Brief update given the holiday-thinned trading schedule.

This market squeeze is a rebound, not a trend reversal. Two unusual moves caught my attention:

Tesla's long call position $TSLA 20260220 440.0 CALL$ was closed. This is the same position that was just rolled on Friday. Closing it just one day later is highly unusual. This likely indicates strong expectations for an impending pullback, prompting an early risk-off move.

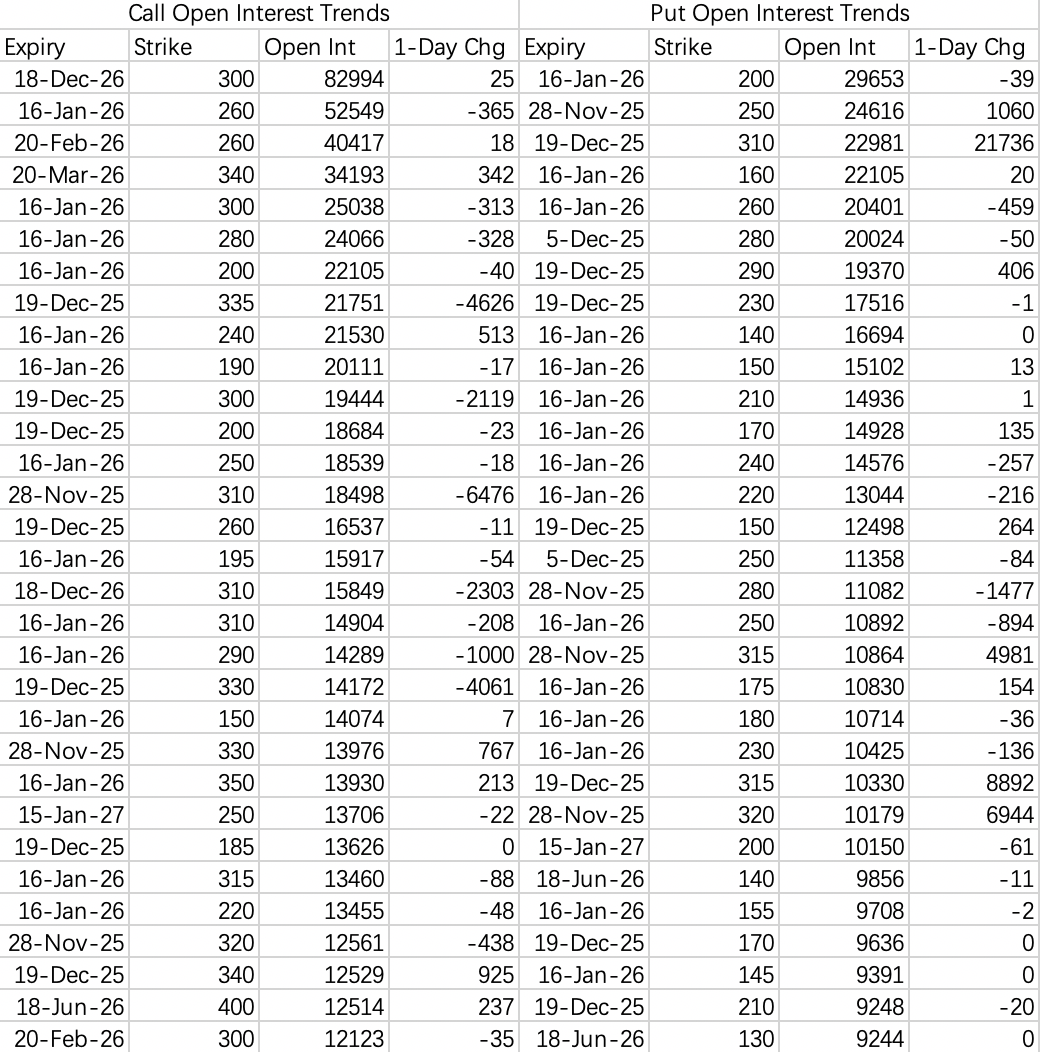

Google's options flow shifted defensive. The top open interest calls are being closed, while put opening is active. For example, 21k contracts of the Dec 19th 310 Put $GOOGL 20251219 310.0 PUT$ were opened as buys. This clearly shows a move into hedging/protection.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

W