AI Demand Boom Sets “Super Profit Cycle”, Asian Tech's Lead Next Wave

The AI industry in 2026 is destined to be extraordinary. With AI demand continuing to surge and prices rebounding across the board, profit expectations for Asia's tech sector are entering another upward revision cycle. From AI infrastructure to semiconductor equipment, this wave of tech investment is accelerating its spread, and the risk of a bubble bursting remains nowhere in sight—at least for now.

Profit growth acceleration resumes, with AI demand driving high growth through 2026

Following the brief tariff disruption during the summer, earnings revisions for Asian tech stocks have resumed their upward trajectory. Sustained robust demand for AI infrastructure, coupled with the gradual spread of price pass-through effects, has led to market expectations of approximately 20%-25% upside potential in 2026 earnings forecasts. This upward revision is anticipated to materialize as early as Q4 2025 through H1 2026.

Along the beneficiary chain, NVIDIA and Google's TPU-related supply chains remain focal points— $Taiwan Semiconductor Manufacturing(TSM)$ $Samsung Electronics Co., Ltd.(SSNLF)$ $SK Hynix, Inc.(HXSCF)$ $Aisin Corporation(ASEKF)$ $HON HAI PRECSN(HHPD.UK)$ $Delta Electronics Thailand Public Co., Ltd.(DLEGF)$、Jentech, and others are poised to be the first beneficiaries of AI server demand. The price increase effect is most pronounced in the memory chip, substrate, and PCB sectors.

In the semiconductor equipment sector, the weak performance since mid-2024 is expected to reverse in 2026. As front-end capital expenditures by foundries and DRAM manufacturers begin to shift toward 2026, equipment suppliers such as $Tokyo Electron Ltd.(TOELF)$ , Advantest, GPTC, KIMET, and AMEC will benefit directly.

AI capital expenditures continue to expand, with a profitability inflection point in sight.

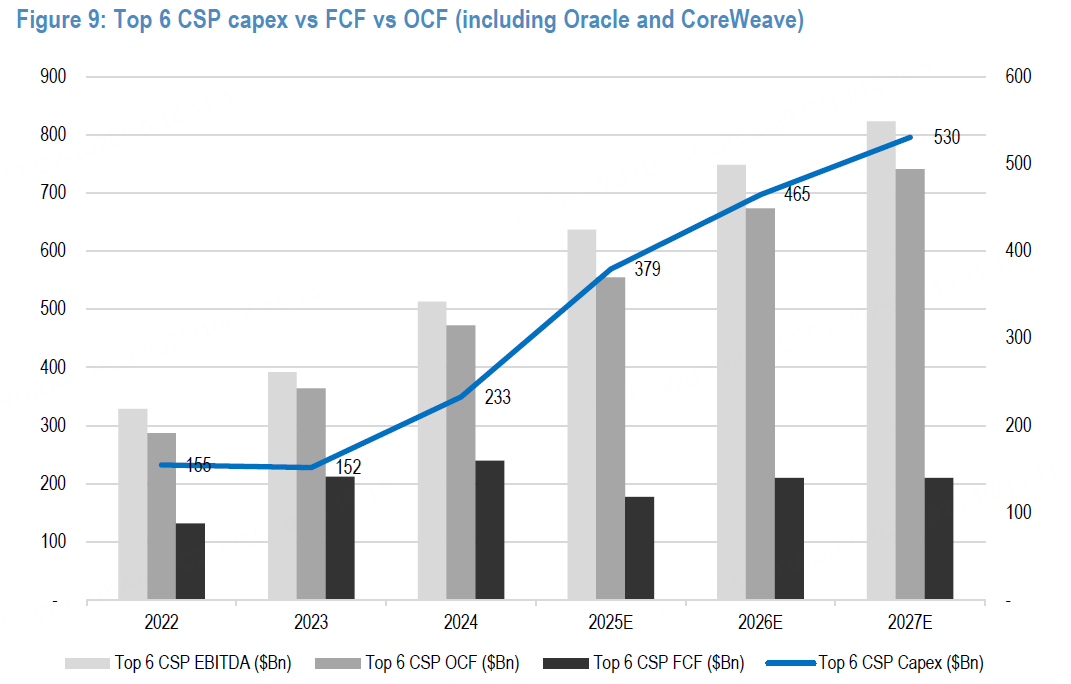

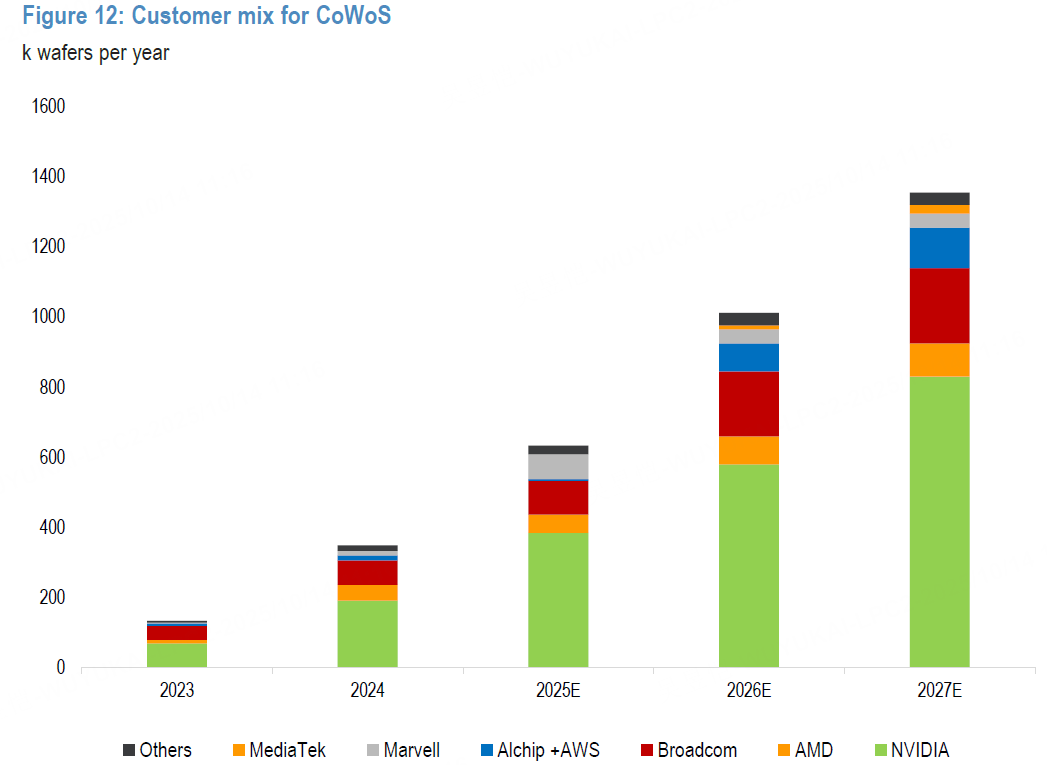

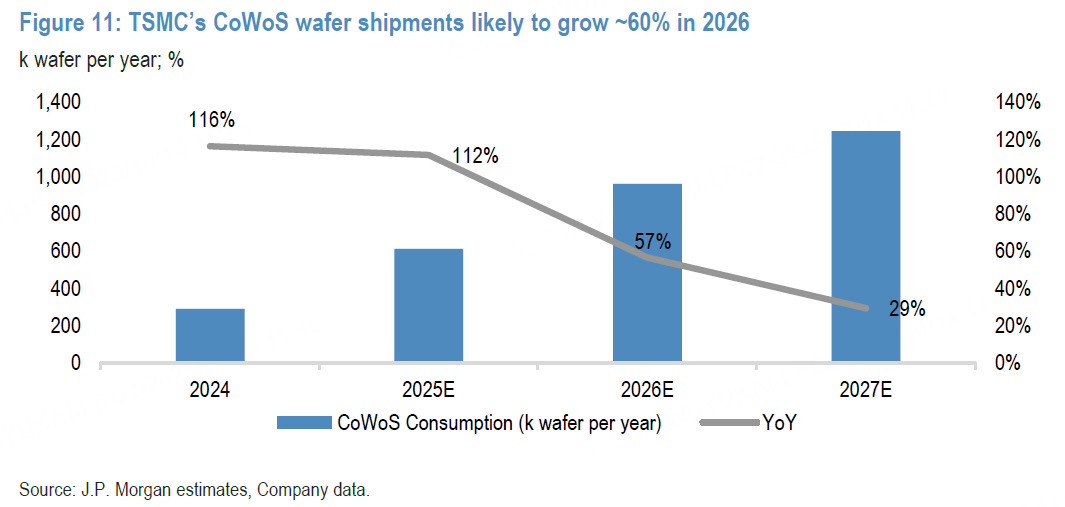

The top four cloud service providers (CSPs) $Amazon.com(AMZN)$ $Alphabet(GOOGL)$ $Microsoft(MSFT)$ are accelerating AI investments— —with capital expenditures projected to rise another 20% year-over-year by 2026, potentially even higher. Supply chain data indicates a significant increase in hardware spending, with TSMC's CoWoS wafer shipments expected to grow approximately 60% by 2026.

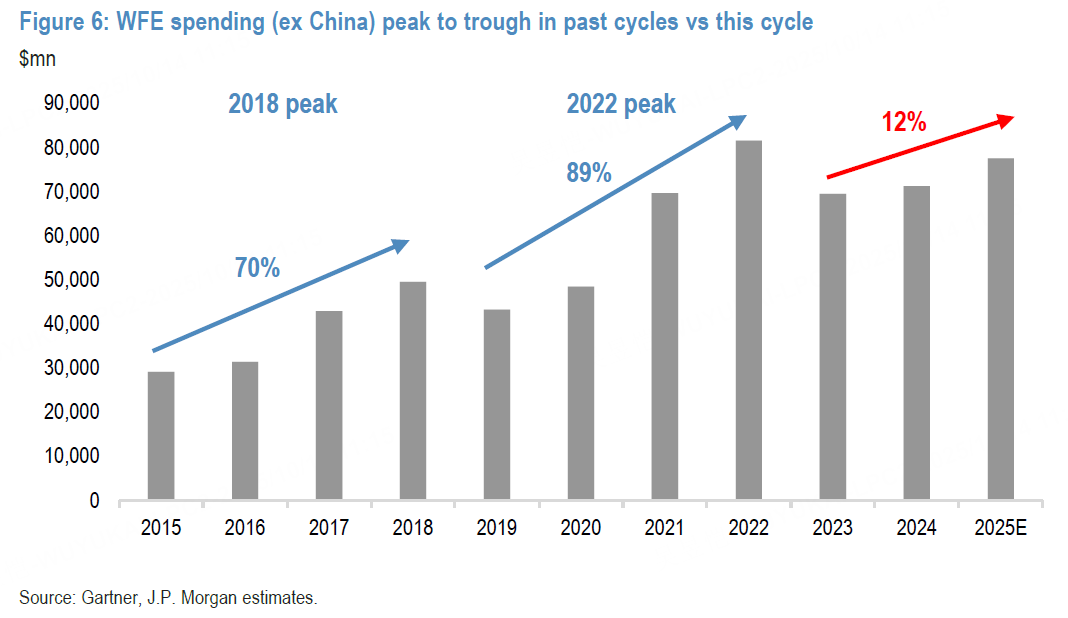

Past tech bubbles typically followed the familiar pattern of "sudden demand surge—excessive supply expansion—cycle reversal," but this time is entirely different. Current global wafer fab equipment spending has rebounded only 8% from its 2023 low (12% excluding China), far below the 80% seen in historical upturns. In other words, this AI-driven tech upswing remains in its early stages.

From a funding perspective, major cloud providers' AI investments are primarily supported by cash flow, with limited debt leverage and manageable short-term risks. Even companies like $Oracle(ORCL)$ and $CoreWeave, Inc.(CRWV)$ with financing structures more reliant on debt see their overall debt-to-spending ratios remain around 11%.

Semiconductor Equipment: 2026 May Mark the Beginning of a New Cycle of Prosperity

As AI computing power demand continues to surge, capital expenditures for advanced foundries and memory manufacturers are entering a new cycle. TSMC's N3 capacity constraints are expected to persist through 2026, with AI-driven incremental demand potentially boosting its capital spending by over 20%. Simultaneously, robust demand for DRAM and HBM will also drive expansion of front-end wafer fabrication capacity.

Supply chain structure optimization, price increases are unstoppable

The sustained surge in AI demand is reshaping the supply-demand balance within Asia's tech supply chains. Capacity constraints are emerging across DRAM, NAND flash memory, PCB materials, BT/ABF substrates, and even certain MLCC segments, with price increases likely to persist through mid-2026.

The sectors of memory chips, outsourced assembly and testing, and substrates stand to benefit the most. The earnings resilience of companies such as Nanya Technology, ASE, Unimicron, Ibiden, Elite Materials, and Samsung Electro-Mechanics is worth watching.

Consumer tech faces pressure as high costs squeeze OEM profits

As prices for core components rise, profit margins for PC, smartphone, and AI server manufacturers are being squeezed. Brands like Asus, $XIAOMI-W(01810)$ are expected to face pressure on gross margins, while profits at the AI server OEM end may also be constrained—despite robust revenue growth, Nvidia's premium is fading, and ODM competition will squeeze margins.

Additionally, the new round of 100% tariffs imposed by the United States on Chinese electronic products will further dampen consumer demand, potentially impacting companies such as MediaTek, UMC, and Novatek.

Industrial and automotive demand shows a modest rebound, limiting risks for China's rare earth sector.

The industrial and automotive chip sectors have gradually emerged from their inventory cycles and are expected to see a moderate recovery by 2026. However, weak macroeconomic growth coupled with tariff uncertainties may result in a slower pace of recovery.

Regarding recent market concerns over China's rare earth export controls, we believe the risks are limited. Major manufacturers like TSMC typically maintain 3-6 months of inventory for critical materials. Moreover, Taiwan's rare earth import structure has significantly diversified—China's share has dropped from 23% to 12%, while Japan has surged to become the largest source country. Supply chain risks are actively being de-Chinaized.

The AI wave is reshaping Asia's tech supply chain. Whether in memory chips, packaging and testing, or semiconductor equipment, the 2026 profit inflection point is fast approaching. In terms of valuation, the sector currently trades at a price-to-book ratio of around 5 times and a price-to-earnings ratio in the low-to-mid range, still far from bubble territory.

This round is not a frenzy but a healthy growth cycle. For investors, positioning in high-quality AI supply chain targets before valuations fully reflect the upside potential may be the most cost-effective choice at present.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·2025-10-14After earning, TSM will be $ 400 for sure. How can it not be, when they own 70% of the market for chip making?LikeReport

- Merle Ted·2025-10-14TSM is going to break out!!! Easy $350-360 on Thur-Fri.LikeReport

- RitaClara·2025-10-14Incredible insights! Love the optimism! [Heart]LikeReport

- Brando741319·2025-10-15GoodLikeReport