元,同時買入行權價爲395的看跌期權,花費1317美元。

標的資產價格: $395

看漲期權(Call):

行權價:$395

權利金:$2510

看跌期權(Put):

行權價:$395

權利金:$1317

總成本: $2510 + $1317 = $3827

盈虧公式

最大損失: 權利金總成本 = -$3827(發生在到期時標的價格正好等於行權價$395)

盈虧平衡點:

上方平衡點 = 行權價 + 總成本 = $395 + $38.27 = $433.27

下方平衡點 = 行權價 - 總成本 = $395 - $38.27 = $356.73

潛在收益: 理論上無限(標的價格遠高於 $433.27)或幾乎無限(標的價格接近於 $0)

1. 標的價格 > $433.27

看漲期權內在價值 = 標的價格 - $395

看跌期權到期作廢

盈利 = (標的價格 - $395) - 總成本

2. 標的價格 < $356.73

看跌期權內在價值 = $395 - 標的價格

看漲期權到期作廢

盈利 = ($395 - 標的價格) - 總成本

3. 標的價格在 $356.73 到 $433.27 之間

雙方期權損益無法覆蓋總成本,投資者虧損。

盈虧 = -$3827 + 內在價值(取決於標的價格)

4. 標的價格 = $395

看漲期權和看跌期權均爲虛值,到期作廢。

損失 = -$3827

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

🌟🌟🌟Tesla $Tesla Motors(TSLA)$

In many ways Tesla is more than just an EV company with its Tesla Bot in the pipeline of projects. Tesla is spending billions to have its AI computers train cars to drive and humanoid robots to complete tasks typically done by human workers.

I believe that in the short term Tesla's shares may dip further as the DeepSeek story unfolds. So for now it is better to trade cautiously on Tesla.

@TigerStars @Tiger_comments @TigerClub

🌟🌟🌟Tesla $Tesla Motors(TSLA)$

In many ways Tesla is more than just an EV company with its Tesla Bot in the pipeline of projects. Tesla is spending billions to have its AI computers train cars to drive and humanoid robots to complete tasks typically done by human workers.

I believe that in the short term Tesla's shares may dip further as the DeepSeek story unfolds. So for now it is better to trade cautiously on Tesla.

@TigerStars @Tiger_comments @TigerClub

隨着美國大選的到來,特斯拉更是進入到新一輪上行週期,自11月6日以來,特斯拉股價飆升逾60%,並在12月一度觸及488.54美元的歷史高點。最近一個月,特斯拉股價進入區間震盪整理期,因此,Q4的業績的好壞直接決定着股價未來的變盤方向。