Papa Johns: Better Upside Potential On Takeover Offer

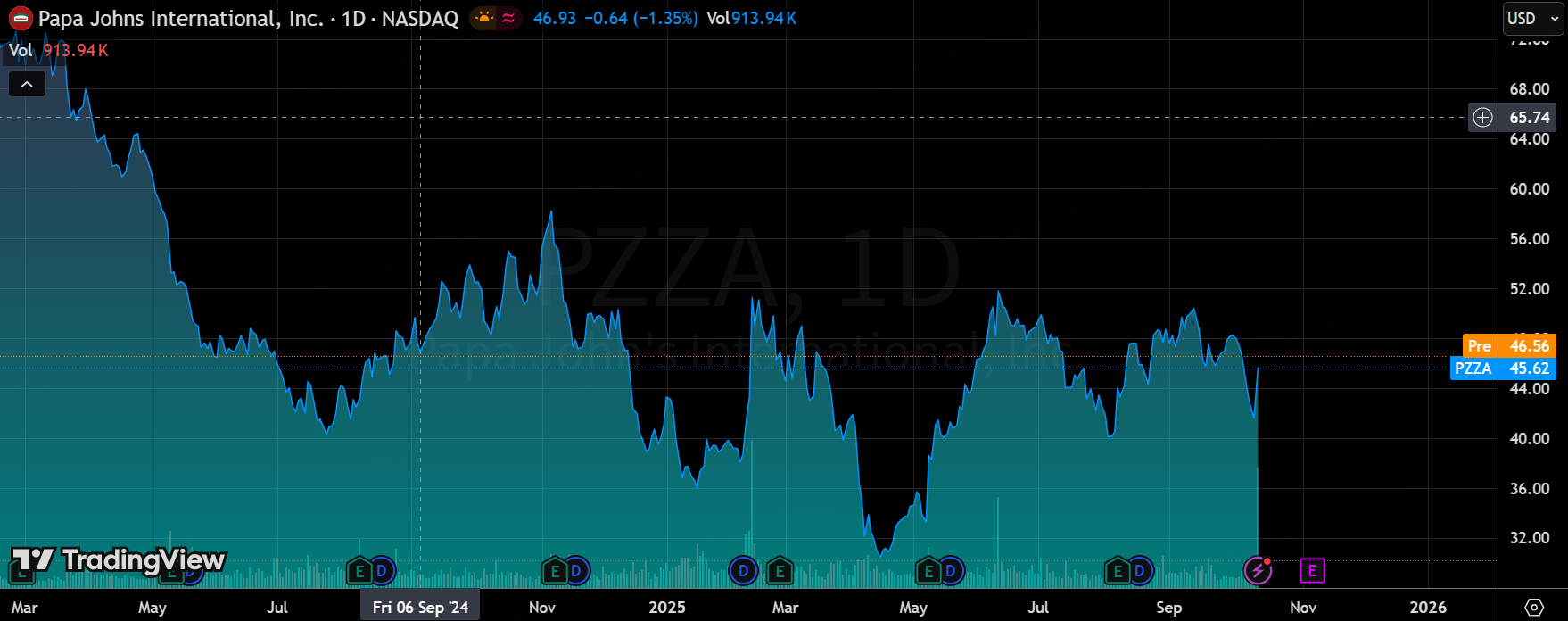

$Papa John's(PZZA)$ The recent resurgence of acquisition offers has caught my attention. $Apollo Global Management Inc(APOS)$ has proposed a $64 per share offer (still about half the historical peak of $130), which holds significant return potential if the deal closes successfully. The stock currently trades at $45.62 as of October 13, 2025. With such a wide spread, it's practically a paradise for arbitrageurs—though the risks are considerable.

Causes: Domestic pressures facing the franchise giant

Papa John's currently operates 6,019 stores across 50 countries and regions worldwide. Data as of March 30, 2025 shows that among its 3,516 North American locations, 2,977 are franchised. This model generates stable royalty income, while international expansion—such as the recent re-entry into India with four new outlets in Bangalore—is offsetting domestic inflation and labor cost pressures. Year-to-date, PZZA shares have surged 15%, significantly outperforming competitor $Domino's Pizza(DPZ)$ 's flat performance, partly fueled by acquisition rumors.

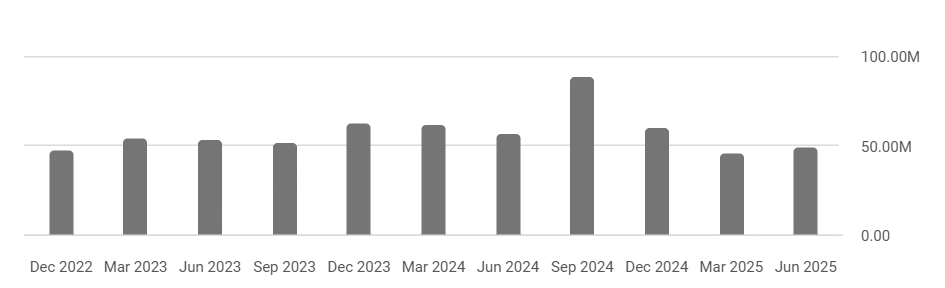

Financially, the company has a market capitalization of approximately $1.494 billion, with revenue stabilizing around $500 million in Q2 2025 despite same-store sales declining by 1-2% in recent quarters. Market consensus projects modest revenue growth over the next 12 months, slower than the 5.6% annualized growth rate over the past five years. However, EBITDA margins are expected to remain between 12% and 15%, primarily driven by supply chain optimization and partnerships like $Uber(UBER)$ Uber Eats and Uber Direct.

In the fiercely competitive pizza market, Domino's accelerates delivery through technology, while Pizza Hut focuses on value-driven meal deals. Papa John's emphasizes premium ingredients and Google-powered AI marketing, creating growth opportunities in international markets. However, weak U.S. consumer spending has dampened its same-store sales.

Regarding valuation, I personally believe that without an acquisition, PZZA trading at a forward P/E of 20x is still fair. However, after going private, through cost control and global expansion, similar to $McDonald's(MCD)$ and $Yum(YUM)$ it could easily unlock 20-30% value potential. (Its international business grew 8% YoY in Q1, far outpacing North America's stagnation. Management guidance targets 50% overseas store penetration by 2030, indicating significant upside in this segment). If it can adopt the management model of $Chipotle Mexican Grill(CMG)$ it could achieve even higher growth.

Details of the Acquisition Offer: Why Apollo Again?

Acquisition rumors began circulating as early as April this year, when Qatar-backed Irth Capital Management expressed interest in a privatization deal. By June, Semafor reported that Apollo and Irth had jointly offered $2 billion—equivalent to $64 per share—representing a 40% premium over pre-rumor levels.

On October 13, Reuters and StreetInsider confirmed that Apollo has entered the due diligence phase, gaining access to the company's books, with the deal potentially closing within weeks. Irth's role is now somewhat ambiguous, possibly shifting to an Apollo-exclusive operation, though the $64 bid remains unchanged.

Why Apollo?

This private equity giant managing $700 billion in assets possesses extensive experience in consumer brands (having previously invested in similar fast-food chains). They value Papa John's franchise model for its ease of consolidation and profit expansion—targeting an EBITDA margin potentially rising from the current 12-15% to 18-20% through supply chain synergies and international expansion. Compared to JAB's $7.5 billion acquisition of Panera in 2017 (at 17x EBITDA), PZZA's valuation at 12x trailing EBITDA appears attractive. In my view, Apollo could leverage debt financing for growth, double the investment within 3-5 years, and achieve a 25% IRR upon exit.

Market Reaction and Valuation Analysis

Following the leak of the offer, PZZA shares surged 18% on the 13th to close at $45.62, briefly climbing to $47.10 in after-hours trading—yet remaining well below the $64 bid and the 52-week high of $60.75. The spread remains over 40%, far exceeding the typical 5-10% range for announced deals, indicating investor skepticism about the transaction's completion. However, the surge in trading volume suggests arbitrage funds are entering the market.

Currently, based solely on the company's target price, the average price of $50.90 implies an 11.6% upside potential (excluding trading costs).

My personal DCF model (3% perpetual growth, 10% WACC) yields an intrinsic value of $55 without transaction costs, which also supports the quoted premium.

This year's 15% increase surpassed DPZ, fueled by rumors, but fundamentals like the $25 million marketing expenditure planned for 2025 also played a significant role.

Table: PZZA vs. Peer Valuation Comparison (As of October 13, 2025) | |||

Indicator | PZZA | DPZ | YUM |

Forward Price-to-Earnings Ratio | 20.2x | 28.5x | 22.1x |

EV/EBITDA | 12.4x | 18.2x | 15.6x |

Market capitalization | 14.9亿 | 12.5 billion | 382亿 |

Short Position Ratio | 11.9% | 4.2% | 2.8% |

Year-to-date gain | +15% | Flat | +8% |

PZZA's discount is significant, with pronounced signs of undervaluation, further amplified by the tender offer catalyst.

M&A Arbitrage Opportunities: Digital Deconstruction and Scenario Analysis

The core of M&A arbitrage lies in the price differential, currently calculated as follows:

(64 - 45.62) / 45.62 = 40.3%

If the trade closes in Q2 2026 (held for 3-6 months), the annualized return could approach 100%—significantly higher than the historical average of 8-12% for arbitrage strategies.

Scenario Analysis (Based on $45.62 Entry):

Base Case Scenario (70% Probability): Trade executes at $64. Return: +40.3%. Catalysts: Positive Q3 earnings in late October + official announcement, spread narrows to 5%.

Upside Scenario (Probability < 10%): Increase bid to $68 (if competitive). Return: +49%.

Downside Scenario (20% Probability): The trade fails to execute. The stock price drops to $40 (10% decline). Loss: -12.3%.

Overall, the loss-to-gain ratio is greater than 2.

Of course, the market is cautious about the 25% failure rate for restaurant M&A deals in 2025. However, with Apollo's involvement in this case, the success rate will increase. Moreover, the pizza industry has low antitrust barriers due to its franchise model.

Currently, short positions account for 11.9% of the market. Trading activity could trigger a squeeze of 10-15%, presenting a favorable low-point opportunity to "buy and hold until the announcement." The spread is currently wide. If necessary, partial hedging can be achieved using PUT options.

Risk Assessment

Geopolitical Risks: Irth's Qatari background may invite scrutiny during Middle East tensions, particularly given the Trump administration's "America First" considerations (depending on whether this is viewed as part of Middle East investment in the U.S. or aligned with MAGA principles).

The impact of U.S. regulators may be limited, but economic risks—particularly pressures from a restaurant industry downturn—could delay or affect pricing. Should negotiations stall, a 15-20% stock price correction is not out of the question, similar to the 2024 US Steel case (where antitrust issues and trade negotiations added complexity to the steel sector).

Founder John Schnatter's past controversies have faded, but litigation risks remain. Macro-wise, rising interest rates increase Apollo's financing costs, though their $200 billion cash buffer is ample. I believe risks are manageable, but don't go all-in.

Still a worthwhile "big meat" acquisition deal worth recommending—Go Long!

At a 40% price spread, the risk-reward ratio tilts positively—far outperforming holding ordinary long positions like DPZ.

At the same time, I will also employ certain options (such as a $48 call) to accumulate PZZA, targeting an exit at $64.

Conservative investors may opt for selling puts or employ spread strategies for arbitrage. This approach could yield returns of 30-40% within a few months, but it is only suitable for those comfortable with volatility.

Disclosure: Holding PZZA call options; currently no APO positions.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-10-14Big boys are shorting/driving this down…small players dumping their shares…then it’ll shoot back up. DON’T SELL!1Report

- Merle Ted·2025-10-14Buyout rumors part 3 or 4. I can’t remember it’s happened so many times last year.1Report

- NellyJob·2025-10-14Wow, what a detailed analysis! Love it! [Great]1Report