The NVIDIA procurement guy is back, choosing to buy $300 million in straddle options

After the January FOMC meeting ended, there was no rate hike as expected. Powell maintained his previous stance on controlling inflation, but during the Q&A session, he mentioned he hadn't communicated with Trump, leaving uncertainty about whether his attitude might change after such communication.

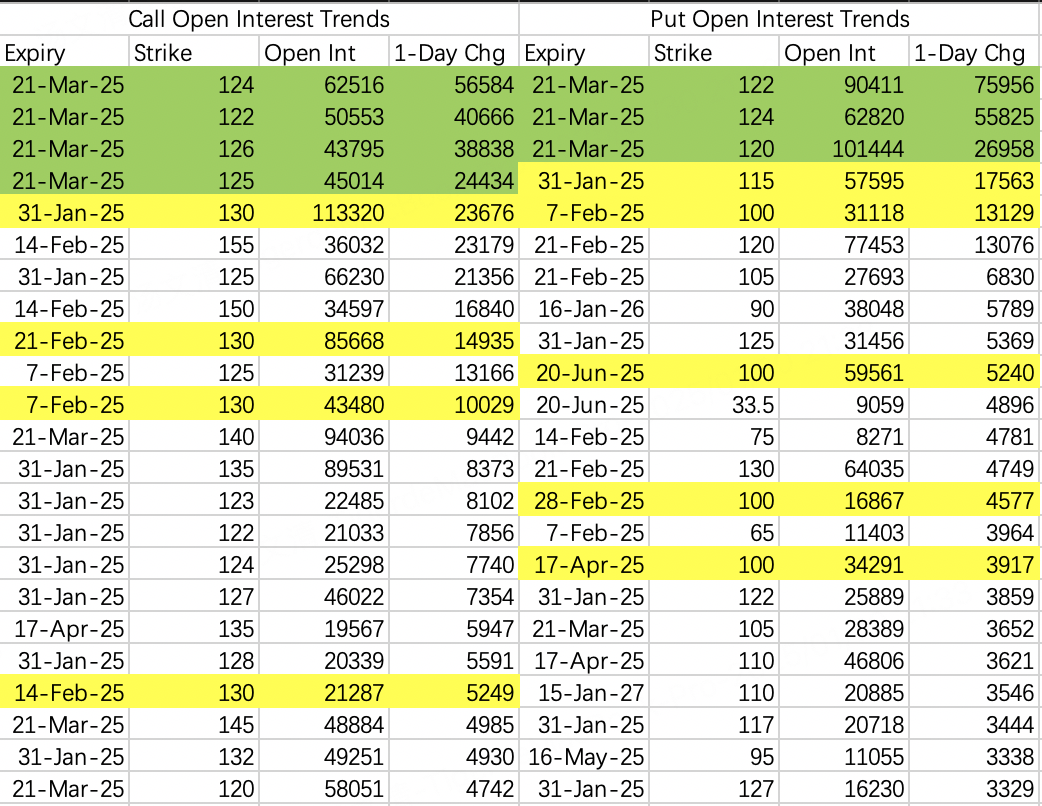

According to Wednesday's options opening details, this week's bullish top positions exceeded bearish ones, maintaining the original judgment above 120, with the upper limit raised to 130.

Long-term outlook remains bearish, with strike prices down to 100, with positions extending to June. This is understandable - January's Deepseek incident suggests companies will continue to enhance computing power this year, leading to ongoing questioning of AI chip demand. Stock prices will likely continue to fluctuate significantly, probably shaking off many investors this year.

Today's focus is on the green-marked data.

The familiar opening style, buying in series, reminds me of an old acquaintance: the procurement guy

Previous operations by the procurement guy:

Mysterious retail whale bets over $100 million on continued Nvidia upside

Giant Retail Investors Enter the Market, Market Makers Harvest $100 Million

This time, the procurement guy learned from experience, buying both calls and puts.

March expiry call options openings, top four positions totaling about 160,400 contracts, transaction value approximately $176 million:

$NVDA 20250321 122.0 CALL$ , 56,600 contracts opened

$NVDA 20250321 124.0 CALL$ , 40,600 contracts opened

$NVDA 20250321 125.0 CALL$ , 38,800 contracts opened

$NVDA 20250321 126.0 CALL$ , 24,400 contracts opened

March expiry put options openings, top three positions totaling about 158,800 contracts, transaction value approximately $175 million:

$NVDA 20250321 120.0 PUT$ , 76,000 contracts opened

$NVDA 20250321 122.0 PUT$ , 55,800 contracts opened

$NVDA 20250321 124.0 PUT$ , 27,000 contracts opened

Notably, both calls and puts are single-leg purchases, together forming a straddle strategy.

Of course, it might not be one person but several traders who had the same idea on Wednesday, with some deciding to buy calls and others puts.

If it's one person buying a straddle, they're essentially long volatility, needing NVIDIA's stock price to be below 100 or above 145 before March 21 to profit.

If it's several people making single-leg purchases, call buyers profit above 133, while put buyers profit below 110.

However, I see this as a futile strategy against market makers. These distinctions matter little, as there are many ways to grind away value.

For me, these option positions suggest NVIDIA will likely stay below 145 by late March but also limit any severe downturn, unless these options are closed early.

Q4 results below expectations, weak price mix, unclear outlook, but stock price rises

UBS honestly set a target price of 259, saying Tesla's Q4 2024 results missed expectations, but the stock price reaction indicates higher market expectations for its AI business.

Tesla has returned to its strongest field. Looking back at its early post-IPO years, the public perception isn't just similar - it's identical. The difference now is that most analysts are flattering, and short sellers are rare.

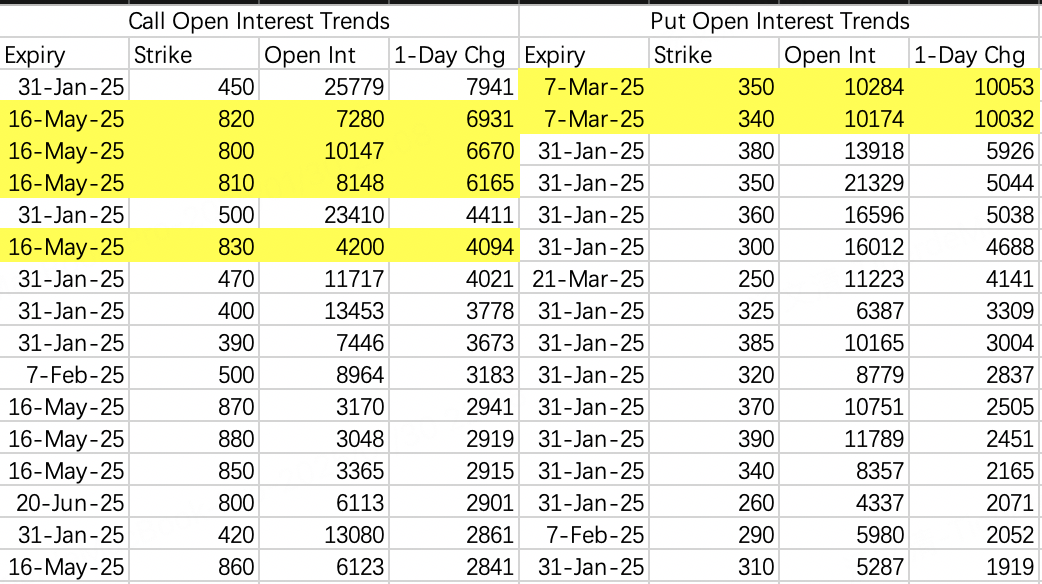

Options openings show some expecting the stock to fall to 350.

After-hours price dropped to 365 but was boosted by the earnings call.

If earnings can't bring it down, there's not much to do with Tesla. Currently, it seems unlikely to rise significantly, but downside risk persists. Selling extremely out-of-the-money puts below 350 might be the way to go.

Let's see if tomorrow's large orders will reclaim long-term call options.

Despite surging OpenAI orders, Azure missed actual/guidance expectations for the third consecutive quarter, causing the stock to drop significantly. Compared to Tesla above, the treatment is extremely biased.

Current stock price situation is similar to Apple, oscillating in the 400-460 range.

Apple reports earnings Thursday after hours, quite average. March quarter guidance expected to be weak due to declining iPhone sales.

Expected volatility is 4%. New options positions are low, with trading range roughly 220-250, low probability of upside.

Consider a bull call spread: sell $AAPL 20250131 250.0 CALL$ , buy $AAPL 20250131 255.0 CALL$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Good

Good